Limitation Of Capm Model

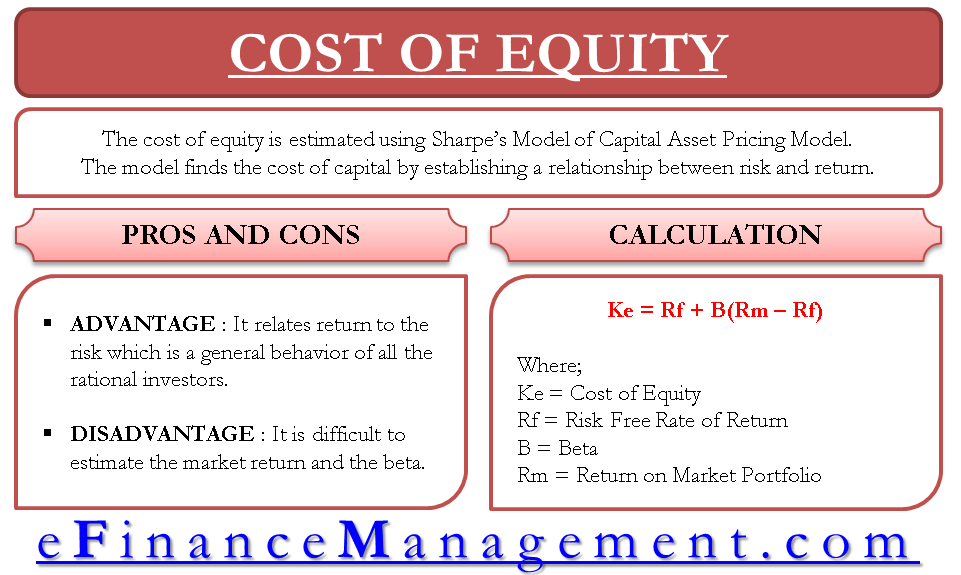

They may not be reflective of the true risk involved. In order to use the CAPM values need to be assigned to the risk-free rate of return the return on the market or the equity risk premium ERP and the equity beta.

Capm Capital Asset Pricing Model Definition Formula Example

Besides Beta coefficient is unstable varying from period to period depending upon the method of compilation.

