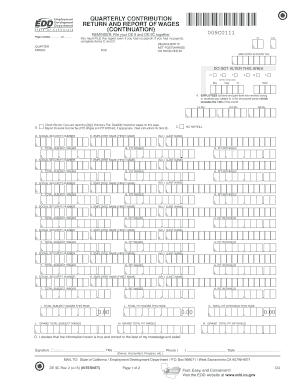

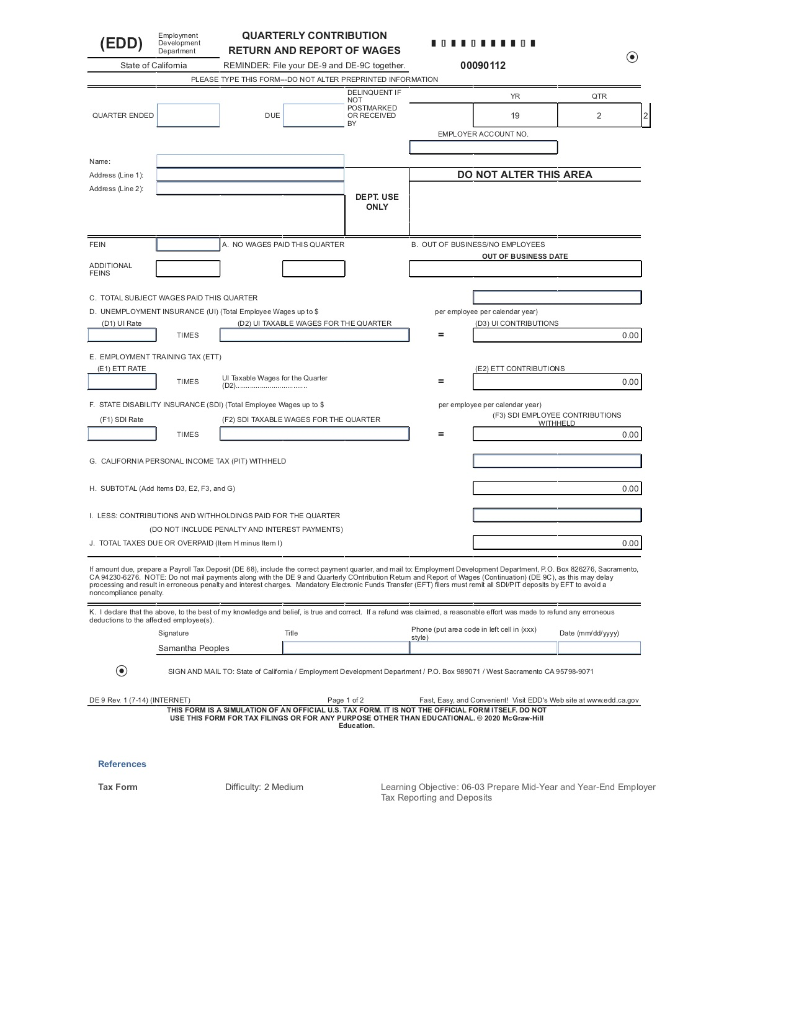

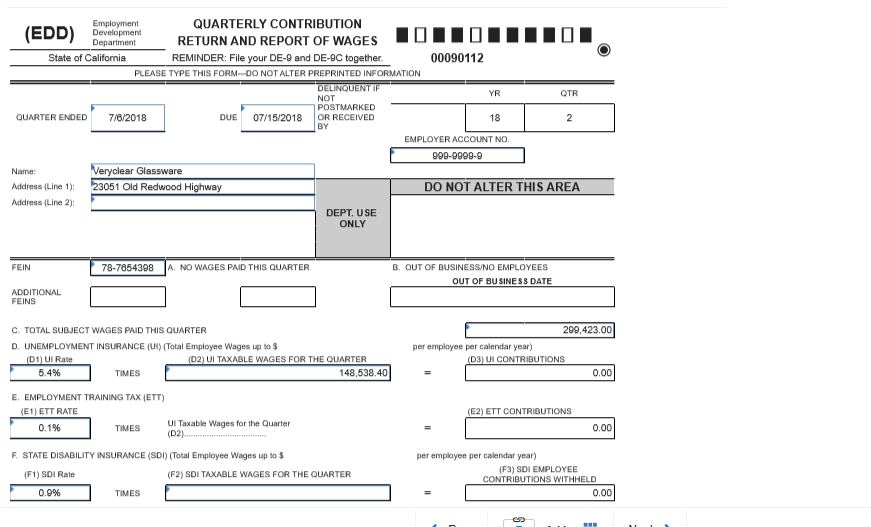

Quarterly Contribution Return And Report Of Wages

It specifies which workers and what information you must report each quarter. Once you submit your report UI Online will calculate your balance due for unemployment insurance contributions EMAC and workforce training fund.

