Why Do Banks Want Audited Financial Statements

In certain circumstances when applying for a loan or maintaining a loan from a bank they require yearly reviewed financial statements signed off by a designated accountant. Financial statement audits provide the highest level of assurance and can be extremely useful in securing equity and debt financing from third parties.

Financial Audit Procedures Financial Financial Statement Audit

Identifying opportunities for growth and expansion.

Why do banks want audited financial statements. Importance of auditing financial statements is a method for assessing the adequacy of an organizations interior controls. Audited financial statements ensure that an independent firm with high level accounting and forensic skills will look very carefully at your financ. Wait a moment and try again.

An experienced certified accountant can help you create financial statements and apply GAAP principles to your business. It use as the integrity evident to the owner and shareholders by management. Both methods can help you understand the financial status of your business.

Statements should be audited by. By reviewing financial statements before extending credit banks are complying with regulations and exercising prudence in safeguarding bank shareholders capital. An audit provides the highest level of assurance that the financial statements are free from material misstatement.

An audit increases the value and credibility of the financial statements produced by management thus increasing user confidence in the financial statement Company can use the auditors report to promote accountability for the managers and employees in the company. During a financial audit a CPA confirms that the financial statements do not contain material errors. Improving your companys credibility and reputation.

While the general structure of financial statements Analysis of Financial Statements How to perform Analysis of Financial Statements. If you do not they will issue a subpoena to your bank to acquire them. I understand why the bank wants to view our statements before approving the expansion loan.

Some of the reasons why you may need a financial statement audit include but are not limited to the following. Audit report could be used for many different purpose. Nov 13 2012 0 Comments.

A tax law proposal by the Biden administration has led. The IRS will request you to provide the bank statements for the audit. Most of the case the financial statements need to be audited due to the statutory requirement shareholders management as.

Well if the audit report express that financial statements are true and fair based on this information shareholders and investors could imply that. In the event you fail to provide the reviewed financial statements you can be in default of the loan agreement and the bank can request the money back. Under an audit the CPA firm is required to obtain an understanding of the client companys internal controls and assess the fraud risk.

However why do they want the statements audited. Audited financial statements from a CPA provide assurance that the financial statements have been properly prepared in accordance with accounting rules and the numbers are materially correct Bankers are interested in CPA-prepared financial statements because they rely on the numbers to perform an analysis to determine if you can pay them back and how much collateral is available to secure a loan. Financial Statements for Banks.

However why do they want the statements audited. There are many reasons why financial statements need to be audited. Explain to me the objectives of the accrual basis of accounting and the purpose of adjusting entries.

Audited financial statements from a CPA provide assurance that the financial statements have been properly prepared in accordance with accounting rules and the numbers are materially correct Banks request audits when the amount being loaned is large for their bank or the bank is concerned about repayment risk. Our family is talking about opening a second water park in another city and allowing the younger generation to. I understand why the bank wants to view our statements before approving the expansion loan.

When one loans money out it is with the expectation that it will be repaid in full with interest. Audits provide an unbiased objective examination of the financial statements of the company including the selective verification of specific information such as inventory. Current profit and loss statement and balance sheet indicate if they are audited and by whom Describe any current funding or sources of funding IE institutional investors bank line etc We have included a formal non-disclosure agreement covering any non-public corporate financial information that.

A bank deposit analysis involves the IRS adding up every deposit in your bank account and comparing it to the income you reported on your tax return. Many small businesses use cash accounting but as your business grows you may want to change to accrual accounting for financial statements. If you have a solid and expanding business it is best for your bank shareholders and investors to know everything about it.

Bank accounts over 600. Keeping up a powerful arrangement of inside controls is essential for accomplishing an organizations business destinations acquiring dependable financial related giving an account of its activities averting misrepresentation and misappropriation of its. Having regular audit reports is very beneficial to your relationship with any stakeholder or financial institution that you have business with.

Audited financial statements are needed to provide information to decision-makers. Whenever bankers suppliers investors and potential merger partners need to evaluate a company they prefer to have statements that have passed a rigorous examination by. Detecting and stopping fraud before it can escalate further.

