Does 401k Show On W2

I have searched the IRS website and W2 instructions but find nothing for printing the 401 a amounts on the W-2. Your safe harbor 401 k contributions are already accounted for when your employer reports your wages tips and other compensation in Box 1 of your Form W-2.

This Is The Info From My W 2 For 2019 I Am An A2 And Put 2 Allowances And Married On My W 4 When I Calculate My Tax Return It Shows I Owe

I dont think it has anything to do with the W2 unless memo type entry in box 14.

Does 401k show on w2. Yes for 2020 and 2021 if you are age 50 or older you can make a contribution of up to 26000 to your 401 k 403 b or governmental 457 b plan 19500 regular and 6500 catch-up contributions and 7000 to a Roth IRA 6000 regular and 1000 catch-up. Finding More About W-2 Reporting. No both the regular 401k contributions and catch up payments are to be reported on the.

However your 401 k contributions arent taken out of the Social Security wages reported in Box 3 or the Medicare wages in Box 5 because 401 k contributions are still subject to those taxes. The loan has no bearing on your income unless you go into default. There should be no tax consequences on repayments of principal or interest.

You receive a W-2 from your employer after the close of the tax year showing your taxable earnings in Box 1. A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employees wages to an individual account under the plan. Lets talk about how a 401k impacts your W-2.

We are a government employer that has a 457 b and a 401 a plan. 5 Are 401k Catch Up Contributions to be reported on separate W-2 forms. 401 a Plan on the W-2.

CODE Y Box 12 Code Y reports the current year deferrals to a Section 409a non-qualified deferred compensation plan. The subject line mentions W2. Does my 401K contributions showing on my W2 qualify as a retirement contributions expense.

The loan is not reported on your W2. Please let me know if you need more information. I know the 457 b contributions print in Box 12 code G on the W-2.

Box 13 on the Form W-2 you receive from your employer should contain a check in the Retirement plan box if you are covered. The IRS 401k Excess Deferral Project has found reported in Box 12 of Form W-2 significant errors in elective 401k salary deferrals in excess of the annual contribution limit. Up to 20 cash back A 401K loan is not generally reported anywhere on your W2.

I have always understood that Box 13 does not need to be checked because there are no tax implications. Code AADesignated Roth contributions under a section 401 k plan Code AADesignated Roth contributions under a section 401. Your 401K contributions yours and the employer match will not show in your W-2 Box 1 wages but will show in Box 12 with a Code D.

401 k Plan Overview. Contributions are not reported on your W-2. When viewing your W-2 you could easily get overwhelmed with the number of W-2 boxes there are.

