How Companies Make Financial Decisions Based On Stock Valuation

Financial statements and discounting cash flow models are just some of the methods used for company valuation. Because when there is more information in financial markets managers directors employees and so on can make more informed decisions which will increase the value of the firm.

What Is A Financial Ratio The Complete Beginner S Guide To Financial Ratios Fourweekmba Financial Ratio Financial Accounting Education

Along with the scientific and practical methods some factors could be taken into consideration in stock valuation.

How companies make financial decisions based on stock valuation. Ad Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals. All investment decisions are based on probability. Price Matters in Investment Decisions.

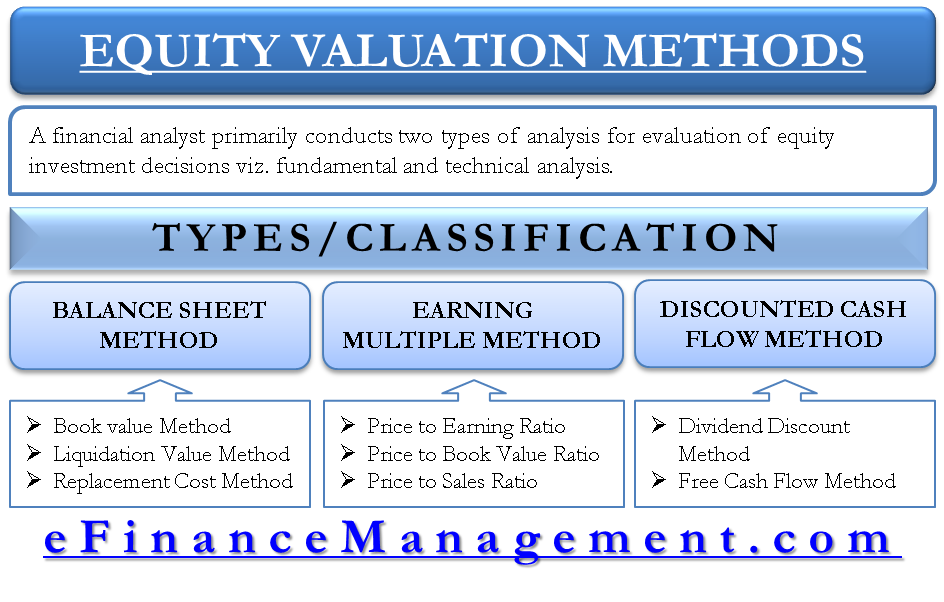

Stock valuation involves many methods. The priceearnings ratio PE is a way companies are compared based on their stock price relative to. Ad Confidential Business Valuations For Privately Held Companies.

The companys income statement balance sheet and statement of cash flows are especially useful to. When you say financial decisions you may mean buy stocks. A stocks intrinsic value provides such a.

When trying to decide what the true intrinsic value of a company is it is possible to find a number of different values. Ad Confidential Business Valuations For Privately Held Companies. Take these two.

There are several methods for valuing a company or its stock each with its own strengths and weaknesses. Answered 3 years ago Author has 46K answers and 13M answer views. Investment firms usually work by finding several stock prices using different metrics.