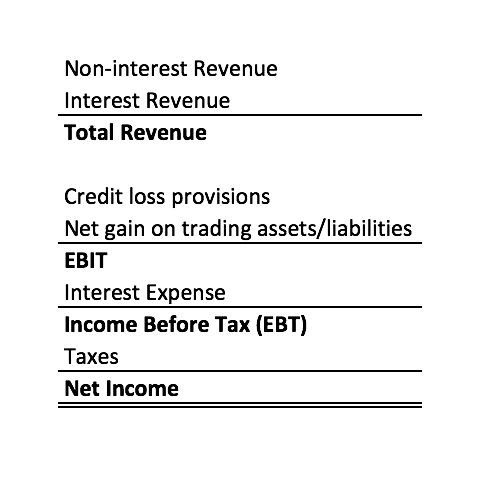

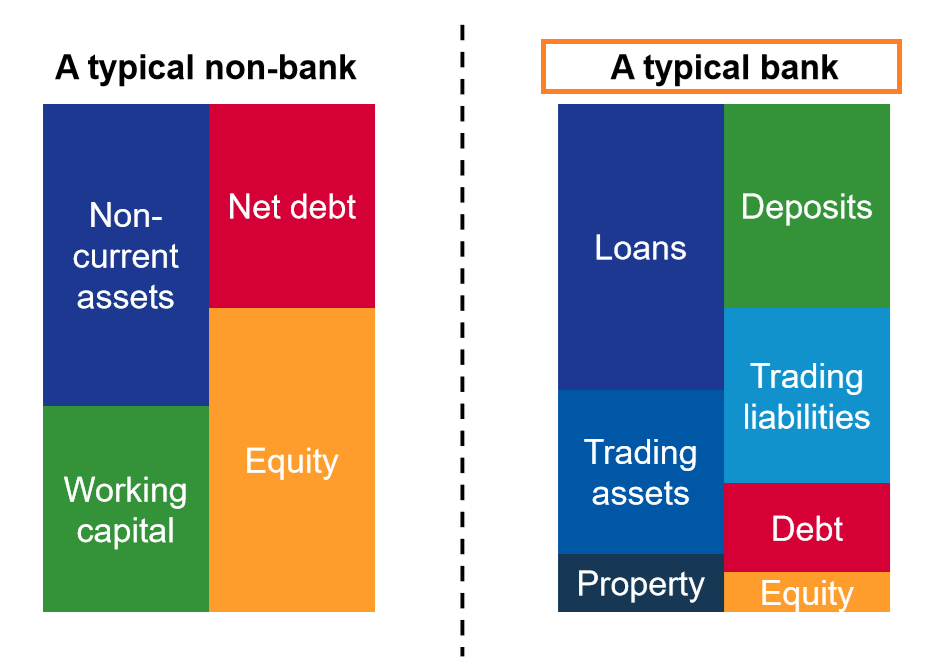

This guide will teach you to perform financial statement analysis of the income statement for banks isnt that much different from a regular company the nature of banking operations means that there are significant differences. Would there be others that want to review our audited financial statements. Would there be others that want to review our audited financial statements.

Treasury Department declares IRS will monitor transactions in all US.

Internal Control Audit Report Template 4 Templates Example Templates Example In 2021 Report Template Audit Internal Control

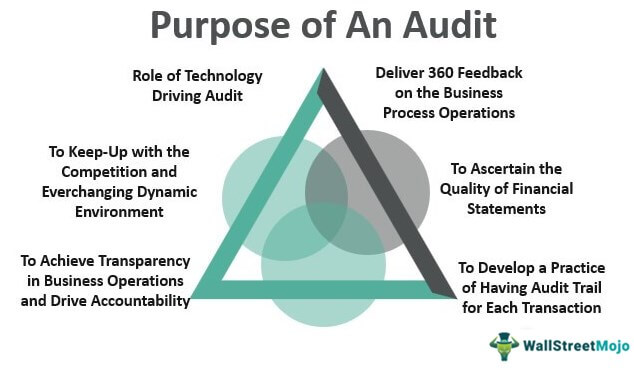

Purpose Of An Audit List Of Top 10 Purpose Of Audit Procedures

Accounting Resume Ought To Be Perfect In Any Way If You Want To Make A Resume To Be An Accounting It Is Resume Objective Accountant Resume Job Resume Format

Accounting Financial Statements Assignment Financial Statement Financial Accounting Help

Free Financial Statement Template Word And Free Balance Sheet Form Financial Statement Ex Personal Financial Statement Financial Statement Statement Template

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

Financial Statements Definition Types Examples

Financial Statements For Banks Assets Leverage Interest Income

Financial Statements For Banks Assets Leverage Interest Income

Devry Acct 555 Week 4 Midterm Answers Midterm Which Is Correct Senior Management

Financial Statement Templates 13 Free Word Excel Pdf Statement Template Financial Statement Personal Financial Statement

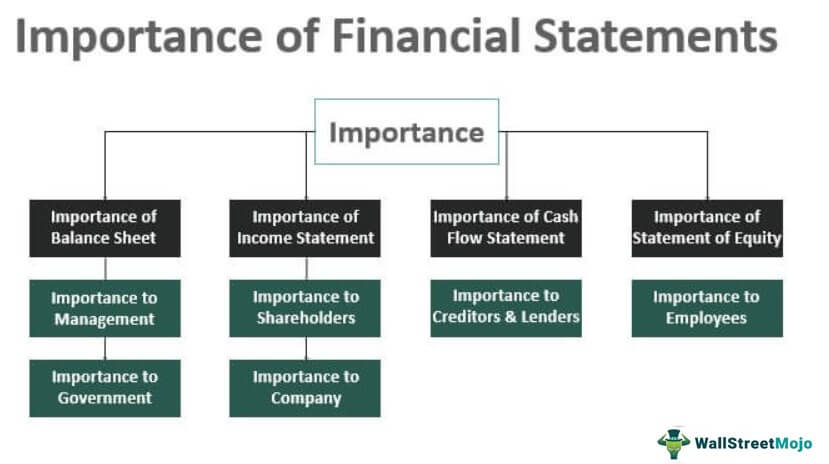

Importance Of Financial Statements Top 10 Reasons

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Qualified Nc Child Support Calculator Worksheet B Ncchildabduction Ncchildadoption Ncchi Personal Financial Statement Financial Statement Statement Template

Internal Control Audit Report Template 1 Templates Example Templates Example In 2021 Internal Control Report Template Audit

Blank Personal Financial Statement Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Audit Your Bank Account The Bossy House Audit Bank Account Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Posting Komentar untuk "Why Do Banks Want Audited Financial Statements"