I Want To File A Tax Return Or Wage Report Youtube

If you have employees you must submit a quarterly wage report Form ES-903A listing wages paid to all workers and pay a tax at the rate applicable to your account.

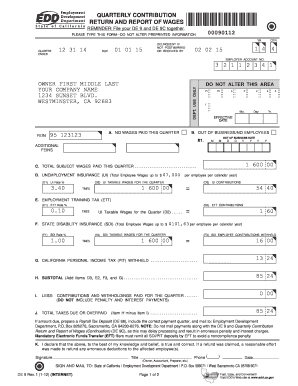

Quarterly contribution return and report of wages. Effective January 1 2011 all employers with an assigned Oklahoma State Unemployment Tax Act SUTA account number shall be required to file the Employers Quarterly Contribution Report through the employer portal on the Commission Internet website. Another option is to complete and mail a paper return. Each quarter all employers must submit an employment and wage detail report to DUA.

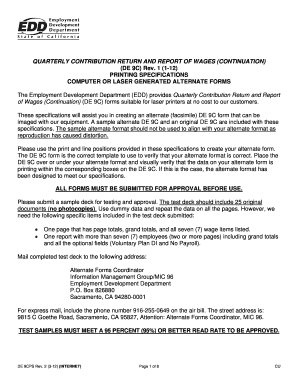

Employers with 25 or more employees in a quarter are required to file their quarterly tax and wage reports electronically. Quarterly Contribution Return and Report of Wages Continuation Payroll Tax Deposit DE 88DE 88ALL Report of New Employees DE 34 You must report all new or rehired employees who work in California to the New Employee Registry within 20 days of their start date. Texas Workforce Commission TWC Rules 815107 and 815109 require all employers to report Unemployment Insurance UI wages and to pay their quarterly UI taxes electronically.

Submitting Quarterly Wage Reports. If you currently file online give us a call and we will suspend the paper mailings. Domestic employers who report annually must submit using the Annual Wage Report Form 21D E.

Employers are required to use a file to report more than 50 workers. The form is available on our Forms page. EMPLOYER NAME AND ADDRESS 14FEDERALID NUMBER _____ If mailing return this page with remittance to.

If someone does not have an SSN report their name wages andor withholdings without the SSN and TAKE IMMEDIATE STEPS TO SECURE ONE. PIT wages even if they are the same as total subject wages. Report the correct SSN to the EDD as soon as possible on a.

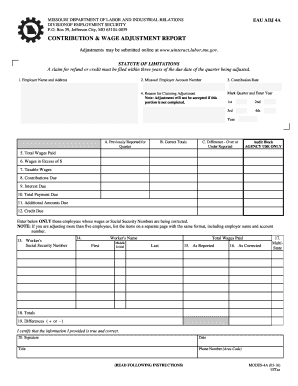

Ad Tax professionals for small business owners and self-employed entrepreneurs. If you have an account with DEW but have not used SUITS you will need to authenticate your account to get started. Quarterly Contribution and Wage Adjustment Form DE 9ADJ.

Income Tax PIT wages andor from whom you withheld PIT during the quarter. This is mailed quarterly to the address we have on file. For additional information regarding PIT wages refer to the Information Sheet.

All employers must file a tax-and-wage report every quarter. Filing reports electronically using our online tax and wage reporting system is easier more accurate and more efficient. Quarterly Contribution Return and Report of Wages Continuation DE 9C.

The State Unemployment Insurance Tax System SUITS makes it easy for employers to file online. Personal Income Tax Wages Reported on the Quarterly Contribution Return and Report of Wages Continuation DE 9C DE 231PIT. Once you are required to file electronically you must continue to file electronically in the future.

Beginning January 1 2017 employers with 10 or more employees will be required to electronically submit employment tax returns wage reports and payroll tax deposits to the Employment Development Department EDD. You may file your quarterly wage reports via FTP. Talk to a 1-800Accountant Small Business Tax expert.

The Wage and Premium Reports and any premiums due become delinquent after. For a successful upload the file must be in a comma-delimited format This means that all data elements on each line must be separated from each other by a comma. Mandatory Electronic Funds Transfer EFT filers must remit all SDIPIT deposits by EFT to avoid a noncompliance penalty.

The start date is the first day services were performed for wages. Quarterly Contribution Return and Report of Wages Continuation DE 9C as this may delay processing and result in erroneous penalty and interest charges. Otherwise you must pay a penalty.

We currently still accept your premiums and wage reports by mail as well. And PIT Wages on the. Employers may create a quarterly report file using either.

