Impact Of Closing Stock On Profit

So If today I sold the entire lot of 1000 units 100030 30000 - Profit 10000 30-20 10 per unit. 5000 Closing stock.

Understanding P L Statement Part 2 Varsity By Zerodha

When inventories are overstated it lowers the COGS because the excess stock in accounting records translates to higher closing stock and less COGS.

Impact of closing stock on profit. An increase or decrease in closing stock will have an effect on the net profitif closing stock increase the gross profit will increse and vice versa. If proper accounting steps are followed inventory does affect your profit or loss. Impact of Pricing Method on Closing Stock.

Where Closing Stock ac is present in the Trial Balance it is an indication that the Journal entry for recording the value of closing stock has already been recorded. So if the stock is over valued the profit increases and vice versa. An increase in Closing Inventories would ideally mean Goods remaining unsold at the end of the year.

Gross profit without stock journal entries would be sales minus purchases. Journal Entry for Closing Stock. I have 1000 units of a product the cost of which is 20 and Selling Price of which is 30.

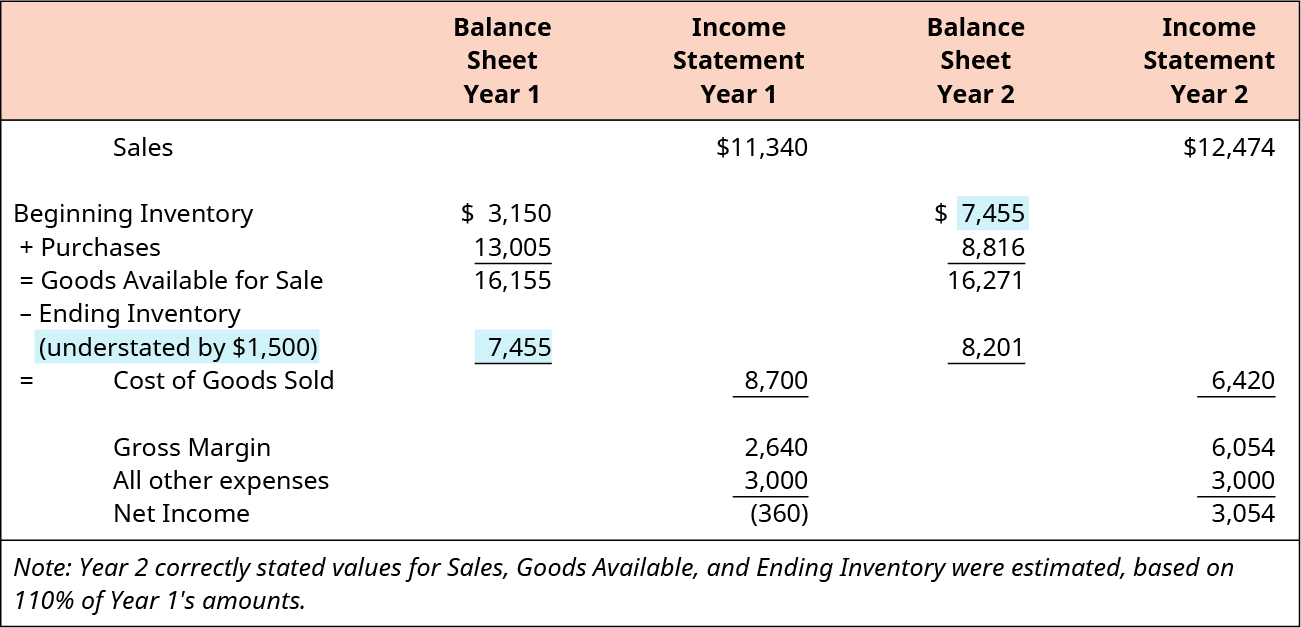

While profit is inversely proportional to the beginning inventory. If a corporation overstates its inventory it will also be overstating its gross profit and net income as well as its current assets total assets retained earnings stockholders equity and all of the related financial ratios. Share on Facebook.

