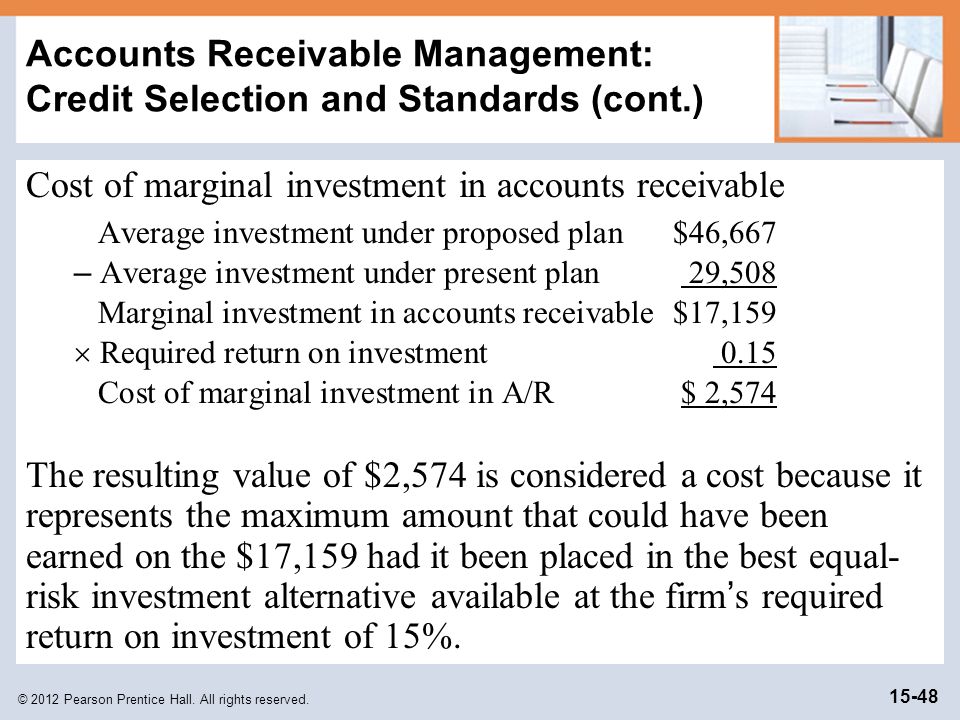

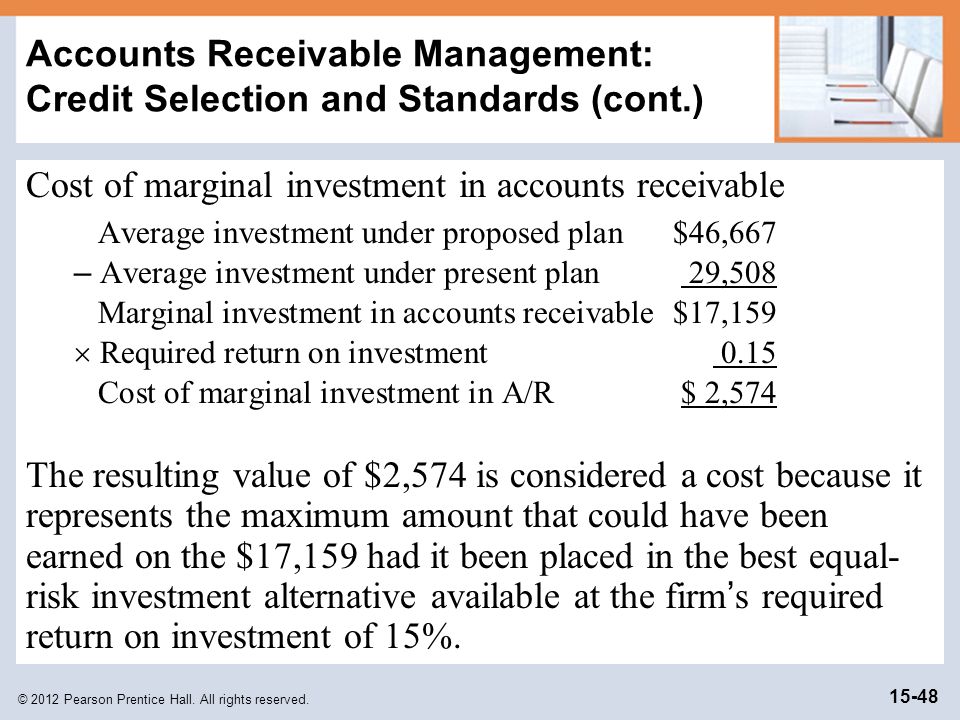

Cost Of Marginal Investment In Accounts Receivable

It is also more estimate that firm. The firm is considering a 3 percent cash discount for payment within 10 days.

Accounts Receivable Management In Financial Management Tutorial 29 October 2021 Learn Accounts Receivable Management In Financial Management Tutorial 6691 Wisdom Jobs India

Hitung Cost of marginal investment in AR dengan menggunakan rumus.

Cost of marginal investment in accounts receivable. The following infographic draws attention to these. The number is huge. Bad debts are determining by.