As shown in the grid below some wage items are considered PIT Wages and reported in Item H on the DE 9C even though the wages are not subject to Personal Income Tax PIT withholding. The wage report and payment are due on or before the end of the month following the close of each calendar quarter. Employers with payrolls of 5000 or less should use the online WebTax application for filing their quarterly wage and contribution report.

Get the tax answers you need. Enter the amount of PIT withheld from each individual during the quarter. Report of Independent Contractors DE 542.

Reporting requirements are determined by the Washington legislature. This video will show how to fill out a DE 9 and DE 9C forms Quarterly contribution return and report of wages state of CaliforniaDetailed information is her. When filing a quarterly Tax and Wage Report online you may manually key your employee and wage data or upload it in your own data file.

Quarterly Contribution Return and Report of Wages Continuation DE 9C. QUARTERLY CONTRIBUTION AND WAGE REPORT File online at uinteractlabormogov 1. Box 888 Jefferson City MO 65102-0888 Make check payable to Division of Employment Security.

Employers that do not file and pay electronically may be subject to penalties as prescribed in Sections 213023 and 213024 of the Texas Unemployment Compensation Act TUCA. If you are interested in registering for FTP transfers or wish to discuss the service please contact the Accounts Receivable Unit via email at DLUIFTPAdmin-labormarylandgov. Employers can enter their workers directly on the Wage Reporting screen in the ESS UPLINK web application if they have fifty 50 or less workers to report.

The Employers Quarterly Contribution Investment Fee and Wage Report Form 21 is available on our Forms page. UNEMPLOYMENT INSURANCE TAX AND WAGE REPORT. Please include a contact name phone number and email address when registering.

January 31 April 30 July 31. All third party administrators shall be required to file the Employers Quarterly Contribution Report through the. Per employee per calendar year.

The Tennessee Department of Labor and Workforce Development Division of Employment Security Wage Report and Premium Report and premiums due are submitted to the Department quarterly and are due within one month after the end of each calendar quarter. Employers must file a quarterly wage report each quarter. Division of Employment Security PO.

Personal Income Tax Wages Reported on the Quarterly Contribution Return and Report of Wages Continuation DE 9C DE 231PIT. Employers may also use a file for less than 50 workers.

Fillable Online Edd Ca Quarterly Contribution Return And Report Of Wages Continuation Edd Ca Fax Email Print Pdffiller

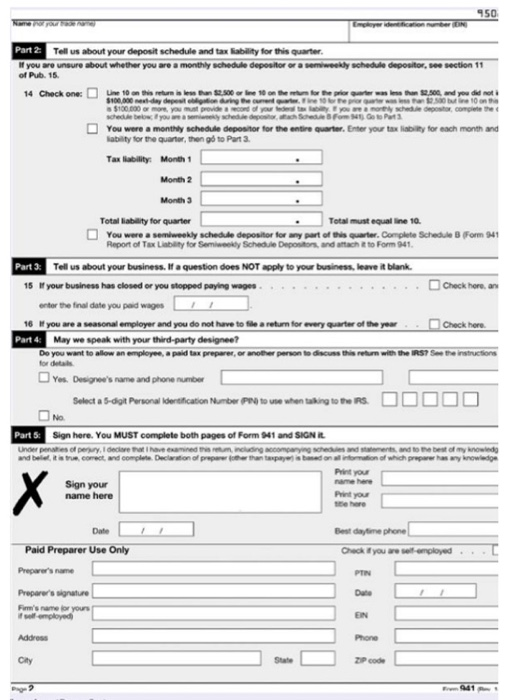

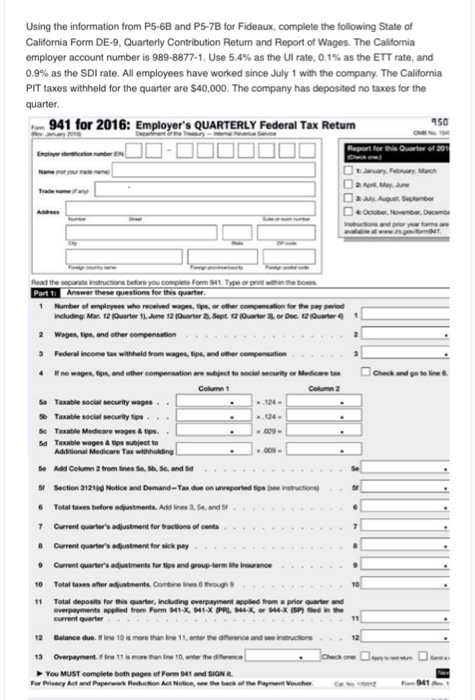

Using The Information From P5 6b And P5 7b For Chegg Com

What Are Quarterly Wage Reports And Why Do They Matter Smallbizclub

Quarterly Contribution Return And Report Of Wages Fill Online Printable Fillable Blank Pdffiller

