Non Profit 401k Plans

A 403b retirement plan is often described as a 401k for nonprofits The two defined contribution plans are certainly similar but there are important differences between them. Employees may be inadvertently investing in companies that directly contradict publicly-stated corporate sustainability goals on issues like climate change and racial justice according to a press release from California-based non-profit.

Retirement Plans For Nonprofits 403 B 401 K And More

Even if they do there is a limit mandated by the IRS.

Non profit 401k plans. No- 457b plan 5500 catch up bc there is no catch up in a non profit 457b plan However the employee could do a 5500 catch up in the 403b plan if age 50. Those that dont may offer 401 k plans. New Comparability 401 k Profit Sharing.

For more information including a helpful chart comparing the features of available plans see IRS Publication 4484 Choose a retirement plan. Until 1996 nonprofit 501 c 3 organizations could only offer 403 b plans to their employees. Employers rarely match 100 of employee contributions.

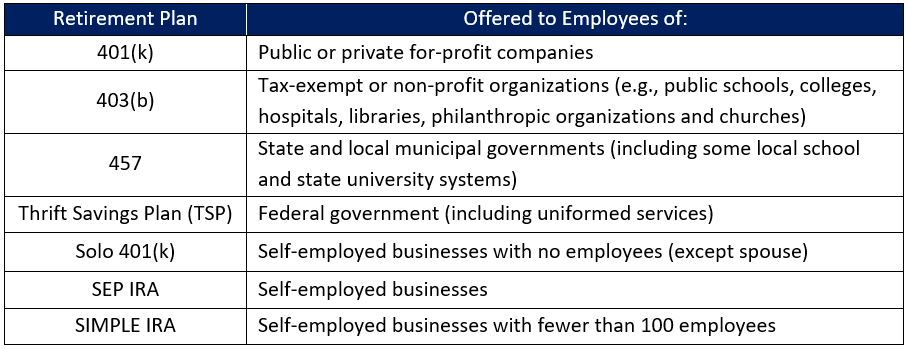

In 1996 the law changed allowing nonprofit organizations to choose either the 403 b or 401 k plan. Nonprofit organizations typically use 403b plans 401k plans SIMPLE IRA plans and other retirement plans for employees. Ad Search For 401 k plans With Us.

Similar to the more well-known 401 k plan the 403 b offers employees the ability to save for retirement through payroll deductions that are sometimes matched by their employers. Three-fourths of employees in the nonprofit sector have access to an employer-sponsored retirement plan. Search for 401 K Plans Here.

The simplest retirement plan option for nonprofit. Search for 401 K Plans Here. Retirement Plans for Employees of Nonprofits Common Benefit.

Ad The 401k your employees deserve. Employees know theyre making 401k contributions but do they know where their money is going. To be eligible for the 457b the.

For 2020 employees can contribute up to 19500 to their 401 k accounts. Visit our Web Now. In this plan employers can group employees when outlining a contribution plan.

Ad Strong Retirement Benefits Help You Attract Retain Talent. One is that not all 501 c 3 nonprofits qualify to offer their employees 403 b accounts. A modern 401k built for startups and small businesses.

Ad Retirement Plans That Support Client Goals Risk Tolerance. Visit our Web Now. Ad Search For 401 k plans With Us.

Traditionally 403b plans were a default option for nonprofits but 401k plans are a viable option for some organizations and SIMPLE plans may make sense when employers want a basic plan. Donating an IRA or other retirement assets to charity can be a tax-smart estate planning strategy. Effective January 1 2013 Massachusetts Mutual Life Insurance Company MassMutual acquired The Hartfords Retirement Plans Group.

Executive Compensation Plans Most common retirement plans 401kprofit-sharing plans Traditional pension plans 403b plans Other arrangements used for executives 457b plans for tax-exempt Non-qualified plans. We make it easy to offer a plan theyll love. Before a 401k plan can cross-test a new comparability contribution it must first allocate a gateway minimum contribution to all non-HCEs.

During a transition period you will see branding of both The Hartford and MassMutual. This contribution prevents an employer from passing the general test by giving large contributions as a of compensation to young low-wage workers while giving miniscule contributions to other non. How Does 401 k Profit Sharing Work.

Welcome to Empower Retirement. Nonprofits and 401 ks. In this common type of plan all employees receive employer contributions at the same rate.

A 501 c 3 nonprofit employee might open a 401 k account instead of a 403 b retirement account for many reasons. It is always possible to donate retirement assets including IRAs 401 ks. Retirement plans may also help an organization attract and retain better qualified employees.

Nonprofit Retirement Plans An Overview Of 403 B Options

Rpc Retirement Plan Consultants Social K

Which Retirement Plan Is Better For Nonprofits 401 K Or 403 B Shore Tompkins Actuarial Resources

Employer Sponsored Retirement Plans Real World Made Easy

401 K Plan What Is A 401 K And How Does It Work

4 Questions Plan Sponsors Should Ask To Understand The Similarities And Differences Between 401 K And 403 B Plans Hanys Benefit Services

Which Of The Three 401k And 403b Service Models Is Right For Your Plan 401k Plan Optimization Compliance Investment Partners

Types Of Retirement Plans Infographic Quicken

401 K Vs 403 B Which Is The Best Choice For My Non Profit

403 B Vs 401 K Which Is Right For Nonprofits Windes

403 B Retirement Plan Questions And Answers About 403 B S

Do The Rules About Related Companies Apply To Non Profits With No Owners

403 B Plan Definition Example Explanation

Attention Small Nonprofits If You Care About Your Employees Help Them Retire Rvc

Retirement Plans Maryland Nonprofits

403 B Vs 401 K Which Is The Better Plan Pros And Cons

Retirement Plans For Nonprofits 403 B 401 K And More

Posting Komentar untuk "Non Profit 401k Plans"