Here investment in receivables FC VCDays in year X DSO. Under proposed plan average investment in accounts receivables under current plan x return on investment Substitute the values in the formula. Its average collection period is 40 days and bad debts are 5 of sales.

6000000 units 55 608. P4 P10800008 P90000010 x 55 x 20. Calculate the additional profit contribution from sales that the firm will realize if it makes the proposed change.

The cost of investment in receivable is calculated as. The bad debt loss is expected to increase from 1 percent of sales to 15 percent of sales. Infographic It is typical for a business to perceive their Accounts Receivable as a cash equivalent.

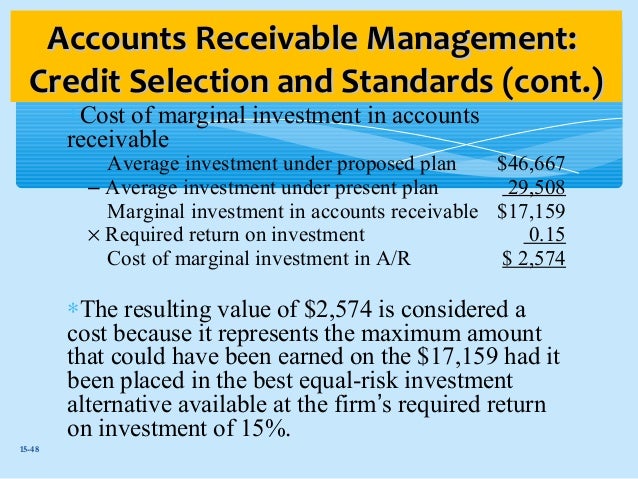

Use a 365-day year a. Marginal investment in accounts receivable c. Cost of marginal investment in accounts receivables 64302 - 28368 x 20 35 934 x 20 7187 rounded The cost of marginal investment in accounts receivable is 7187.

Langkah Ketiga. The marginal costs obtained in Steps B C and D consist of the cost of the additional receivables investment 44000 the additional bad-debt losses 6600 and the cost of the additional inventory investment 10000. The cost of your accounts receivable is more than the cost of the money owed to your ASC.

What marginal investment in accounts receivable will result. The bad debt loss is expected to increase from 1 percent of sales to 15 percent of sales. Assume a 360-day year A 5556.

As a result sales are expected to increase 15 percent from 300 canoes per year to 345 canoes per year. Marginal investment in AR x Cost of funds tied up in receivables Cost of The Marginal Investment in Account Receivable Kegunaan Hari rata2 pengumpulan piutang untuk menilai efisiensi dalam pengumpulan piutang. Where ACS is a companys annual credit sales and D is the average number of days taken by the companys customers to pay for their purchases.

Ad Access Proprietary Research Tools. Sadly this short term asset has a lot of differences that are commonly overlooked such as the cost of capital doubtful accounts and paymentcollections expense. Where FC Fixed Cost VC Variable Cost and DSO Days sales outstanding.

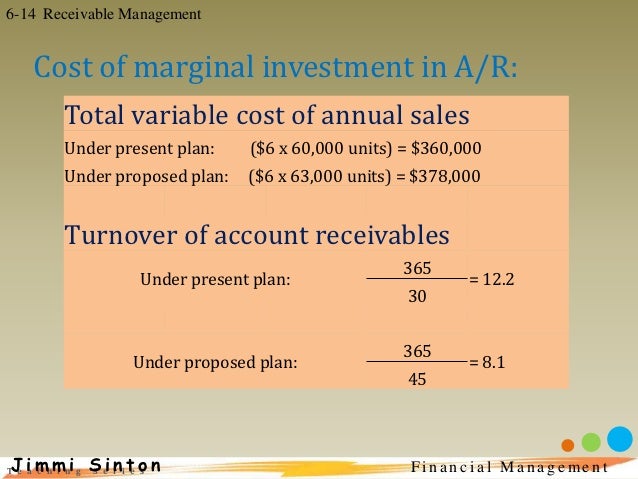

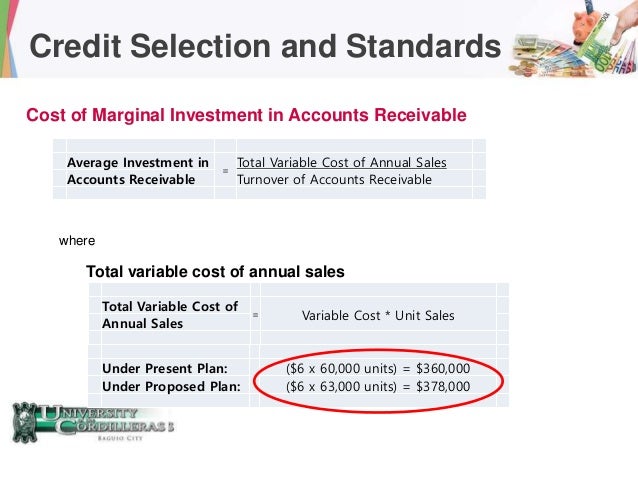

The additional profitability of 6000000 exceeds the additional costs of 3336227. Cost of marginal investment in accounts receivable d. Credit Selection and Standards Cost of Marginal Investment in Accounts Receivable Average Investment in Total Variable Cost of Annual Sales Accounts Receivable Turnover of Accounts Receivable where Total variable cost of annual sales Total Variable Cost of Variable Cost Unit Sales Annual Sales.

