Replacing Income Tax With Consumption Tax

This interest is reflected in Blueprints for Basic Tax Reform 1977. For example a driver could be charged 12 cents a mile for driving on a highway.

How Do Taxes Affect Income Inequality Tax Policy Center

Any money someone saves is not taxed.

Replacing income tax with consumption tax. If they drive 100 miles on this highway a month that mean a 1200 tax bill. Well if you just say scrap the income tax and replace it with a sales tax or a value added tax. Recent academic work does however sug-gest.

This is similar to tolling but the technology could potentially allow the tax to be much more flexible in. Ban income tax and you ban the IRS. Consumption tax could replace the federal income tax raising requisite revenue while improving economic efficiency and increasing economic output.

Even if Congress created as many preferences and other special rules as under the existing income tax. Fifty-four House Republicans on Thursday reintroduced legislation that would terminate the IRS and replace the system of income taxes on people and corporations with a consumption taxThe FairTax. Consumption taxes can encourage saving.

Supporters of consumption taxes point to several advantages relative to an income tax. Ad Real prices from local pros for any project. In theory if income tax was abolished and a.

When economists look at the transition from an income tax to consumption tax. Ly support replacement of the income tax with a progressive consumption tax. It is proposed that when consumption tax replaces income tax as the means of financing the state investment increases individuals are able to consume more over a lifetime and levels of government revenue can be maintained.

Shifting from an income tax to a consumption tax would offer major simplification advantages. Its a compelling idea replacing the federal income tax with a national sales tax. Rather than paying a tax on earnings people would only be required to pay taxes on goods and services that they consume.

ECONOMIC SURVEY OF THE UNITED STATES 2005 at 4 Oct. Broadly taxes tend to distort individual decisions by altering price signals within the economy. The strongest case here is that the IRS has become too intrusive too.

Prices to suit all budgets. The possibility of a new broad federal consumption tax A tax levied on spending on good and services rather than on income. Commentators and analysts have often noted that complete replace-ment of the federal income tax with a consumption tax regime would.

Well Im talking about replacing the income tax so Im replacing the corporate tax the personal income tax the capital gains tax the estate tax the dividend tax. Austin TX April 5 2021 Texas property tax burden is among the worst in the nation and its intensity lies at the local level. Find pros you can trust and read reviews to compare.

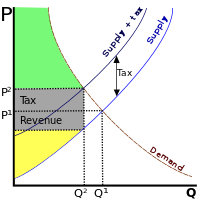

If income tax were to be replaced by consumption tax less goods would be produced in View the full answer Transcribed image text. Suppose that the government were to replace the income tax with a consumption tax. Fat Stacks for Everyone.

9 Everyone Would Have More Money. If your 100 item suddenly costs 134 that might discourage people from making a purchase. Such as a value-added tax commonly known as VAT is an alternative to merely increasing the income tax.

James White R-Hillister aims to replace ad valorem property taxes with value-added taxation commonly known as a VAT. Despite these claims no state has opted to replace income tax with consumption tax as the prime source of revenue. We dont use our property like we.

This approach is explained in ORG. This consumption-based tax would also replace payroll tax like Social Security Medicare and self-employment tax gift tax estate tax and even capital gains tax with a 23 percent sales tax. House Bill HB 3770 filed by Rep.

A consumption tax which is not a sales tax but rather uses similar information to that required by the existing tax system is simple and elegant and could save a couple of hundred billion. Consumption taxes are not as progressive as the income tax so replacing the income tax with a consumption tax or introducing a consumption tax only to raise revenue would be a regressive change to the federal tax system. COOPERATION AND DEV POLICY.

By Elizabeth MacDonald FOXBusiness. Mileage-taxes are levied on drivers based on the number of miles they drive. Those who advocate a consumption tax to replace income taxes make several points that seem appealing to the average taxpayer.

Most estimates for the inclusion of a consumption tax in the United States peg the estimated rate to be at 23-34 on the purchases of all qualifying goods. A bill filed in the state House would abolish its use entirely in the State of Texas. 10 Reasons to Abolish Income Tax and Replace it With a Consumption Tax 10 By Abolishing Income Tax the IRS Would Likely be Eliminated.

That means nothing taken out of your paycheck no annual tax return to. Whether this is the right way to go is clearly a matter of opinion and not to be dictated from behind a mantle of claimed academic expertise. Replacing the Personal Income Tax with a Progressive Consumption Tax 91 Introduction In the last several years there has been renewed interest in the progres-sive consumption tax as an alternative to the federal personal income tax.

Use of the destination basis would eliminate transfer pricing issues although in their place it would create various problems that an origin basis tax avoids such as the need for border adjustments eg tax rebates for exports. Think about that thered. For a consumption tax to actually work it must tax everything.

