Are Outstanding Shares Good Or Bad

Outstanding shares can be either good or bad depending on how the total number affects share prices earnings and availability. A company may have 100 million shares outstanding but if 95 million of.

What Is Price To Book Ratio Definition Formula How To Use It

Share count would increase by 4000 10000 - 6000 because after the 6000 shares are repurchased there is still a 4000 share shortfall that needs to be created.

Are outstanding shares good or bad. When an investor exercises a warrant they purchase the stock and the. Diluted EPS is the same as basic EPS but also includes in the outstanding shares number any shares of convertibles or warrants. Actually so it means 992 of the outstanding shares are available to the public to trade NOT the current short interest.

EPS Total EarningsTotal number of shares. EPS Earnings Per Share EPS is a key financial metric that investors use to assess a companys performance and profitability before investing. The amount of shares outstanding is one of the more overlooked aspects of investingInvestors often pay attention to a share price and a companys profit or sales growth but they may not always notice if the amount of shares is growing at a rapid pace.

Increasing the amount of outstanding shares can lead to share dilution and negatively affect existing investors. Why shares outstanding is useful. Securities can be anti-dilutive.

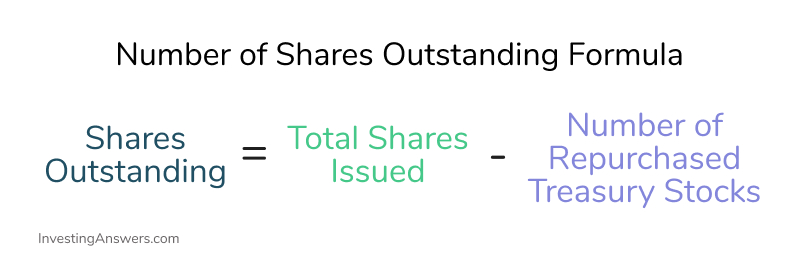

The outstanding share count changes when a company issues new shares or repurchases existing shares. Once again there isnt really a good or bad number here but as a general rule the more investors the better. A companys number of shares outstanding is used to calculate many widely used financial metrics.

Stock warrants are options issued by a company that trade on an exchange and give investors the right but not obligation to purchase company stock at a specific price within a specified time period. That way the moves made by one or two investors will not affect the stock as much as if there were very few institutional investors holding very large percentages of the outstanding stock. From this the stock float is 55000.

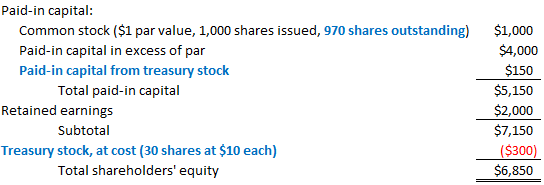

Currently as indicated on the companys balance sheet its total outstanding common shares number 500000 50000 of which are held by the CEO and CFO of the company while 80000 shares are held in treasury. Anyone can very easily look up the number of. Has 100000 shares outstanding.

On October 16 2020. Is 99 good or bad. The Investing Answer.

These changes can affect the stock price and thus the value of investment portfolios. For example if a company issues new shares to pay off long-term debts or to raise funds for building new stores investors might bid up the stock price in expectation of higher profits. Diluted EPS is generally considered a more accurate measure and is more commonly used.

There are many situations in which the total number of outstanding shares is considered important. The remaining shares are held by regular investors. This is the sum of the total outstanding shares minus the shares held by insiders and institutions.

The number of outstanding shares is simply the total number of shares a publicly traded company has. There is no rule-of-thumb figure that is considered a good or bad EPS although obviously the higher the figure the better. Answered 5 years ago.

Posted on September 17 2021 Author Leave a comment. Similarly large companies with many shares outstanding tend to have high trading volume. While outstanding shares are a determinant of a stocks liquidity the latter is largely dependent on its share float.

Good or bad Many assume that the issuance of more shares is unfailingly bad news causing dilution. Company XYZ announces a share buyback program to repurchase lets say 10 per cent of the outstanding shares at current market price. 50 x 50000000 25 billion.

Determine the free float of Company A. Market capitalization share price times number of shares. A company ABC Inc.

This includes the shares that you and I can trade as retail traders the shares that are traded and held by institutionshedge fundsbanks and even the shares that are owned by company insiders. Of the shares outstanding 5000 are held by its employees 40000 shares are held by institutions. The other 08 percent of shares cannot be bought and are owned by institutions or corporations.

Eg to calculate earnings per share EPS. The Outstanding Shares are useful to know the financial performance of the Company per share. Example of Free Float.