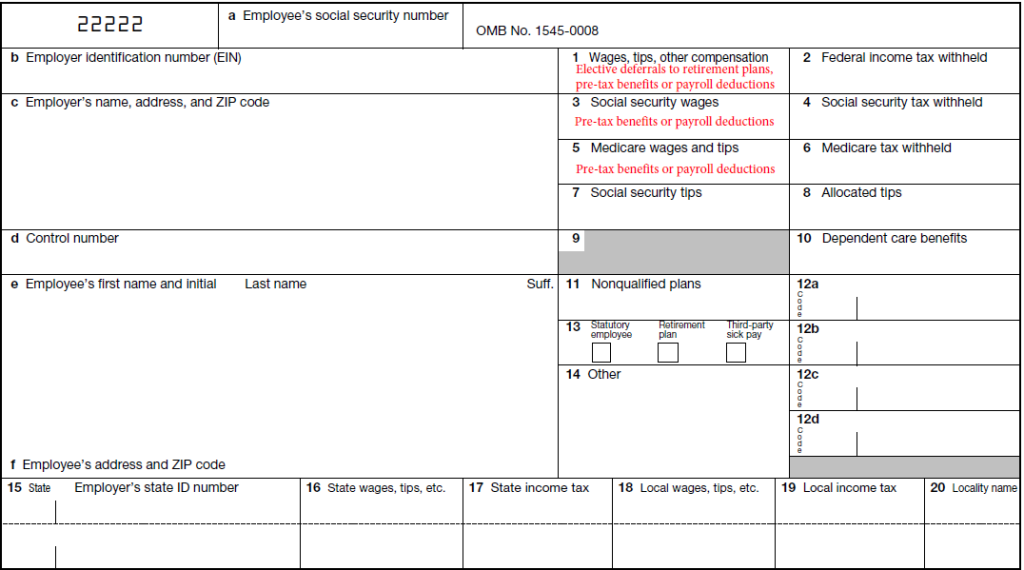

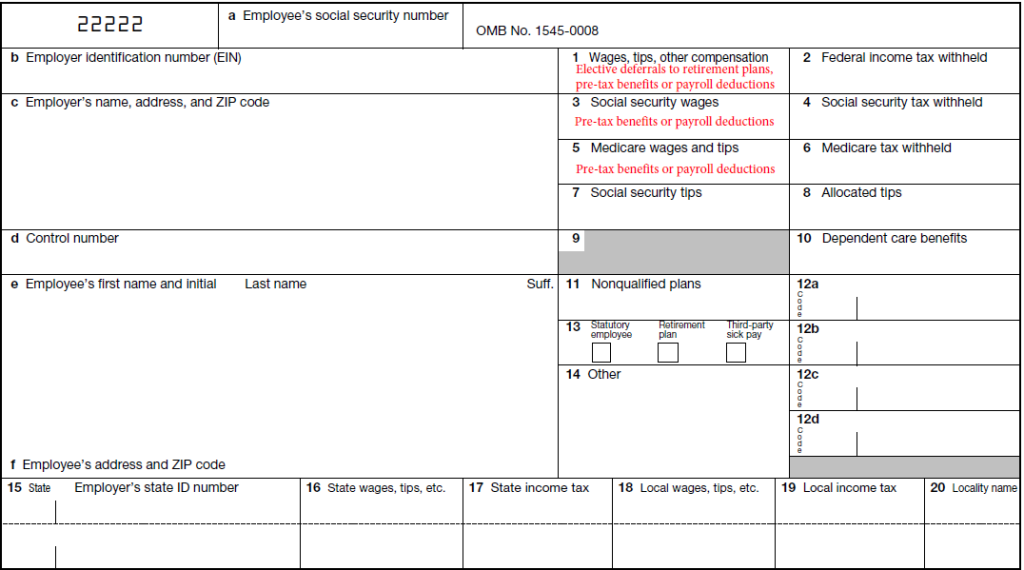

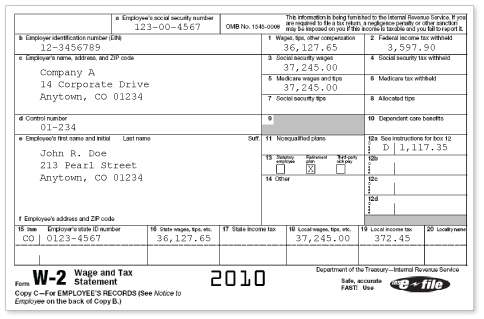

The maximum amount is 20500 15500 over 50 amount of 5000. The W-2 boxes and W-2 codes show the wages youve earned and any taxes paid through withholding. Codes for box 12 Form W-2 Box 12Codes Box 12Codes General Instructions for Forms W-2 and W-3 - Notices.

If the loan is not repaid default then a 1099R is issued as a distribution. The limits on the amount you can deduct dont affect the amount you can contribute. Clergy and religious workers Clergy and religious workers.

How Matching Works. Generally contributions to your 401 k or TSP plan will show up in box 12 of your W-2 form with the letter code D. Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income.

The underlying plan can be a profit-sharing stock bonus pre-ERISA money purchase pension or a rural cooperative plan. To help you understand your Form W-2 weve outlined each of the W-2 boxes and the corresponding W-2 codes below. If you do not then a positive 5 star rating is appreciated.

If you are still not certain check with your or your spouses employer. However you can never deduct more than you actually. If you earn 60000 the maximum amount your employer.

Answer 1 of 6. You can get to the W-2 section in TurboTax by searching for W-2 upper- or lower-case with or without the dash and then clicking the Jump to W-2 link in the. June 7 2019 257 PM.

Posted June 5 2013. As the SIMPLE IRA works similarly to other employer-sponsored retirement plans such as a 401 k plan salary deferral contributions must be reported on each participant employees W-2. You will also note that your Box 3 social security income will include your 401K contributions.

The contributions are notated in Box 12 as AA. Amounts noted on pay records of course. HR Block told an employee that the Retirement Plan box must be checked in Box 13 on their W-2.

W-2 boxes explained box by box.

