Recording Depreciation In Quickbooks

Next in the bottom left corner click the I tem button then click. IRS Rules for Recording Depreciation.

Quickbooks Pro 2016 Tutorial Tracking Depreciation Intuit Training Youtube

To calculate straight-line depreciation subtract the sales price from the original cost to get the depreciable asset cost.

Recording depreciation in quickbooks. From the Account Type dropdown pick Fixed Assets or Other Assets. An equity account named unrealized gainloss. Join us on our next workshop to learn how.

I am not sure if we created a proper depreciation account for each Fixed Asset. Is there an add on module or something to record fixed assets and calculate the associated depreciation schedules. To do this go to L ists F ixed Asset Item List.

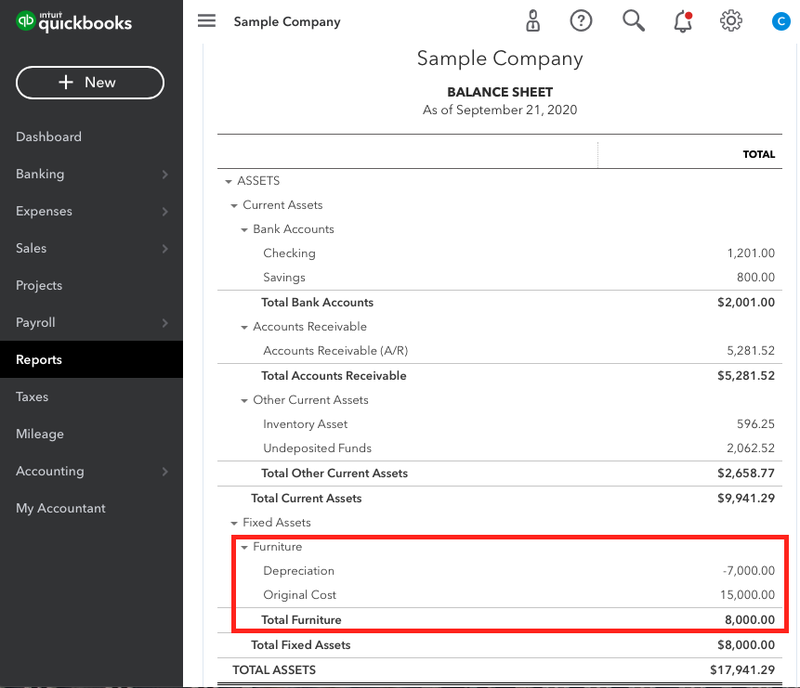

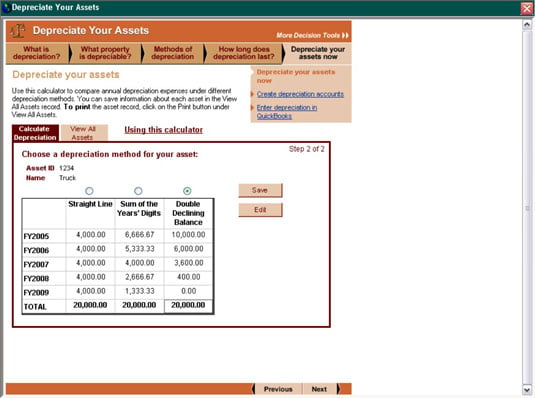

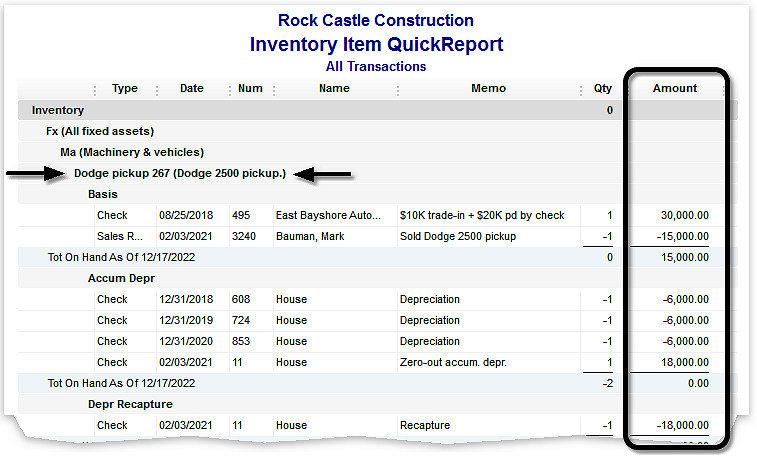

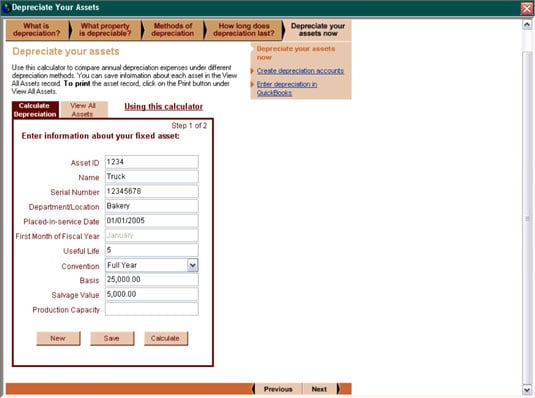