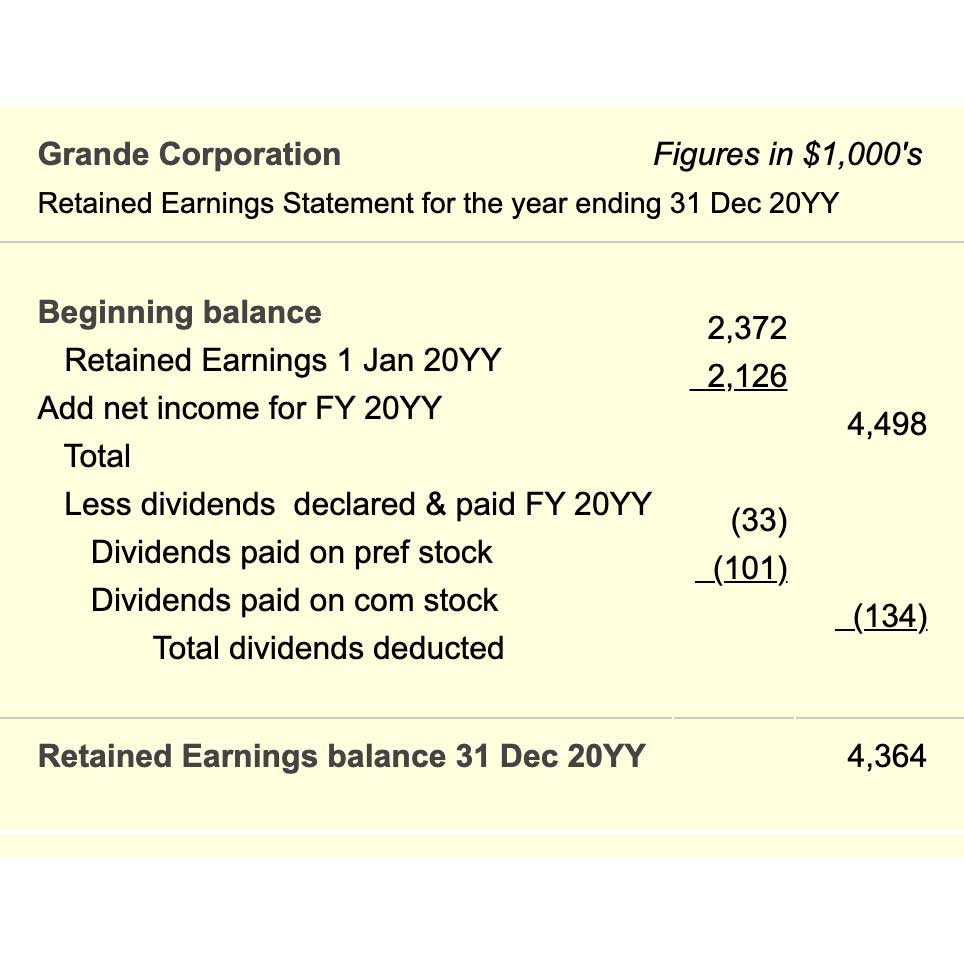

Essentially the 4000 gross profit is removed from 2009 retained earnings and recognized in 2010 consolidated net income. When ending inventory is overstated it causes current assets total assets and retained earnings to also be overstated. It may be shown inside or outside a trial balance.