Hes proposed the change in House Bill 59. James White R-District 19 wants to replace the property tax with a consumption tax. A consumption tax can use either method but an income tax is practically compelled to use the origin basis.

Comparing The Value Added Tax To The Retail Sales Tax

Progressive Consumption Taxation The X Tax Revisited American Enterprise Institute Aei

Consumption Tax Increase Place Card Holders Paying Taxes Stock Photos

Why A Consumption Tax May Not Make Any Sense At All Evonomics

Comparing The Value Added Tax To The Retail Sales Tax

Consumption Tax New World Encyclopedia

Why A Consumption Tax May Not Make Any Sense At All Evonomics

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Consumption Based Taxation An Overview Sciencedirect Topics

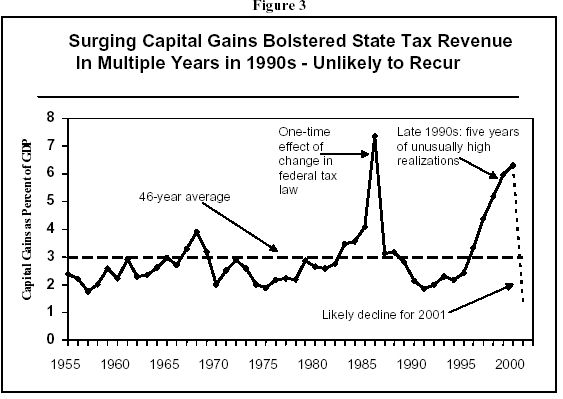

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

Sources Of Government Revenue In The Oecd 2014 Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

