How Much To Hold Back From Contractor

On average people discover write-offs worth 1249 in 90 seconds. If payment in full is made to the contractor then the contractor must pay its subcontractor the full amount owing within 7 days of its receipt of payment unless the contractor delivers within 7 days of receipt of the owners notice of non-payment or if the owner did not give a notice of non-payment within 35 days of the date on which the contractor gave the owner the proper invoice a notice of non.

Soup Up Your Shop Woodworking Tools Workshop Woodworking Woodworking Tips

Remember if you pay a contractor before all work is complete you will be relying on HOPE alone with respect to the uncompleted work.

How much to hold back from contractor. You must mail them their Form 1099-NEC and submit a copy to the IRS by January 31st. Whats New for 2020. 90 of the tax to be shown on your current years tax return or.

If you are working as an independent contractor you are responsible for filing your own taxes. The IRS penalizes taxpayers who have a. 2600 and invoice the Owner for 22600.

In my contracts I always withhold 10 until the house is sold and final home inspection has passed. This is a very unique practice specific to the construction industry but within the industry its extremely popular. Finally the Contractor should issue a separate invoice to the Owner for the holdback.

The holdback is held by you the homeowner for 45 days and then the remaining balance is paid to the general contractor the general contractor then pays the electrician. Dont Forget to Holdback Money from the Contractor. Hold back enough to hire someone to finish the jobs if he doesnt come back.

That allows the company that hired you to prove to the IRS that it doesnt owe payroll tax for your employment. You should definitely retain enough to pay another contractor to complete the job if necessary. Then come tax season you will receive an IRS form 1099 from each client outlining exactly how much 1099 income you earned from that company over the course of the.

The holdback is the last 10 per cent of the total value of the contract you hold back from the contractor after substantial completion of the job. Never rely on hope. While many contractors run their own business because they want to occasionally you run across one who works for himself because hes so addicted to drugs or alcohol that he cant hold down a regular job.

It usually cost 1k-5k to fix issues that arise during the inspection. If your contractor seems under-equipped for the project frequently shows up late or leaves early you may have hired an addict. The IRS defines an independent contractor as someone who performs work for someone else while controlling the way in which the work is done.

Independent contractors dont withhold tax. The Contractor should apply HST to the value of the holdback ie. Contact the Contractor About Your Concerns.

The hold-back should be at least twice the value of the punch list work the more you can hold back the better in terms of motivating the contractor to finish the job. If youre self-employed or a freelancer you likely get paid as an independent contractor rather than an employee. My contractors complain that its tough to.

In other words someone pays you to perform a service or deliver a product but they only have a say in the final outcome. 10 seems to be the overall standard when building a custom home. If your business hired a contractor in 2020 and paid them more than 600 in a year its your responsibility to file a Form 1099-NEC with the IRS and send a copy to the contractor.

Freelancer and Independent Contractor Taxes. 100 of the tax shown on your prior years tax return. Thus you cannot really hold the contractor to the 5000 initially suggested.

Most construction contracts mandate that a certain percentage of the contract price frequently 5 or 10 is withheld from the contractor until the. Moreover it sounds as if your contractor did not put anything on paper so even proving that the estimate amount was 5000 could become your word against his. Im a flipper and the houses I flip usually takes 50k-60k to fix.

If you worked for a company your employer typically takes money out from your paycheck to set aside for your taxes owed. Treat the contractor as you would like to be treated. You expect your withholding and credits to be less than the smaller of.

As an independent contractor that makes more than 600 youll be given a 1099-MISC to file. Your prior year tax return must cover all 12 months. The amount of the holdback is 10 of the contract price or 20000.

At every point in the project he should not be paid for work that is not done. Back to Topical Index 1. Because you dont have an employer to take out money from your paycheck you have to estimate what you owe and send some of it to the.

Hold back 200 and release the rest. Instead of a traditional W-2 as a contractor you fill out a W-9. You are entitled to holdback 10 of the value of the work after it has been completed for a period of 45 days.

If your worker is a subcontractor he is responsible for keeping his or her own records and paying his or her own income and self-employment taxes. If a worker is an employee you are responsible for withholding and paying the employment-related taxes. Ad Angi makes it easy to tackle any home project.

10 is a standard hold back in contracts 10 is held back until every last thing is done even if the value of that work is less than 10. From minor repairs to major remodels weve got you covered from start to finish. The percentage of holdback can vary depending on the deal you have made with your general contractor.

Is there a difference between an employee and a subcontractor. By Brian Madigan LLB.

What Is An Escrow Holdback Real Estate Tips Real Estate Articles Real Estate Advice

Retainage In Construction Overview Rules Faqs

Pin By Mike Dilorenzo On Gardens Landscaping Solar Garden Lanterns Outdoor Landscaping Front Garden Design

Cable Drive Drawings House Elevation Joker Poster Door Casing

Roofing Bid Proposal Template Roofing Contract Roofing Proposal Templates

Retainage In Construction Overview Rules Faqs

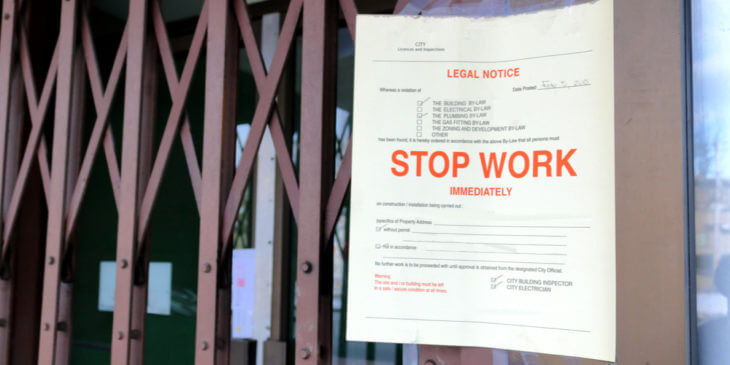

Stop Work Orders What Contractors Need To Know

Amp Pinterest In Action In 2021 Evaluation Form Evaluation Evaluation Employee

Wooden Heart Curtain Tie Backs Cortinas Decoracion De Unas Ideas

Relationship Agreement Template Free Printable Relationship Contract Contract Template Relationship

Have You Found A Great Home That Needs Updating Or You Want To Make It Your Own Take A Look At A Reno Loan Weservepeople Renovation Loans Investing Loan

Spider Tie Concrete House Plans Concrete Wall Form Ties Olalaopx Concrete Formwork Concrete Wall Concrete Block Walls

Tools Of The Trade Common Contractor Tools Contractors Must Have Tools Things To Come

Raleigh Covered Porches Raleigh Home Remodeling Contractor Home Remodeling Contractors Concrete Patio Decks Backyard

7 Things To Never Say To A Contractor Freedom Mentor

Liability Form Template Free Lovely Seven Simple But Liability Waiver Liability Contract Template

Repair Escrows For Kentucky Usda Fha Va Fannie Mae Home Loans Va Mortgage Loans Finance Loans Usda

Top 18 Scandals Involving Singaporean Influencers Lifestyle News Asiaone High Paying Jobs Independent Contractor Jobs Paying Jobs

Five Ways To Get Your Money Back From Bad Contractors Maid Sailors

Posting Komentar untuk "How Much To Hold Back From Contractor"