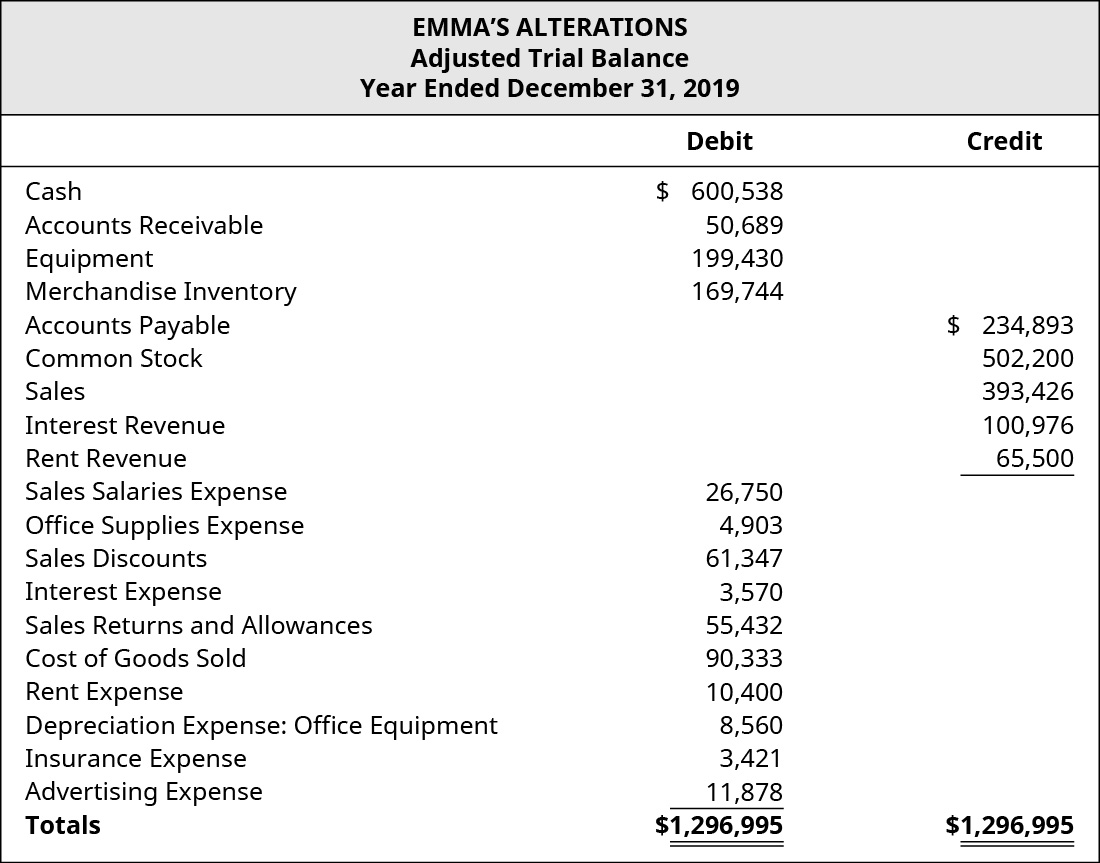

Why is the gross and net profit directly proportional to the closing inventory. Relation of Profit to Opening Closing Inventory. Cost of Sales for the period will be under-stated.

Most often this stock is excluded in Trial Balance. Inventory is an asset and as such it belongs on your statement of assets and liabilities. Lets try this with the help of an example.

Also if there are any inventory losses in that period are higher or lower than the historical rates it can lead to an inappropriate amount of closing inventory. It is an important ingredient to calculate gross profitloss and includes raw material work in progress finished goods. The gross profit and net income are overstated as a result of overstating inventory because not enough of the cost of.

What are the effects of overstating inventory. If the closing stock of previous year was overvalued then previous year profit will be overstated and current year profit will be understated. Dealing with Closing Stock ac in the Trial Balance The Closing Stock balance shown in the trial balance represents an asset and thus the Closing Stock ac is a Real account.

The journal entry of the closing stock is posted at the end of an accounting year. What is Opening Stock Stock which we have at beginning of a month or year is called Opening Stock Closing Stock of Last Month becomes Opening Stock of Current Month Q 4 - Continuing Last Question There were 3 Mobile Phone Closing Stock left in Janaury All 3 were sold in February at 18000 each Prepare Profit and Loss of Feb View Answer. Net Profit will be overstated or Net Loss will be under-stated etc.

The entrance fee is 100 profit and goes straight to your bottom line profits. The impacts will be as follows. As a result it is crucial for businesses to choose a method which is more relevant to the products they deal with.

The method by which a company decides to price its inflation affects its financial position and profits. As the gross profit will increase the firm. So if stock is over valued the profit.