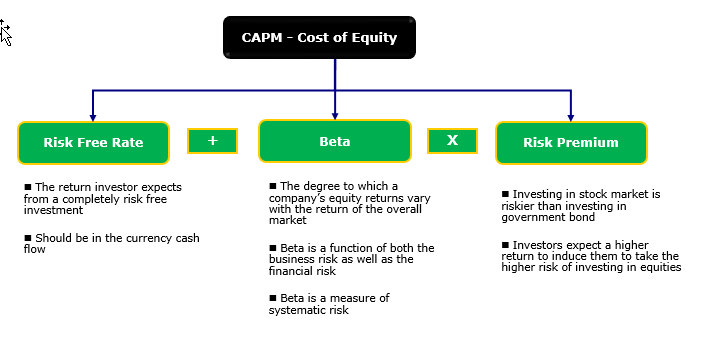

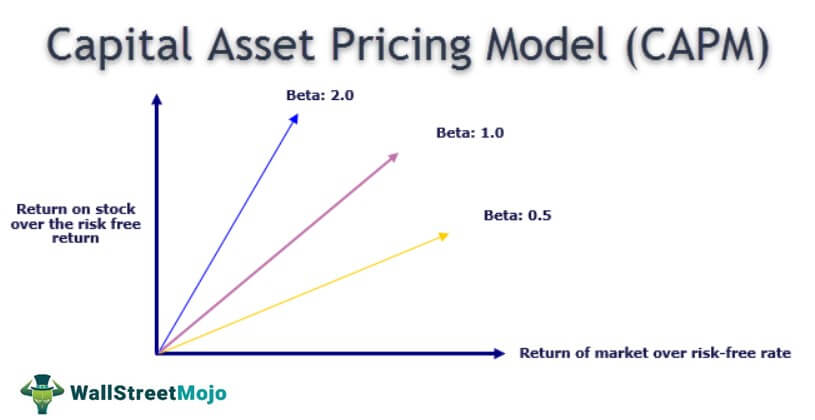

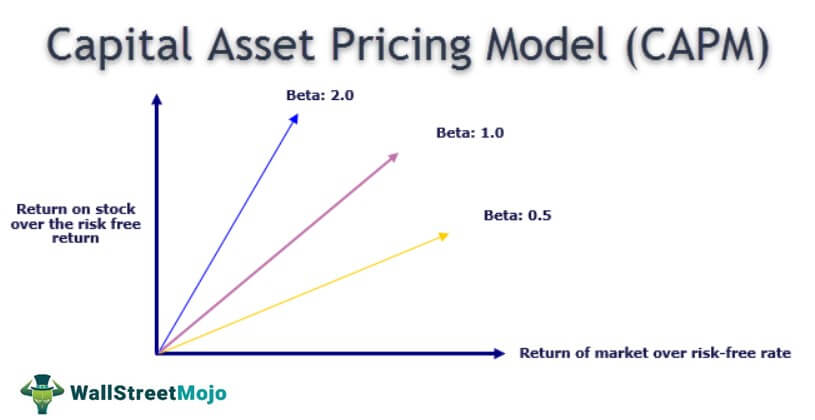

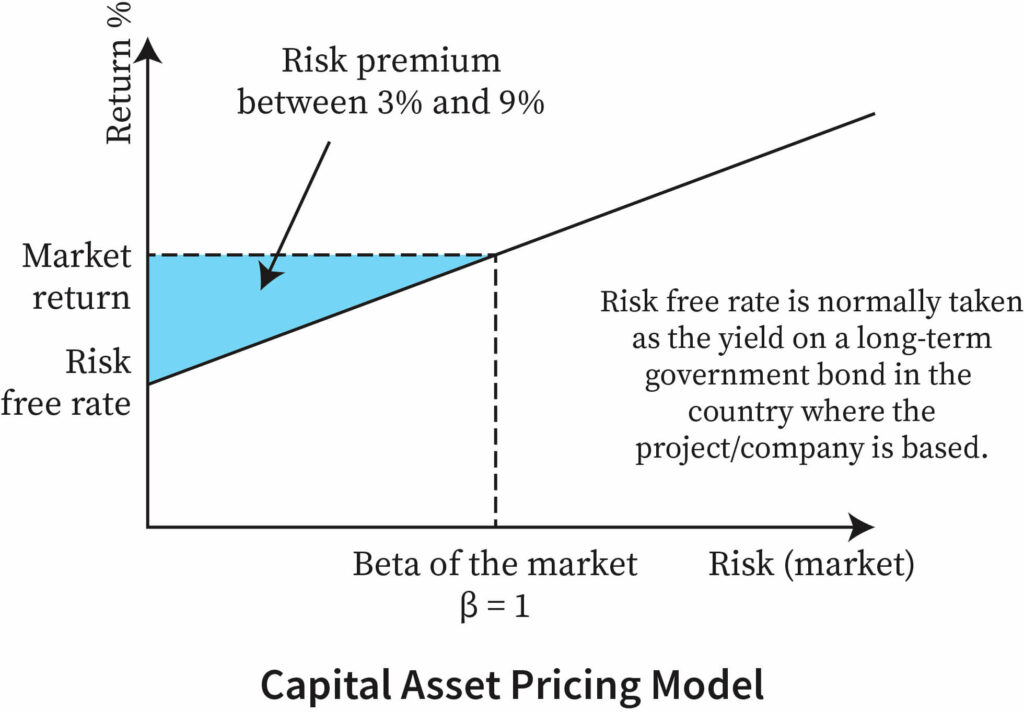

Limitation of capm model. The most significant limitation of CAPM is the measure of risk in the equation. The capital asset pricing model CAPM while criticized for its unrealistic assumptions provides a more useful outcome than some other return models. CAPM is defined as the Risk-free rate Beta x Market return - Risk-free rate where Beta is.