You select the method you want to use and save the information about each asset which you can then refer to at the end of each year when you need to record the depreciation expense. How to Record Accumulated Depreciation on Fixed Assets Login to your chapter QuickBooks Online Enter your User ID Password Note. QuickBooks deducts the depreciation amount from the initial cost of the item in the fixed asset account and increases your depreciation cost in the account you use to track depreciation.

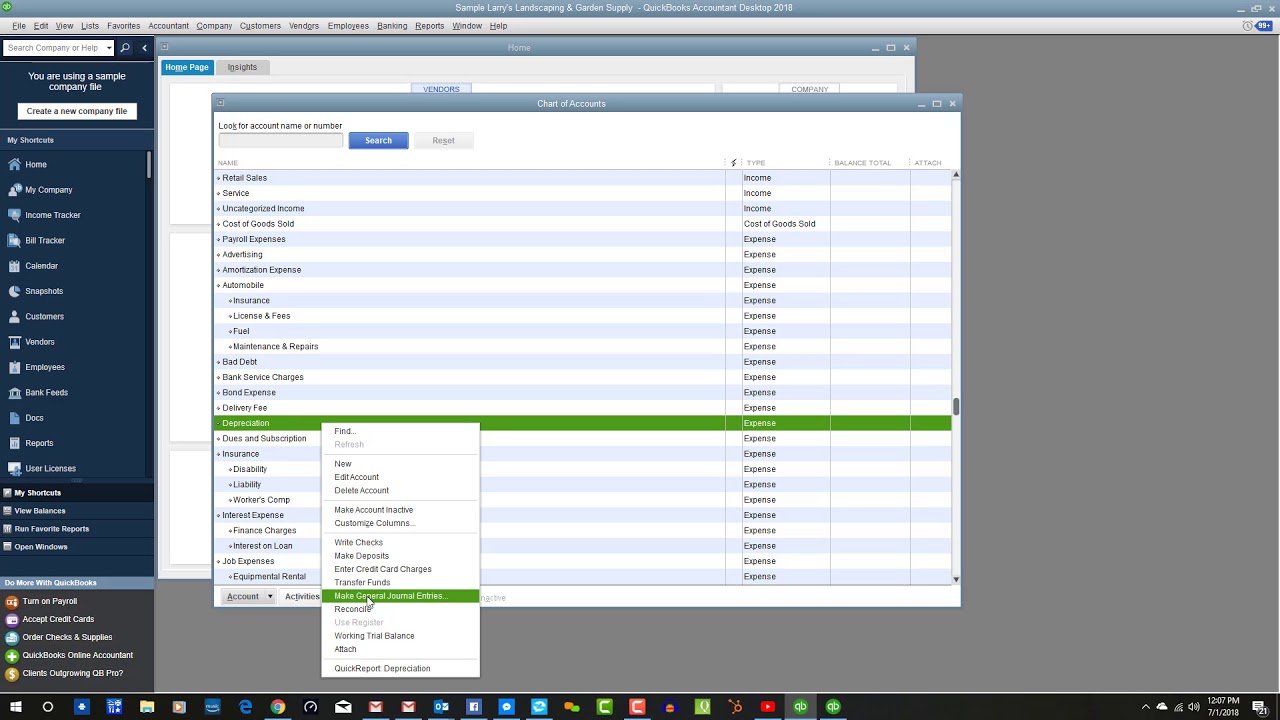

From the Detail Type dropdown click the option that best suits your asset. Recording Depreciation Using Ledger in quickbooks Desktop ShortsIn this short you will learn how to apply depreciation on a fixed asset using ledger account. When recording depreciation on income tax returns its important to.

To determine depreciation expense with the straight-line method use the following formula. Fixed asset sub account of the property named unrealized gainloss. Your first step when recording a fixed asset should be to record the fixed asset item in QuickBooks.

