How Do I Issue A 1099 To A Foreign Person

Generally Form 1099 is not used to report payments to foreign persons. As long as the foreign contractor is not a US.

Change To 1099 Form For Reporting Non Employee Compensation Ds B

If they give you a W-8BEN then you need to withhold 30 or lower treaty rate as specified in the W-8.

How do i issue a 1099 to a foreign person. The Form W-8BEN is. The Form W-8BEN certifies that the foreign contractor is not a US. Only a few steps are required to get it done.

You should get a form W-8BEN signed by the foreign contractor. You need to get a W-8 from the foreign person you should have already done this. Answer 1 of 5.

And who are also citizens of the country. Rules for Foreign Workers. A Form W-8 is completed by non-resident aliens NRA who do work andor make income in the US.

Issuing a 1099 isnt difficult once you know the process. If your independent worker completes all tasks in hisher country of origin and receives compensation via PayPal a Form 1099 is also not necessary. Information Returns which is similar to a cover letter for your Forms 1099-NEC.

Or foreign business entities who make income in the US. It is the onus of the business owner to determine whether a contractor or vendor is a citizen. You are required to report payments subject to NRA withholding on Form 1042-S and to file a tax return on Form 1042.

You typically provide that information on Form W-8BEN-E when the company requests it and you should attach a statement to t. First make sure your information is correct. And in the future before a stitch of work is done before a dime is paid have these people complete w W-9 for you.

A 1099 is required for any worker who is not a US. If the foreign contractor lives and delivers their services in the US the income is considered US-sourced and the company must withhold 30 as per non-resident tax rates. If they will not then do not employ them.

It certifies foreign status regarding tax withholding on income. They are not subject to this filing since they are foreign. A 1099 is normally issued to individuals living in the US.

Source FDAP is paid to Foreign Persons called chapter 3 or NRA Withholding IRC 1441-1443. Q-1 issue to cultural exchange visitor. No Form 1099 then needs to be filed for payments to foreign persons.

Foreign worker providing services inside the US- It is vital for tax purposes to monitor where services are performed because if a foreign. In the case of a payment to a foreign account of an amount subject to chapter 3 withholding the payment is presumed to be made to a foreign person and not to a US. Thus the payor must file a Form 1099 for the payee but the payment is not subject to backup withholding.