Ar Employer S Quarterly Contribution And Wage Report Jobs Ecityworks

How To File Your Quarterly Contribution And Wage Report Youtube

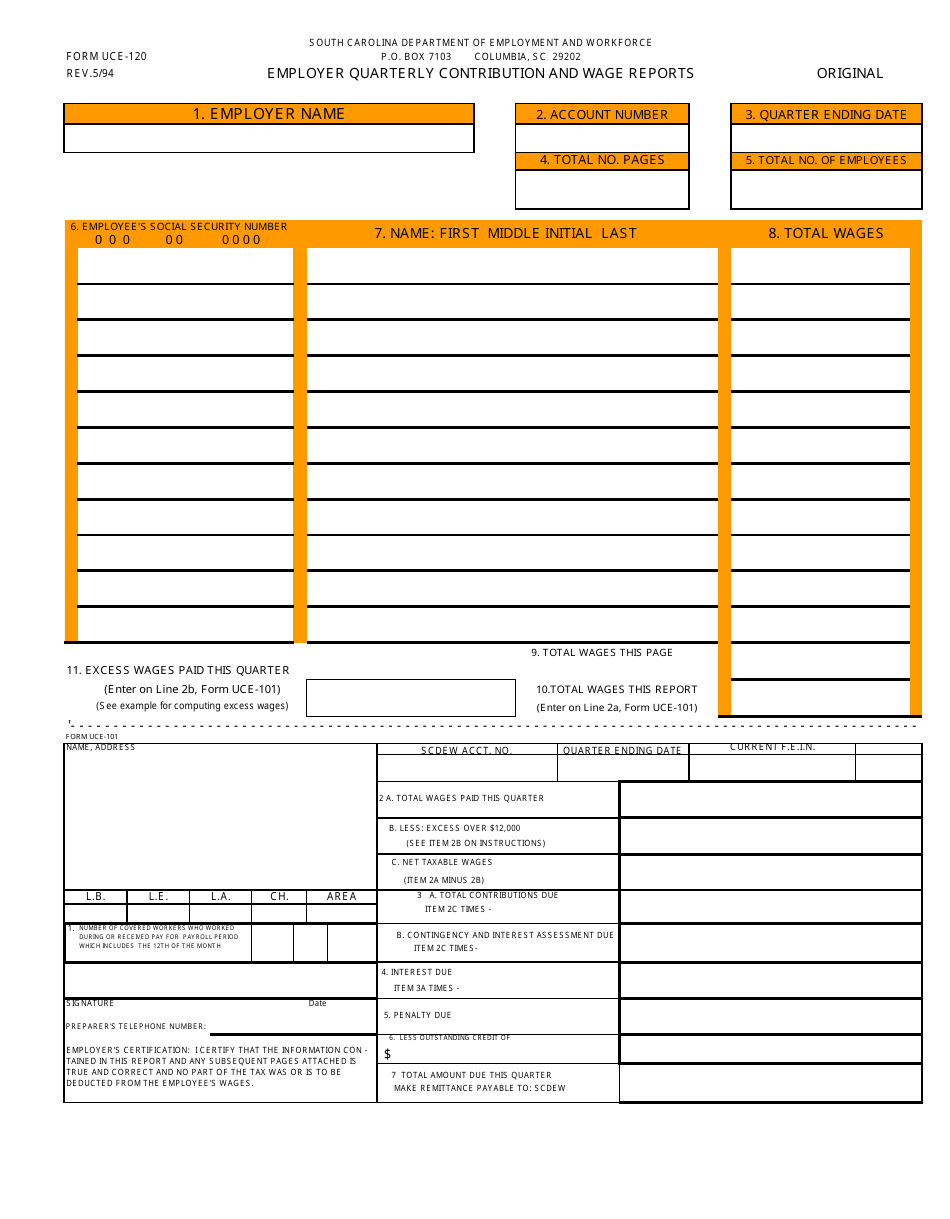

Form Uce 120 Download Printable Pdf Or Fill Online Employer Quarterly Contribution And Wage Reports South Carolina Templateroller

Using The Information From P5 6b And P5 7b For Chegg Com

Help Filling Out State Of California Form De 9 Chegg Com

Ar Employer S Quarterly Contribution And Wage Report Jobs Ecityworks

Quarterly Contribution Return And Report Of Wages Fill Online Printable Fillable Blank Pdffiller

Fillable Online Quarterly Contribution Return And Report Of Wages Reminder File Your De 9 And De 9c Together Fax Email Print Pdffiller

Mo Quarterly Contribution And Wage Report Fill Online Printable Fillable Blank Pdffiller

Ca Preparing De 9 For E Filing Cwu2015

Veryclear Glassware Is A New Business Owned By Chegg Com

Posting Komentar untuk "Quarterly Contribution Return And Report Of Wages"