How to Track a Fixed Asset Item in QuickBooks. Of course depreciation tracking is optional meaning you arent required to use it. QuickBooks calculates the depreciation expense using all three methods and lets you choose the one you want to use.

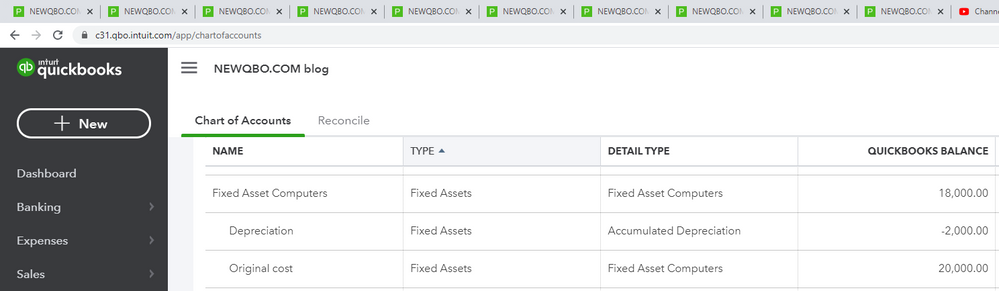

How to add an Accumulated Depreciation in QuickBooks online for each fixed Asset Separately and accumulate for each type please advise steps with video support 1As we are at end of the year i wanted to record accumulated depreciation of my all Fixed asset. Go to Settings then click Chart of Accounts. Keep in mind that Quickbooks supports depreciation tracking of fixed assets.

Learn how to enter Depreciation Accumulated Depreciation into QuickBooksNeed to learn more areas of QuickBooks. Finally multiply the depreciation rate by the depreciation asset cost to calculate annual depreciation. You can handle it.

Input the accounts name then tick the Track depreciation. When the value of a purchased asset is more than 250 we have to record the asset under account 1908. How do I record appreciation of real property in an IRA LLC.

Where depreciation account will be debited and the respective fixed asset account will be. Everything I have come across looks like I would need to buy quickbooks accountant premier version which is every year. 96667 12 8056.

Depreciation expense asset purchase price salvage value useful life. QuickBooks displays the Fixed Asset Item List window see Figure 1. Next divide the useful life of the asset by 1 to work out the depreciation rate.

To do so follow these steps. Depreciate assets in QuickBooks Online Step 1. Im not a Qbooks user but have an accounting background and have used over a half dozen GL systems.

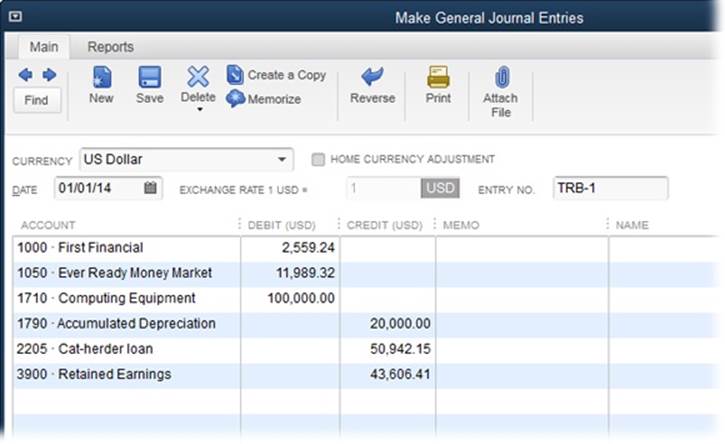

If you click the box labeled Track depreciation of this asset Quickbooks will add a subaccount for depreciation. To record a depreciation simply access the Lists menu Chart of Accounts double-click the assets Depreciation subaccount enter the respective date in the date field enter the depreciation amount in the Decrease column select the depreciation expense from the Account drop-down menu and click Record. This yields your annual depreciation figure.

Go to Settings. If youre recording depreciation monthly youll do a second calculation. Create two new accounts.

I have 2018 quickbooks desktop pro. How to record depreciation expenses in QuickBooks. This video will guide you how to record depreciation accumulated entries in QuickBooks and their impact on financial statements.

Journal Entry For Depreciation. You should have the property listed as a fixed asset with an associated accumulated accumulated depreciation account. Depreciation Journal Entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear normal usage or technological changes etc.

For any further question p. This video creates a asset account and shows how to enter depreciation expenses. Once created you can track the equipments depreciation over time.

Set up a depreciation account If you havent already create an account to track depreciation. If the company owns the building for which capital improvements not repairs but substantive improvements to property.

