Statement Of Cash Flows Foreign Currency Translation

While the cash flow transactions can be translated by using the average rate for the period many experts think the statement should use the historical rates for each transaction. Foreign currency translation is used to convert the results of a parent companys foreign subsidiaries to its reporting currency.

The Statement Of Cash Flows Boundless Accounting

The impact on cash balances solely due to changes in exchange rates is not a cash flow.

Statement of cash flows foreign currency translation. An appropriately weighted average exchange rate for the period may also be used if it provides a substantially similar result. Statement of Financial Accounting Standards No. Many entities now use.

Therefore the gains or losses from the currency conversions can be calculated as follows. Lation of Foreign Currency Transac tions and Foreign Currency Financial Statements After numerous public meetings an exposure draft more public meetings and finally a revised exposure draft Statement No. Actual cash management moves even further from this statement my two bits given the impact of currency on this statement.

Determine the functional currency of the foreign entity. Foreign Currency Transactions and Translations Income Taxes Initial Public Offerings Leases. Indicator As Functional Currency As Functional Currency Cash flows Cash flows are primarily in the foreign Cash flows directly impact currency.

When a company has foreign operations the foreign currency cash flows must be translated into the reporting currency using the exchange rates in effect at the time of the cash flows. ASC 830-230-55 provides specific translation instructions based on. 52 Foreign Currency Translation Page FAS52-7.

All groups and messages. What is Foreign Currency Translation. Considering its complexity it may be best to consult an accountant regarding the rules of accounting for foreign currency translation.

Foreign currency cash flows. The effect of these changes however is reported in the statement of cash flows in order to reconcile the cash balance at the beginning and end of the period. Such flows do not impact the the parents cash flows and.

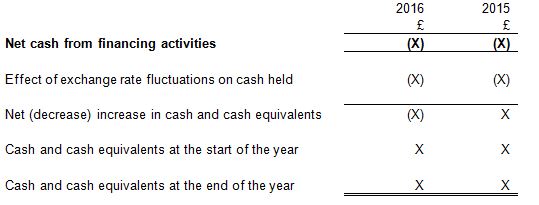

FRS 718a FRS 7 App A FRS 719 FRS 731-34. Preparing the consolidated statement of cash flows based on amounts in the consolidated balance sheet. 52 Translation Process 74 521 Effecting a Translation 74.

Financial Accounting Standards Board. The steps in this translation process are as follows. 26 and 27 clearly says that you should translate cash flows using the foreign exchange rate at the date of cash flow transaction date and you can use the average rate for the period for approximation.

If the pattern of cash flows and exchange rates are relatively consistent throughout the period the reporting entity may use an average exchange rate for translation as the cash flow results would not be significantly different from the result if actual exchange rates on the day of the cash flows were used. Currency transactions and the translation method of foreign operations. There are different rules for translating items in financial statements including assets and liabilities income statement items cash flow statement items etc.

Sales to France 115000 110000 5000 Foreign currency gain Sales to the UK 12 x 100 000 13 x 100000 120000 130000 10000 Foreign currency loss Additional Resources. 10 Overall 20 Foreign Currency Transactions 30 Translation of Financial Statements 230 Statement of Cash Flows 740 Income Taxes 946 Financial ServicesInvestment Companies Additional Resources A Roadmap to Foreign Currency Transactions and Translations. So far in our scenario the balance sheet and the income statement have been adjusted for any remeasurement of transactions to be settled in a currency other than the functional currency.

The impact of unrealized gainslosses as well as the CTA depending on the currencies could have a substantial impact on the month to month reporting. Currency translation differences that arise on the translation of foreign currency cash and cash equivalents should be reported in the statement of cash flows in order to reconcile opening and closing balances of cash and cash equivalents separately. Assumption that financial statement users are interested in cash flow measured in the foreign currency rather than in US dollars.

Foreign currency translation is complicated by the reality that the foreign financial. Standard IAS 7 par. Some also argue that the current rate will un derstate the non-monetary assets of companies in countries with hy perinflation because the Exposure Draft does not permit price-level ad.

Currency translation differences that arise on the translation of foreign currency cash and cash equivalents should be reported in the statement of cash flows in order to reconcile opening and closing balances of cash and cash equivalents separately from operating financing and investing cash flows. This also includes translating cash flows of a foreign subsidiary in the consolidated financial statements. As a rule foreign currency cash flows should be translated using the exchange rate at the date of the cash flow.

Accessed March 31 2021. The statement of cash flows must then report the effect of exchange rate. 52 Foreign Currency Translation was released in.

96 Statement of Cash Flows 132 97 Other Disclosure Considerations 145. How Do the Foreign Currency Transaction and Translation Adjustments Impact the Cash Flow Statement. This is a key part of the financial statement consolidation process.

Three Common Currency Adjustment Pitfalls

Frs 102 Cash Flow Statements Aat Comment

Frs 102 Cash Flow Statements Aat Comment

Three Common Currency Adjustment Pitfalls

Cash Flow Statement Anaplan Community

Consolidated Cash Flow Statement With Foreign Currencies Youtube

Consolidated Statement Of Cash Flow Consolidated Financial Statements Registration Document 2014

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Where Do Unrealized Gains Go On The Cash Flow Statement Quora

How Does An Exchange Gain Loss Appear On The Cash Flow Statement How Should We Recognized And Make Transactions Under Operation Activities Or Any Other Quora

The Statement Of Cash Flows Boundless Accounting

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Foreign Currency Translation Asc 830 And Cash Flows Plug The Flow Gaap Dynamics

Consolidated Cash Flow Statement With Foreign Currencies Youtube

Three Common Currency Adjustment Pitfalls

Cash Flow Statement Anaplan Community

Foreign Currency Translation Asc 830 And Cash Flows Plug The Flow Gaap Dynamics

Foreign Currency Translation Asc 830 And Cash Flows Plug The Flow Gaap Dynamics

Posting Komentar untuk "Statement Of Cash Flows Foreign Currency Translation"