A Corporation Records A Dividend Related Liability

On the declaration date. Record the cost of dividend payments equal to the liability calculation in both the companys cash reserves in your asset records and your retained earnings in equity records.

Corporations Cheat Sheet By Parkeraz Http Www Cheatography Com Parkeraz Cheat Sheets Corporations Cheatsheet Corps Cheat Sheets Cheating Corporate Law

Then at the end of the year the Dividends.

A corporation records a dividend related liability. However the entries. Example of Recording a Dividend Payment to Stockholders. Receive dividends ahead of common stockholders.

A limited liability company is an unincorporated organization that is treated as a separate entity from the members equivalent to stockholders of a corporation but is ignored for tax purposes. Andriy Blokhin has 5 years of expert experience in publicly accounting personal investing and also as a senior auditor v Ernst Young. A companys board of directors has the power to formally vote to declare dividends.

On the record date. The dividend is to be paid on August 15 2014 to stockholders of record on July 31 2014. The liability for a cash dividend is recorded on the date of record because it is on that date that the shareholders who will receive the dividend are identified.

A dividend declaration reduces retained earnings and creates a current liability. On the record date. On the date of record recipients of the dividend are identified.

27 2021 PRNewswire -- Marathon Oil Corporation NYSE. Which of the following is the appropriate general journal entry to record the declaration of cash dividends. Get Started On Any Device.

On the payment date. Enter the amount of the dividend. Greater than the notes face value.

On the declaration date. The board of directors of Yancey Company declared a cash dividend of 150 per share on 42000 shares of common stock on July 15 2014. MRO announced today that the Company.

Retained earnings are listed in the shareholders equity section of the balance sheet. On the record date. An entry is not needed on the date of record.

In order for a corporation to pay a cash dividend the corporation needs. A corporation records a dividend-related liability. A corporation records a dividend-related liability when.

A stockholder will have the same number of shares after a 3-for-2 stock split or after a _____ stock dividend. A corporation records a dividend-related liability on the payment date. To illustrate the entries for cash dividends consider the following example.

When dividends are in arrears. A corporation records a dividend-related liability a. Recording the liability is when the liability is first recorded.

The dividend will be paid on March 1 to stockholders of record on February 5. Some corporations will debit the temporary account Dividends instead of debiting Retained Earnings. The Paid-in Capital in Excess of Par Value is increased in the accounting records when capital stock is issued at an amount greater than par value.

Ad Make Your Free Corporate Records. Dividends appear as an expense on the corporations income statement. With an interest-bearing note the amount of assets received upon issuance of the note is generally equal to the notes maturity value.

Equal to the notes face value. With the liability removed from your books you need to make a permanent record of the dividends. On the declaration date.

Has 1000 sharess of 6 100 par value cumulative preferred stock and 50000 shares of 1 par value common stock outstanding at December 31 2001. The date of declaration is the date on which the dividends become a legal liability the date on which the board of directors votes to distribute the dividends. A corporation records a dividend-related liability.

However after the dividend declaration and before the actual payment the company records a liability to its shareholders in the dividend payable account. The cumulative feature of preferred stock gives the preferred stockholders the right to. On the payment date.

Click the Company menu and select Make General Journal Entries Click the Account column and select the Retained Earnings account from the drop-down list if you are using a Retained Earnings account to track dividends. Cash and property dividends become liabilities on the declaration date because they. A corporation records a dividend-related liability.

On the date of payment cash is paid to stockholders and the current liability is removed. On January 21 a corporations board of directors declared a 2 cash dividend on 100000 of outstanding common stock. A corporation records a dividend-related liability on.

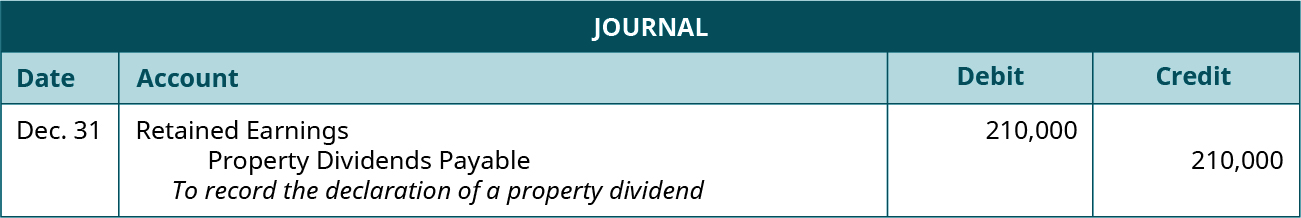

A corporation records a dividend-related liability on the declaration date DEN Inc. On the date that the board of directors declares the dividend the stockholders equity account Retained Earnings is debited for the total amount of the dividend that will be paid and the current liability account Dividends Payable is credited for the same amount. The _____ date is the date on which the corporation records a liability for its quarterly dividend.