Csa The W 2 Forms Are Not Matching The Earnings Report Or 941

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras

Understanding Your W 2 Controller S Office

How To Read Your W 2 Form To Correctly File Your Tax Returns

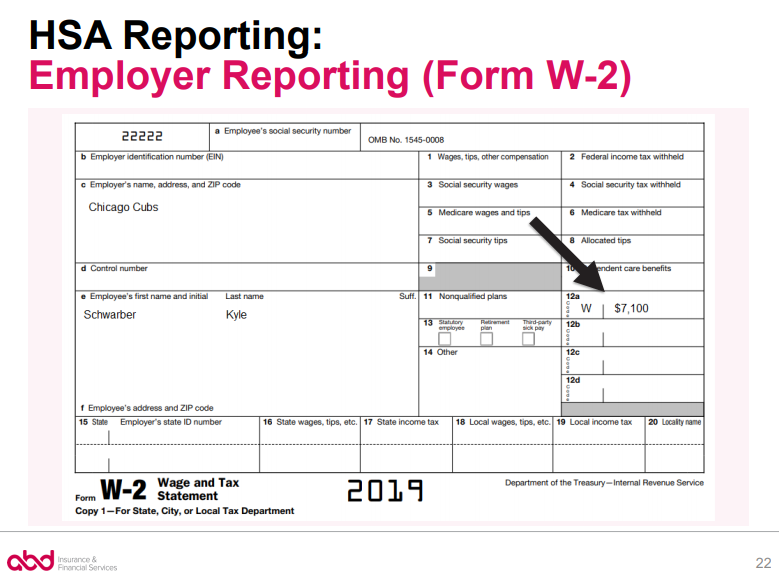

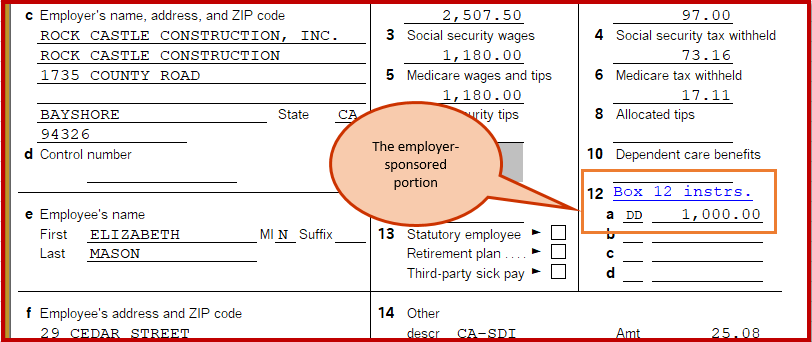

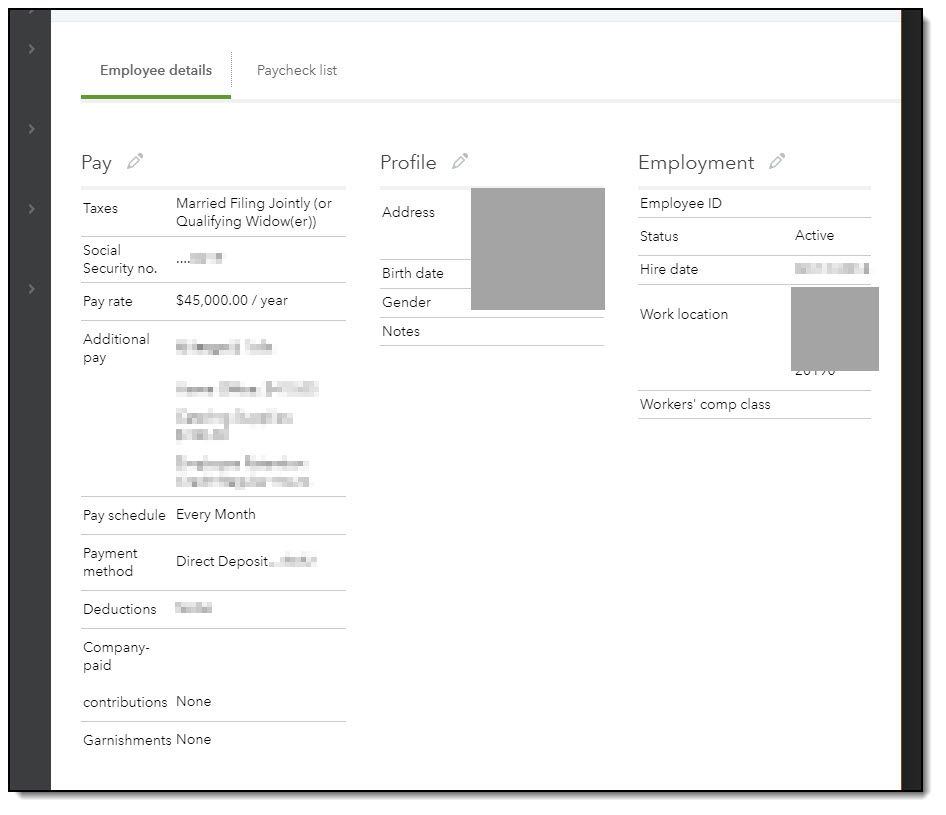

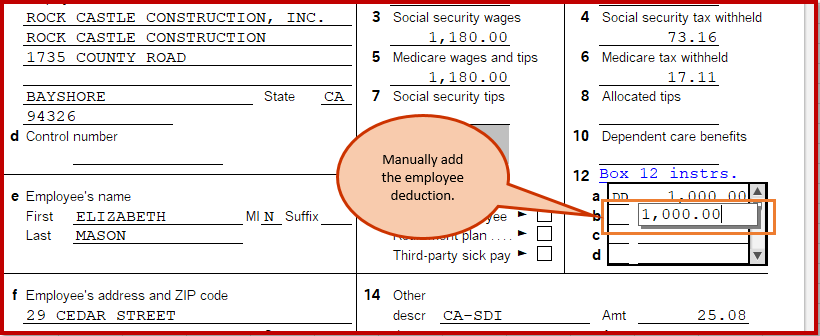

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

Gross Wage Calculation Defined Contribution Plan Auditor

Solved W2 Box 1 Not Calculating Correctly

W 2 Should Not Have Box 13 Checked How Do I Fix T