Why A Consumption Tax May Not Make Any Sense At All Evonomics

How Do Taxes Affect Income Inequality Tax Policy Center

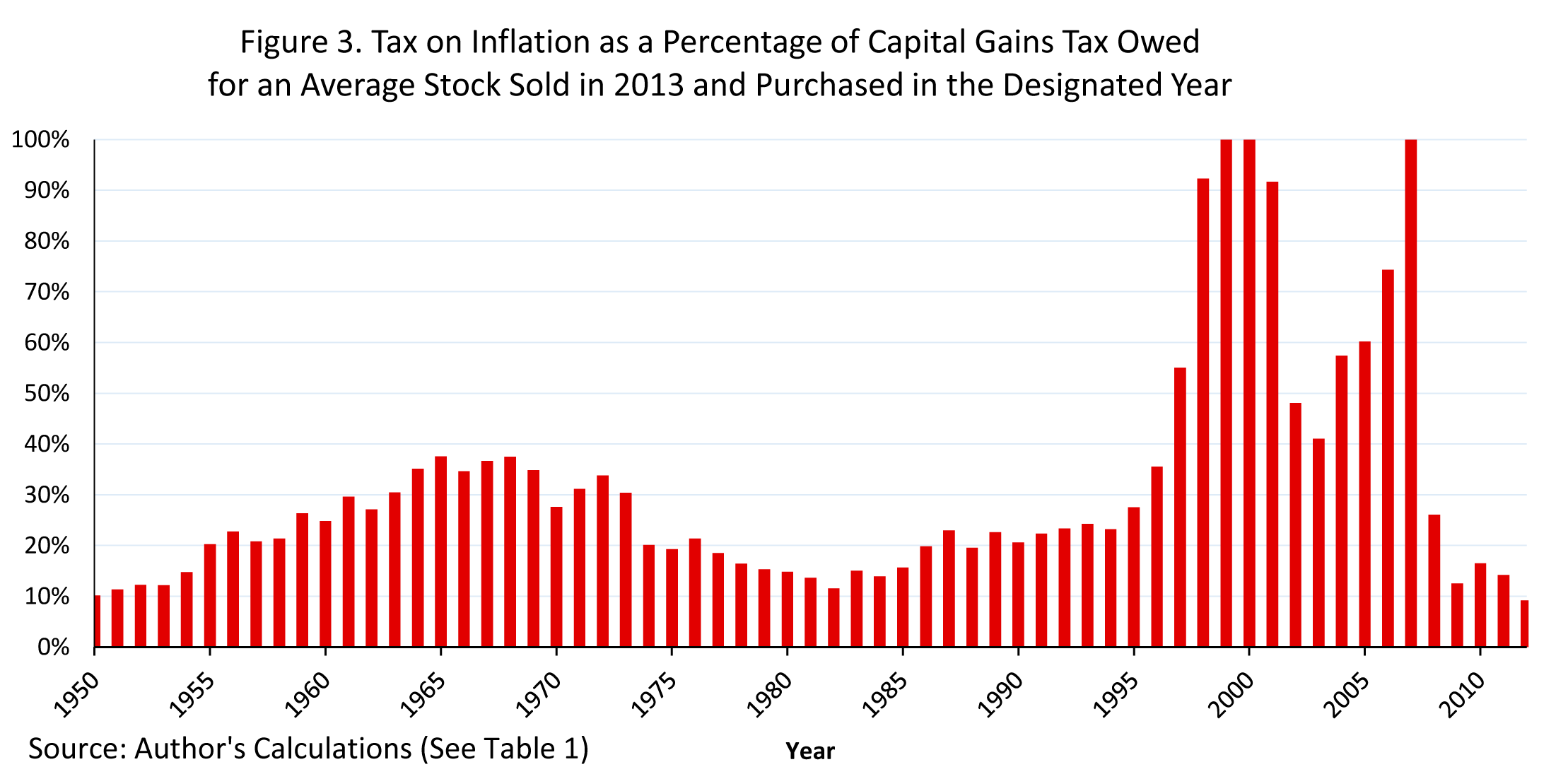

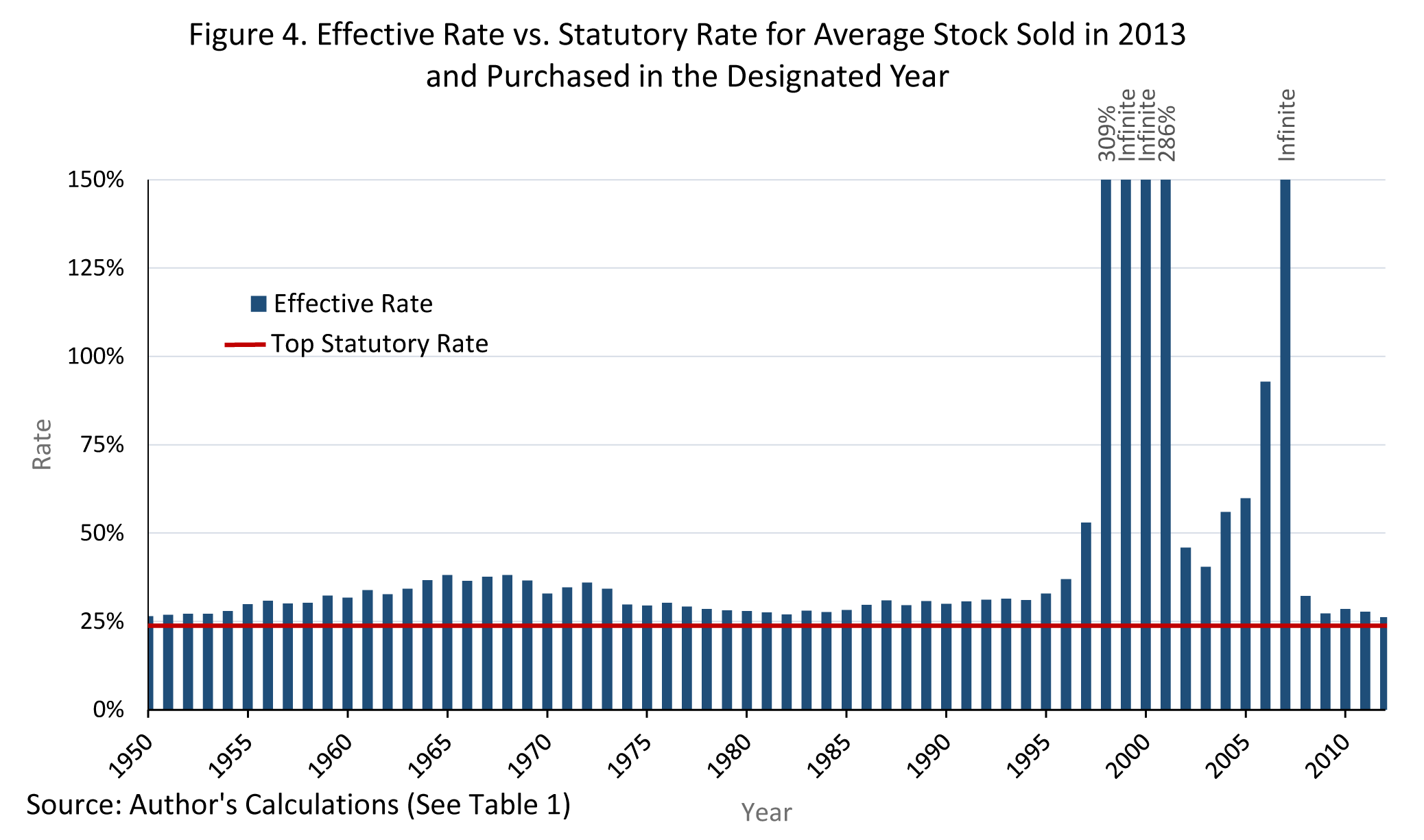

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

Posting Komentar untuk "Replacing Income Tax With Consumption Tax"