You take it out of the liability when its paid. 23102021 A corporation records a dividend-related liability. The board of directors of Bosco Company declared a cash dividend on November 15 2012 to be paid on December 15 2012 to stockholders.

A corporation records a dividend-related liability. Create Legal Documents Using Our Clear Step-By-Step Process. On the payment date.

With an interest-bearing note the amount of assets received upon issuance of the note is generally. When dividends are in arrears. Its a badly worded question but if we pick it apart grammatically and throw out the adjective dividend-related then its asking when to record a liability You dont record a liability when you pay it.

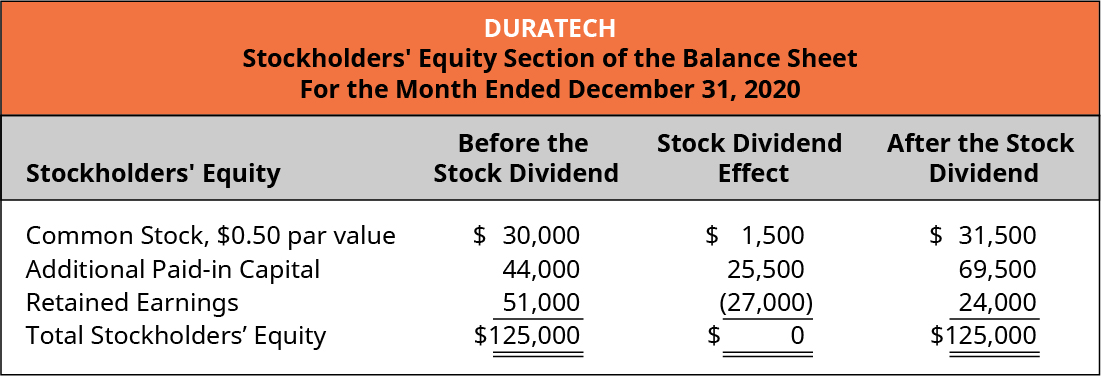

Neither a stock dividend nor a stock split alters company value. Less than the notes face value. Marathon Oil Corporation Declares Third Quarter 2021 Dividend.

When dividends are in arrears. On the record date.

Accounting Class Help Com Accounting Classes Accounting Principles Bookkeeping Business

Introduction To The Accounting Equation From The Large Multi National Corporation Down To The Corner Beauty S Accounting Classes Accounting Accounting Basics

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Net Income Income

How Balance Sheet Structure Content Reveal Financial Position Balance Sheet Financial Position Financial Statement

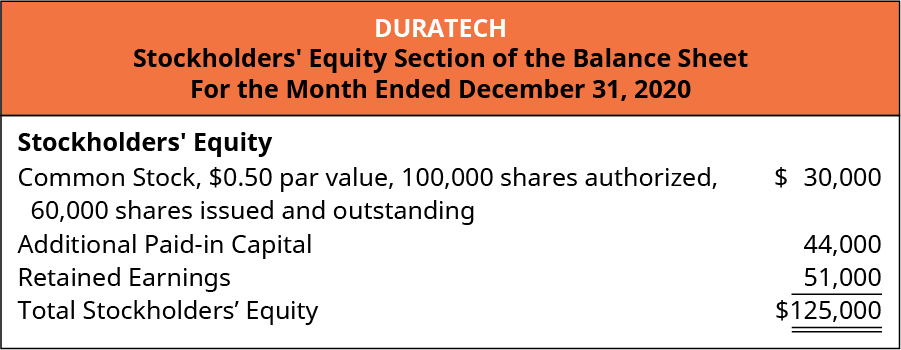

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Reversing Entries Principlesofaccounting Com In 2021 Online Textbook Free Online Textbooks Entry

/GettyImages-1128492098-f6606fdc398b4e0bbecbe4c2fe8493eb.jpg)

How Do Dividends Affect The Balance Sheet

What Is A C Corporation What You Need To Know About C Corps Gusto

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Equity Cash Flow Statement Financial Statement Accounting

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Financial Statement Analysis Personal Financial Statement

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

Mark Kolta Nature And Importance Of Corporate Finance Investment Analysis Financial Asset Company Finance

Learning Money And Bank Terms Can Be Confusing This Infographic Was Designed To Answer The Question What Are Divid Learning Money Finance Investing Investing

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Stockholders Equity Definition

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Posting Komentar untuk "A Corporation Records A Dividend Related Liability"