You sales are entrance fees added to your profits on sales. However this doesnt take into account the 5000 of stock remaining from January. Closing stock is valued at cost or market value whichever is lower.

Most often it is shown outside the trial balance. The calculation with opening and closing stock is. Because of this cost of production or simply cost of sales will decrease and relatively expensive material will be held as closing stock and thus value of closing stock will increase.

Gross Profit for the period will be over-stated. As the overstated closing stock is CARRIED FORWARD to the subsequent period as the OPENING STOCK this will result in the understatement of gross profit and net earningprofit opposite impact for the first year where profits. Because assets do not appear on the profit and loss statement the mechanics involved in inventory account can be confusing.

Please remember the higher the closing stock the higher the gross profit but it also affects your gross profit ratio that is what you aim to achieve as a fair profit percentage before overheads. Closing stock figure in the current assets of balance sheet will be over-stated. The value of the closing stock may be shown inside or outside a trial balance.

So what will the impact on the Income Statement. The next thing we need to understand is that the closing stock of one period is the opening stock for the subsequent period. Entry G creates two effects- First last years profits as reflected in the sellers beginning Retained Earnings are reduced because the 4000 gross profit was not earned at that time.

Closing stock is the most important item to calculate gross profitloss. As FIFO method assumes inventory first to be received will be the first to be applied in production therefore cheaper material will be used in production. The way and methods used to calculate closing stock differs from each other and it has a direct impact on the profitability of the business.

Image Result For Wyckoff Method Trading Charts Stock Market Trading Quotes

Stock Cash Services Design For Specially For Stock Cash Market Trader In This Pack We Provide Best Recommend Stock Market Free Stock Trading Financial Advisory

Costum Non Profit Monthly Financial Report Template In 2021 Statement Template Financial Statement Personal Financial Statement

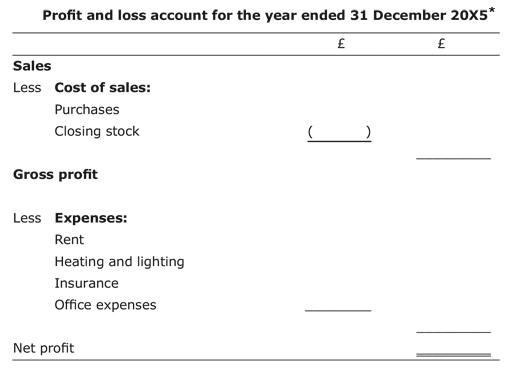

Introduction To Bookkeeping And Accounting 3 5 Accounting For Closing Stock Openlearn Open University B190 1

Statement Of Retained Earnings Reveals Distribution Of Earnings

Stock Market Investors This Is The No 1 Rule Of Investing Cut Losses Short Investor S Business Daily

Explain And Demonstrate The Impact Of Inventory Valuation Errors On The Income Statement And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Definition Of Ebitda Cash Flow Statement Financial Analysis Finance

This Take Profit Method You Must Use When You Trade Forex Forex Forex Trading Stock Index

Profit And Loss Account Gcse Tutor2u

Efinancemanagement Accounting Education Accounting Jobs Financial Accounting

Pivot Point Trading Statistics You Should Be Aware Of Forex Useful Forex Trading Strategies Forex Trading Trading Strategies

Cost Volume Profit Analysis In 2021 Accounting Education Financial Analysis Business And Economics

Introduction To Bookkeeping And Accounting 3 5 Accounting For Closing Stock Openlearn Open University B190 1

Effect Of Inventory Errors Double Entry Bookkeeping

Download A Free Food Inventory Template For Excel Which Helps To Perform Weekly Stocktakes Wor In 2021 Kitchen Inventory Restaurant Management Pantry Essentials List

We Will Show You How To Make An Income From Trading Stocks Become A Funded Account Trader Pay Only Fo Day Trading Options Trading Strategies Trading Brokers

Describe And Prepare Multi Step And Simple Income Statements For Merchandising Companies Principles Of Accounting Volume 1 Financial Accounting

Posting Komentar untuk "Impact Of Closing Stock On Profit"