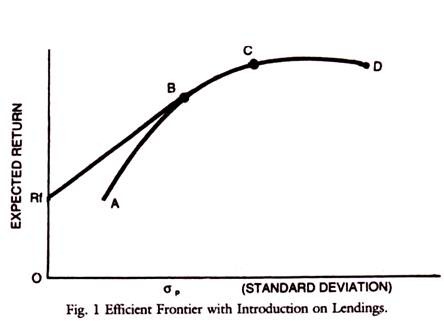

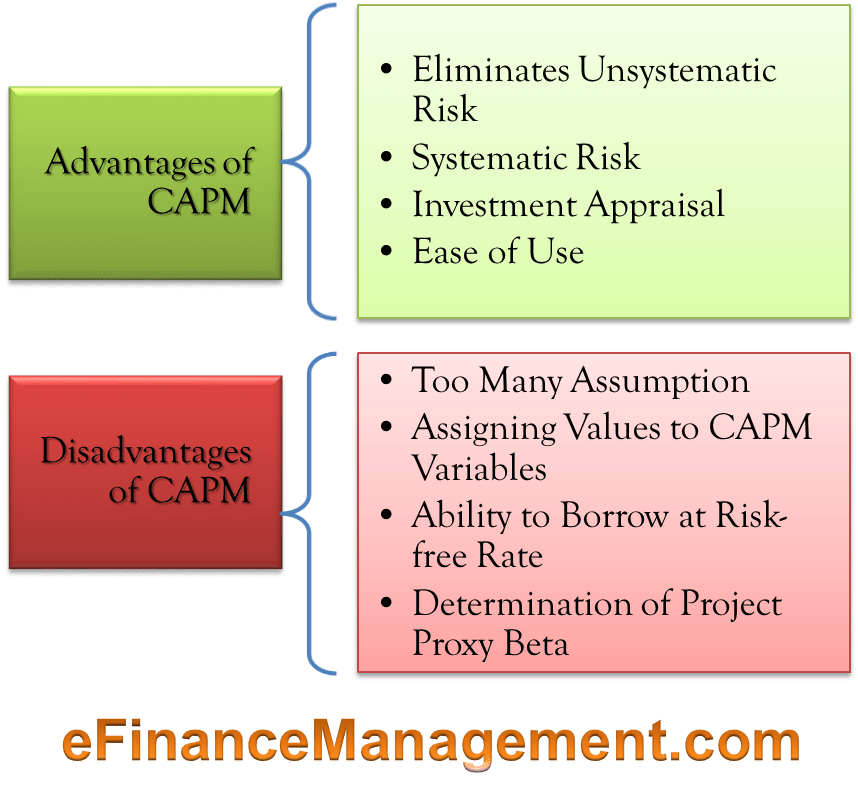

The premise of the model is that the expected investment return varies in direct proportion to its risk ie the riskier the investment - the higher the return you should expect. The CAPM suffers from several disadvantages and limitations that should be noted in a balanced discussion of this important theoretical model. Limitation In CAPM there are several limitations.

The CAPM is subject to theoretical and practical limitations. Capital asset pricing model is based on a number of assumptions that are far from the reality. Theoretical limitations It prices only systematic risk or beta risk which makes it restrictive and inflexible.

Assigning values to CAPM variables To use the CAPM values need to be assigned to the risk-free rate of return the return on the market or the equity risk premium ERP and the equity beta. Those outcomes provide confidence around the required rate of returns. A short term highly liquid government security is considered as a risk free security.

For example it is very difficult to find a risk free security. Many investors do not diversify in a planned manner. They go on to state following considerable empirical research that while the ability of beta used in the CAPM to explain differences in returns of stocks was quite limited and of concern the 3-factory model does not do much better and therefore the.

Training on Limitations of CAPM by Vamsidhar Ambatipudi. The core of the controversy is the contention by Roll 1977 that it is impossible to have. The assumptions are drawn because the CAPM cannot be worked efficiently and precisely without the assumptions.

The CAPM has serious limitations in real world as most of the assumptions are unrealistic. Firstly the risk free rate of return is hard to be estimate by CAPM under different economic environment. This requires being able to accurately assess the volatility of every single possible investment in the market.

Capital Asset Pricing Model CAPM. The CAPM suffers from a number of disadvantages and limitations that should be noted in a balanced discussion of this important theoretical model. It is mostly used in the pricing of equity instruments such as a common stock investment.

Here is how CAPM. Explain the limitations of the Capital Asset Pricing Model and the extent to which the multifactor approach has overcome these limitations. The CAPM model is based on too many assumptions which many criticize as being unrealistic.

Disadvantages of CAPM i Too Many Assumptions. The major components of the models equation the relative volatility of the investment relies on the ability to measure the volatility of the market as a whole. Many of the limitations to the CAPM lie in its methodological assumptions.

CAPM defines the relationship between risk and return. CAPM is a simplistic calculation that can be easily stress-tested to derive a range of possible outcomes. CAPM Current Asset Pricing Model the widely used method to monitor the investment performance has generated a lot of debate on its usefulness.

Capm Assumptions And Limitations Securities Financial Economics

Capm Capital Asset Pricing Model Definition Formula Example

/GettyImages-1126388682-faaf2b46afd54db78f92b8ed7896de56.jpg)

Capm Model Advantages And Disadvantages

Capital Asset Pricing Model Capm Calculation Advantages Problems

Advantages Disadvantages Of Capm Efinancemanagement

Limitations Of The Capm Investing Post

Capm Theory Advantages And Disadvantages F9 Financial Management Acca Qualification Students Acca Global

Limitations Of The Capital Asset Pricing Model Capm Criticism And New Developments Kurschner Manuel 9783640099252 Amazon Com Books

Cost Of Equity Capital Asset Pricing Model Capm

Capital Asset Pricing Model Capm Circle Of Business

Puttable Bonds Finance Investing Accounting And Finance Investing

Capital Asset Pricing Model Capm To Determine Stock Value

7 Advantages Of Capital Assets Pricing Models With Explanation Cfajournal

Assumptions Of Capm Capm Equation Indiafreenotes

Contribution Margin Contribution Margin Financial Analysis Learn Accounting

Capital Asset Pricing Model Bartleby

What Is Capm Capital Asset Pricing Model Definition Capital Com

Alternative Finance Lending Peertopeer Source Peer To Peer Lending An Alternative Peer To Peer Lending Money Management Advice Accounting And Finance

Posting Komentar untuk "Limitation Of Capm Model"