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

Wage Tax Statement Form W 2 What Is It Do You Need It

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Have Your W 2 Form Here S How To Use It The Motley Fool

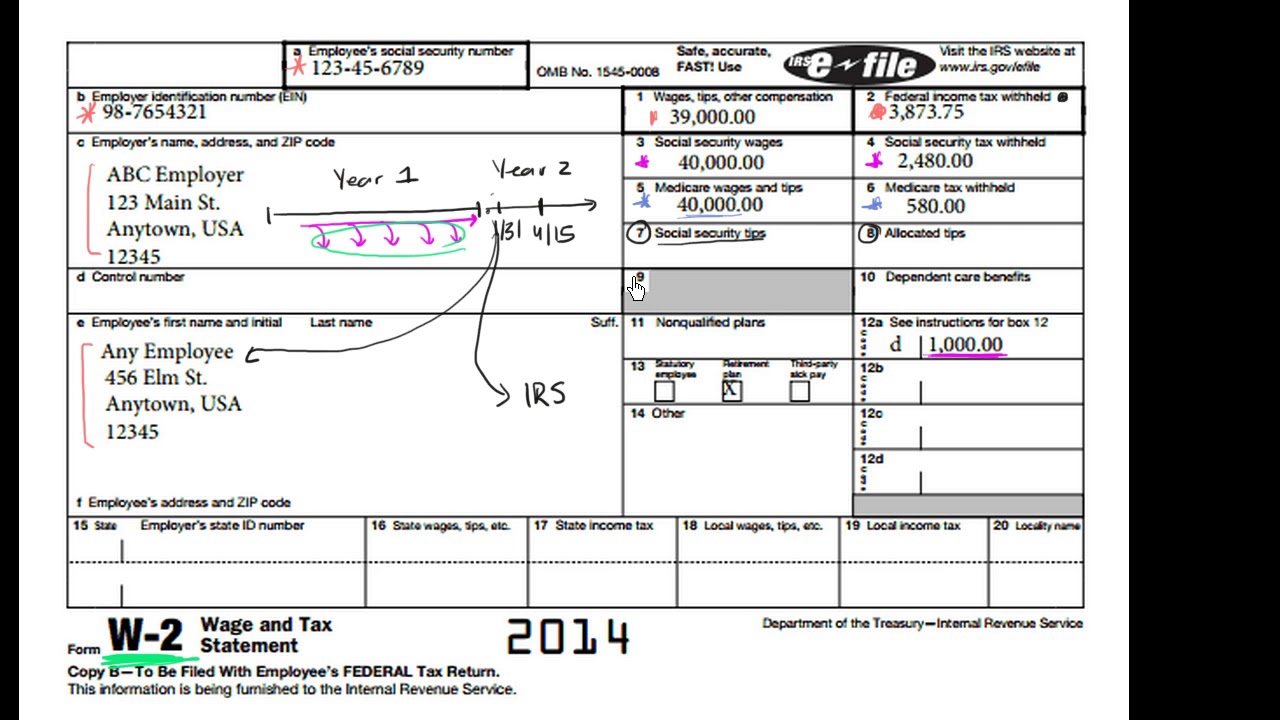

Intro To The W 2 Video Tax Forms Khan Academy

Form W2 Everything You Ever Wanted To Know

How To Read Your W 2 Justworks Help Center

Wage Tax Statement Form W 2 What Is It Do You Need It

Intro To The W 2 Video Tax Forms Khan Academy

Math You 5 4 Social Security Payroll Taxes Page 240

Posting Komentar untuk "Does 401k Show On W2"