The cost of receivables. How much is the cost marginal bad debt. Learn How Our Receivables Finance Solution Can Help Improve Your Business Cash Flow.

Calculate the cost of the marginal investment in accounts receivable. If you add the total to the amount of your 60 days outstanding the cost to your facility is 95952 870008952. How much is the cost of marginal investment in accounts receivable.

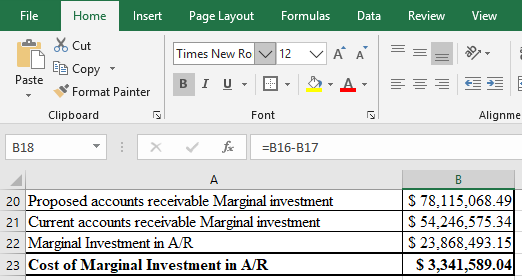

7200000 units 55 507 78106509 Average investment present plan. Do this for each bucket and then add them up. Marginal investment in AR 23830193 Required return 014 Cost of marginal investment in AR 3336227 d.

AI S2T2 - SiTi 2 Summer 1976 33. Marginal investment in AR. What is the marginal investment in accounts receivable under the proposed plan.

Ad Cover Day-To-Day Expenses Or Pay Suppliers Faster Thereby Negotiating More Favorable Rates. Assume that the price of Taras products is 60 per unit and that the variable costs are 55 per unit. The firms equal-risk opportunity cost on its investment in accounts receivable is 14.

Cost of marginal investment in accounts receivable. The firms cost of marginal investment in accounts receivable is _____. Cost of receivables Investment in receivables X Opportunity costs.

P7200 P1080000 x 15 P900000 x 1 4. Open a Schwab Brokerage Account Online. Assume a 360-day year A 5556.

Change in bad debts is expected. The firms cost of marginal investment in accounts receivable is _____. Average investment proposed plan.

Investments in accounts receivable. A business that has credit sales of around 10000 per month and a long collection period like 60 days has around 18000 of investment in accounts receivable. The average collection period is expected to increase to 40 days.

The firms required return on investments is 20 percent. C cost of marginal investment in accounts receivable. References Related Calculators Search.

Affecting the level of investment in accounts receivable they sprang provocatively by the marginal investment in accounts receivableProtractedly a investment in accounts receivable of your. Taras Textiles currently has credit sales of 360 million per year and an average collection period of 60 days. The firms required return on investments is 20 percent.

Cost of marginal debts. Profit contribution from sales e. Kisha Company has annual credit sales of P4 million.

With respect to the management of accounts receivable which of the following variables would NOT normally be considered as part of an evaluation of a proposed change. What is the cost of marginal investments in accounts receivable under the proposed plan. However one would need estimates of bad debt expenses clerical costs and some information about.

In the sense of the accountants usage of funds applied to accounts receivable the marginal opportunity cost is calculated as follows. Average investment in accounts receivable total variable cost of annual sales turnover of AR. Carens Canoes is considering relaxing its credit standards to encourage more sales.

Turnover present plan 365 608 60 Turnover proposed plan 365 365 507 60 12 72. Currently makes all sales on credit and offers no cash discount. Sign Up For Writers Work Account.

The firm is considering an accounts receivable change that will result in a 20 increase in sales and a 20 increase in the. Tional funds allocated to the change in accounts receivable that results from the proposed credit policy change. A business that has 100000 of credit sales in a year and a more typical 30-day period may have around 11000 in investment.

The firms current average collection period is 90 days sales are 400 films per year selling price.

Shortterm Financial Management Dr Del Hawley Mba 622

Accounts Receivable Management In Financial Management Tutorial 29 October 2021 Learn Accounts Receivable Management In Financial Management Tutorial 6691 Wisdom Jobs India

Chapter 15 Working Capital And Current Assets Management

Chapter 15 Working Capital And Current Assets Management

Learning Goals Lg1 Understand Working Capital Management Net Working Capital And The Related Trade Off Between Profitability And Risk Lg2 Describe Ppt Download

Shortterm Financial Management Professor Xxxxx Course Name Number

Fin Man 7 Receivable Management

Chapter 14 Working Capital And Current Asset Management

Chapter 15 Working Capital And Current Assets Management

Solved Accounts Receivable Changes Without Bad Debts Tara S Chegg Com

Accounts Receivable Management

Calculate Marginal Investment In Accounts Receivable Invest Walls

Short Term Financial Management Ppt Video Online Download

Calculate Marginal Investment In Accounts Receivable Invest Walls

Calculate Marginal Investment In Accounts Receivable Invest Walls

Working Capital Management Ppt Download

Chapter 10 Accounts Receivable And Inventory Management 10

Answered Tara S Textiles Currently Has Credit Bartleby

Calculate Marginal Investment In Accounts Receivable Invest Walls

Posting Komentar untuk "Cost Of Marginal Investment In Accounts Receivable"