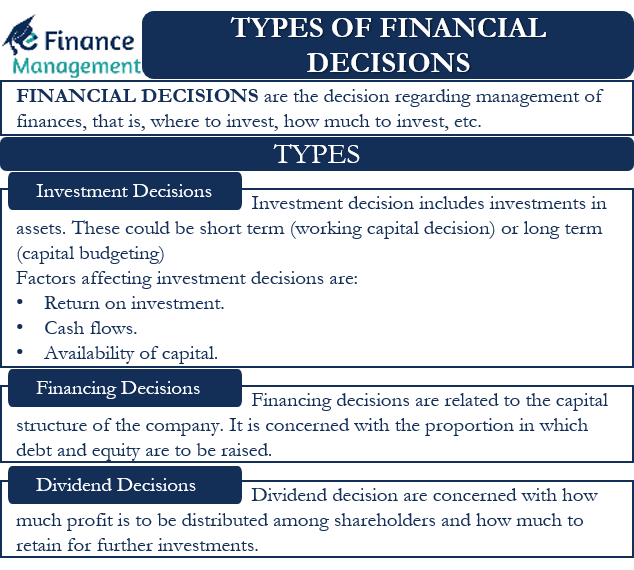

It is a technique that determines the value of a companys stock by using standard formulas. Obtaining a standard of performance that can be used to judge the investment merits of a share of stock is the underlying purpose of stock valuation. The decision is basically taken about proportion of equity capital and debt capital in total capital of the firm.

But if by financial decisions. Learn More From a Ric Edelman Trusted Financial Advisor Today. Weve been Valuing Companies for 20 years.

Call for a free consultation. Stock investors can learn an incredible amount from analyzing a companys financial statements. Stock valuation is an important tool that can help you make informed decisions about trading.

However the IRSrequires business valuation based on fair-market value. See Capital Asset Pricing Model - CAPM. If thats the question then CAPM uses two factors - interest rate and risk - to estimate a stocks value.

Call for a free consultation. Investment decisions should be valuation-based because the price you pay is the biggest determinant of your long term return on investment. Merits of a share of stock is the underlying purpose of stock valuationA stocks intrinsic value provides such a standard because it indicates the future risk and return performance of a security.

Some models try to pin down a companys intrinsic value based on its own financial. Weve been Valuing Companies for 20 years. The conditions of industry supply and demand for the companys products domestic and global market technology companyâs life product pricing and competitive status.

A capital structure having a. A particularly common valuation of companies done by ratio analysis is based on multiples of Earnings. Learn More From a Ric Edelman Trusted Financial Advisor Today.

Higher the proportion of debt in capital of the firm higher is the risk. Ad Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals. Fundamental Criteria Fair Value The soundest stock valuation method the discounted cash flow DCF method of income valuation involves.

By The Numbers Best Stocks In Internet And Software Seeking Alpha Nasdaq Conviction Chart

Equity Valuation Methods Types Balance Sheet Dcf Earnings Multiplier

Tobin S Q Ratio Accounting And Finance Business Money Financial Strategies

Pin On Understanding Market Capitalization Ev

Tips And Resources For Helping Family And Friends Who May Have Diminished Financial Capacity Financial Decisions How To Plan Decision Making

Product Costing Financial Strategies Cost Accounting Budgeting Money

Price Vs Value Infographic Trader Oracle Design By Pixlogix Infographic Price Design

/dotdash_final_Using_Decision_Trees_in_Finance_Jan_2021-01-7c07b9930682431da3124efa5d4b10c4.jpg)

Using Decision Trees In Finance

Financial Decisions Meaning Important Financial Decisions

The Course Will Help You Learn About Valuing Of Company鈥檚 Stock While Financial Decision Making Financial Decisions Cute Designs To Draw Decision Making

Book Value Vs Market Value In Order To Accurately Attribute A Valuation On A Company Those Investing Will T Stock Market Stock Market Chart Financial Charts

How To Interpret The Peg Ratio For A Stock Peg Ratio Stock Analysis Finance Investing

Pin By Rdu Capital Group Llc On Forex Investing Infographic Stock Market Investing

:max_bytes(150000):strip_icc()/dotdash_final_Using_Decision_Trees_in_Finance_Jan_2021-02-b3dcdca170404d9ca4e93c2fe38c59ba.jpg)

Using Decision Trees In Finance

Key Man Clause Meaning Importance How To Implement And More In 2021 Finance Investing Accounting And Finance Website Development Process

Value Investing In India An Ultimate Guide For Value Stock Pickers Value Investing Investing Stock Market

What Is Total Shareholder Return Tsr Capital Appreciation Investing In Stocks Investing

Posting Komentar untuk "How Companies Make Financial Decisions Based On Stock Valuation"