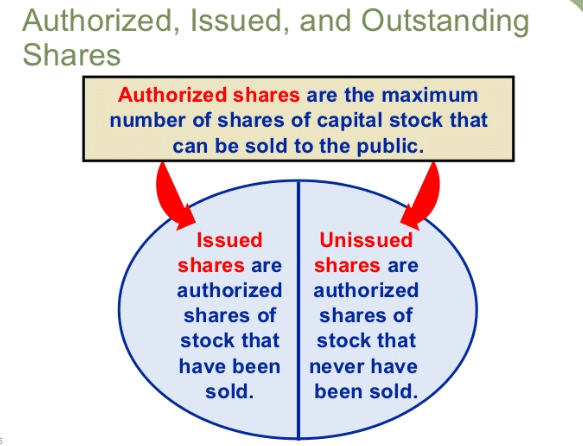

Trading volume can also spike around the release of news as investors scramble to. Company A is a publicly traded company with 1000000 shares authorized. A fast-rising share count can sharply dilute the value of all other shareholders stakes in a company so be sure to keep.

10 x 300000000 3 billion. If you looked only at their per-share prices you wouldnt know the. The company had Rs 1000000 in earnings spread out over 1 million shares or 1000000 shares equating to EPS of Re 1.

Are outstanding shares good or bad. Level 2 3m. Alot of pump and dumps that have billions of shares outstanding eventually do a reverse split to reduce share count to something like 150 million.

Shares are beholden to the same economic laws as anything else that can be. Yes avoid penny stocks that are highly diluted the more shares outstanding the more volume needed for their share price to move. It actually can be not so bad if the funds raised by selling the new shares are spent in.

Dilution is a common penny stock scam by CEOs of worthless companies to make money off suckers.

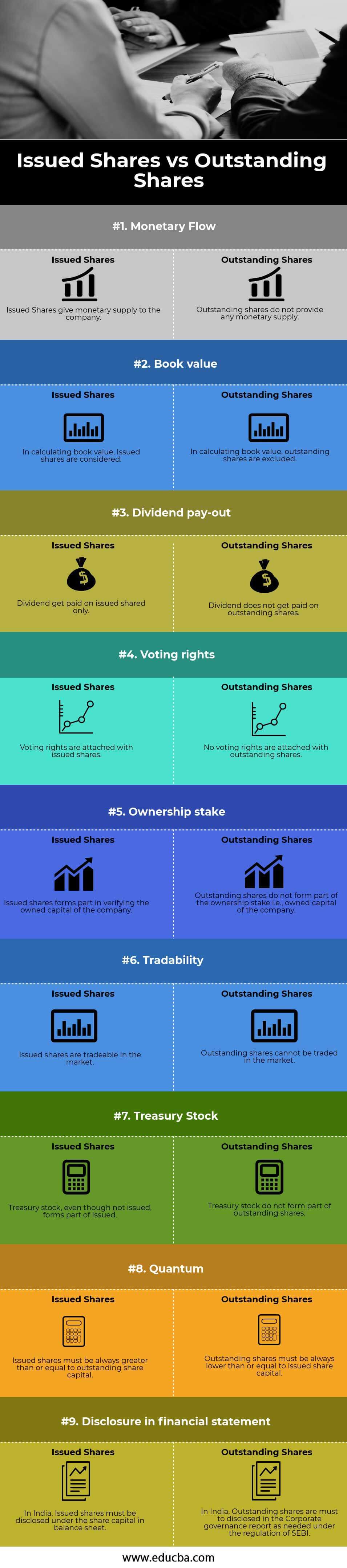

Issued Shares Vs Outstanding Shares Which One Is Better

Issued Shares Vs Outstanding Shares Which One Is Better

Issued Shares Vs Outstanding Shares Which One Is Better

Outstanding Shares Overview Basic And Diluted Example

Shares Outstanding Vs Floating Stock What S The Difference

Issued Shares Vs Outstanding Shares Which One Is Better

Outstanding Shares Definition Example Investinganswers

Common Stock And Stockholders Equity Accountingcoach

What Is Stock Split Yadnya Investment Academy

Shares Outstanding Meaning Formula Investinganswers

Shares Outstanding Meaning Formula Investinganswers

What Is Stock Split Yadnya Investment Academy

How The Sale Of Treasury Stocks Affects Shareholder Equity The Motley Fool

Understanding Shares Outstanding The Motley Fool

Shares Outstanding Meaning Formula Investinganswers

Understanding Shares Outstanding The Motley Fool

Statement Of Stockholders Equity Earnings Per Share Accountingcoach

/dotdash_Final_What_Is_Treasury_Stock_Nov_2020-01-f5035e8520f7431ab833b13a155adbac.jpg)

/dotdash_Final_What_Is_Treasury_Stock_Nov_2020-01-f5035e8520f7431ab833b13a155adbac.jpg)

Posting Komentar untuk "Are Outstanding Shares Good Or Bad"