How To Add Depreciation In Quickbooks Youtube

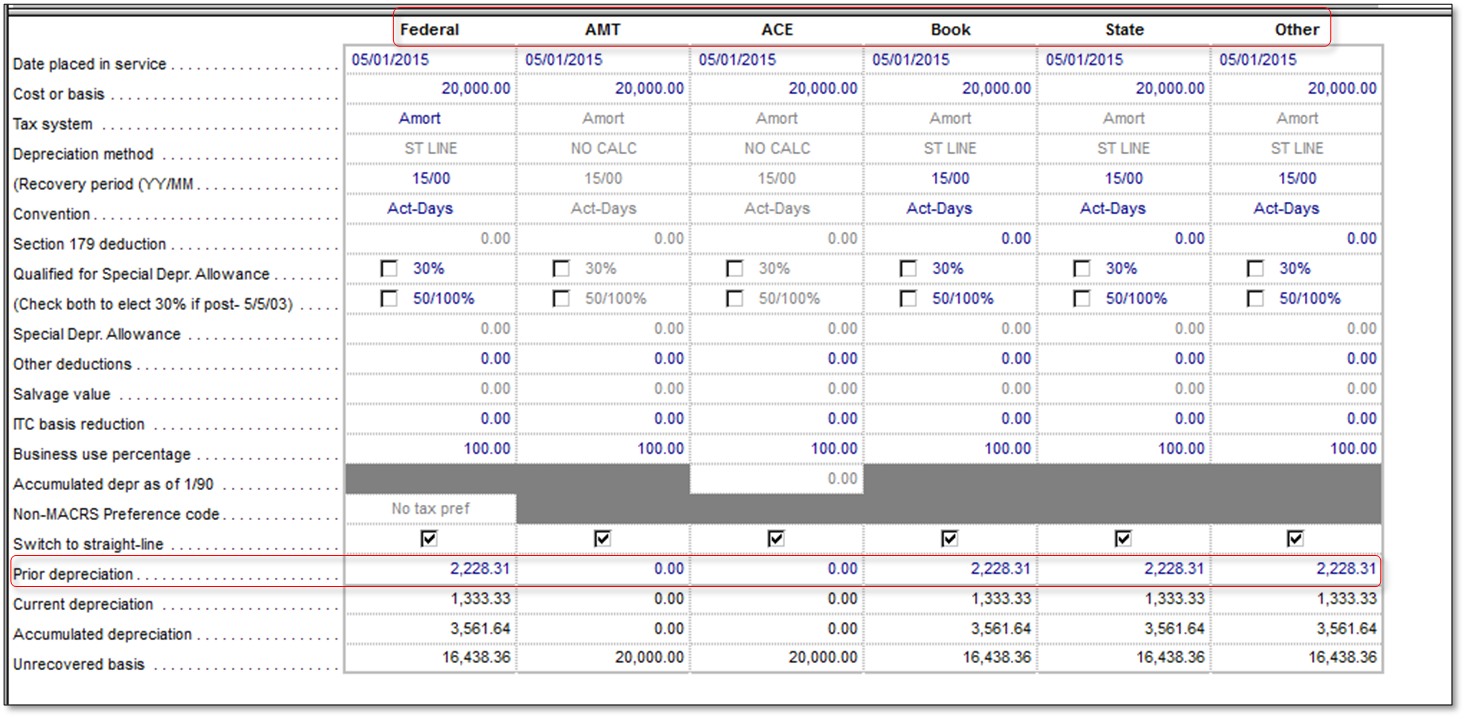

Use Fixed Asset Manager In Quickbooks Desktop

Making Journal Entries Bookkeeping Quickbooks 2014 The Missing Manual 2014

How To Record A Vehicle Purchase In Quickbooks

Solved Accumulated Amortization

Don T Know How To Record Depreciation In Quickbooks Then Give A Quick Call On Our Toll Free Number 1877 249 9444

Journal Entries What When Why And How Fiscal Foundations Llc

Depreciation Expense In Quickbooks Youtube

Quickbooks 2019 Tutorial For Beginners How To Record Depreciation Expense Youtube

Prior Balance Sheet Discrepancies Common Quickbooks Mistakes

Church Accounting Book Church Accounting Software Guide Part 13

Solved How Does Track Depreciation Of This Asset Work

Accumulated Depreciation In Quickbooks Desktop Youtube

A Beginner S Guide To Accumulated Depreciation The Blueprint

How To Use Quickbooks To Calculate Depreciation Dummies

Fixed Asset Depreciation Tracking

How To Use Quickbooks To Calculate Depreciation Dummies

Posting Komentar untuk "Recording Depreciation In Quickbooks"