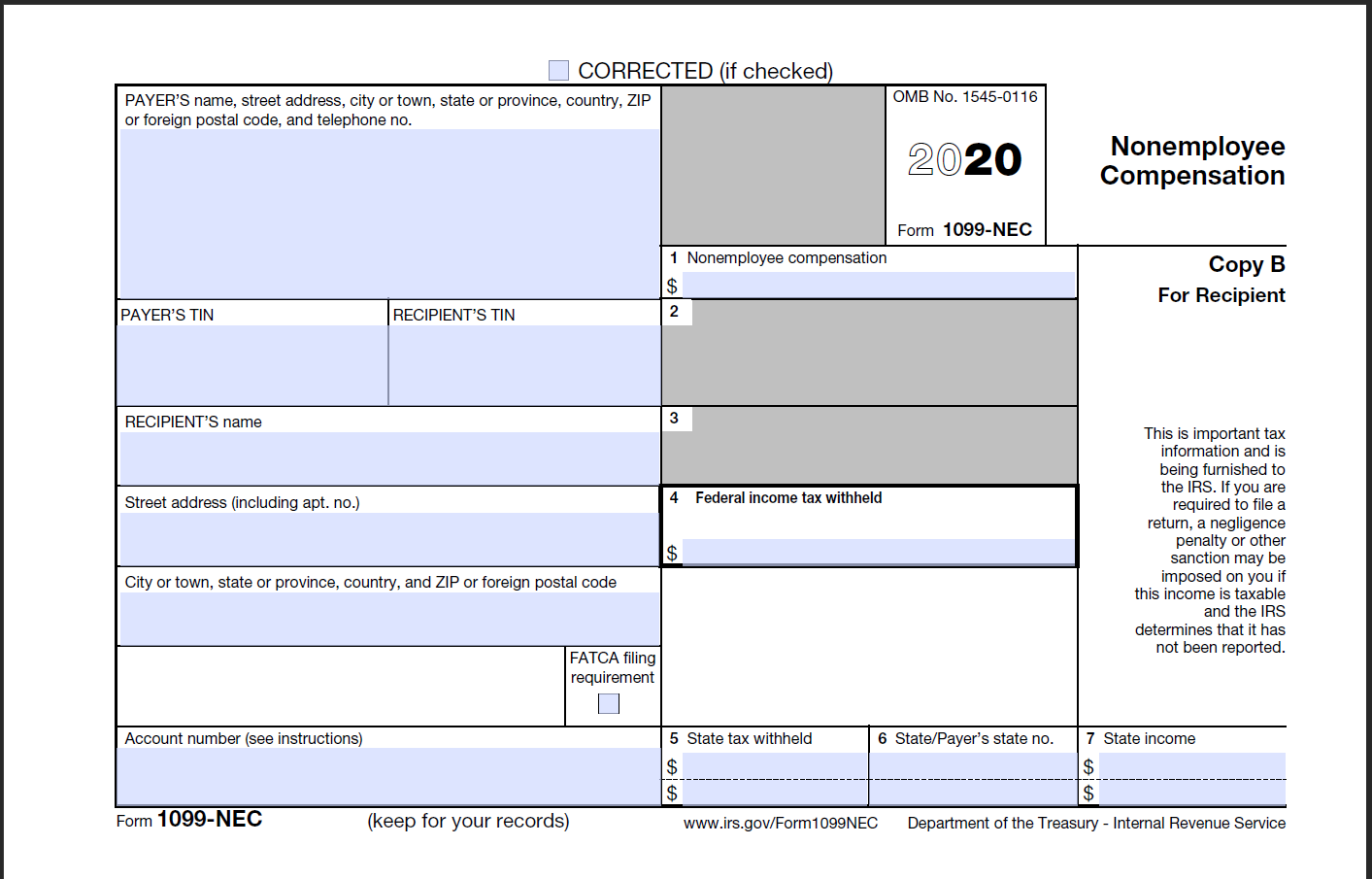

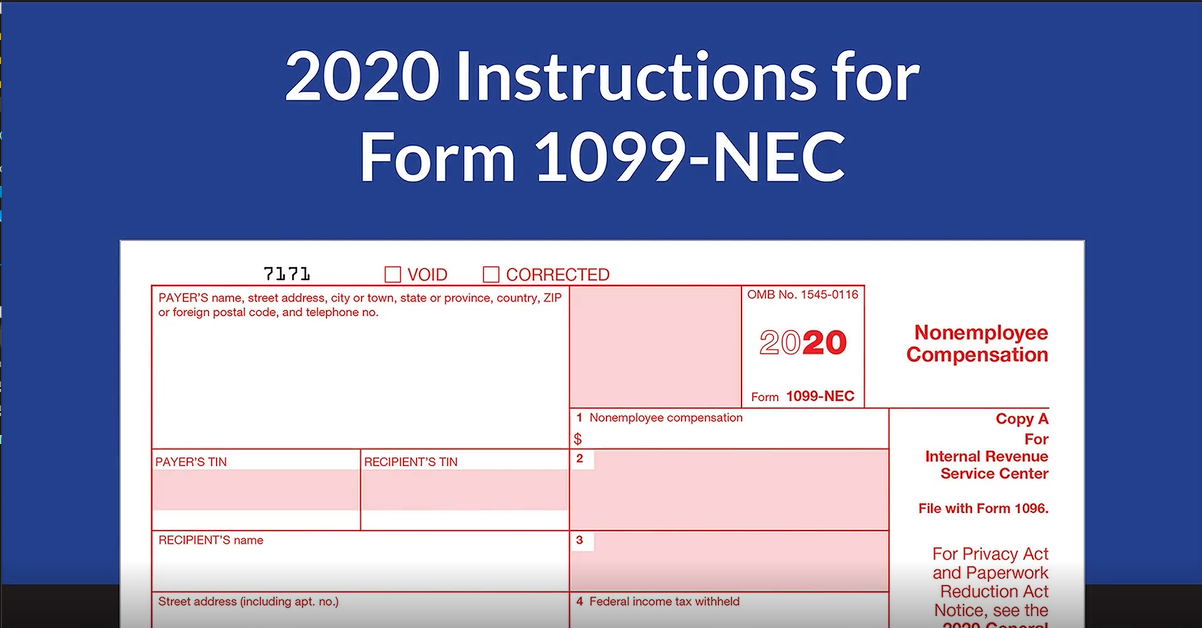

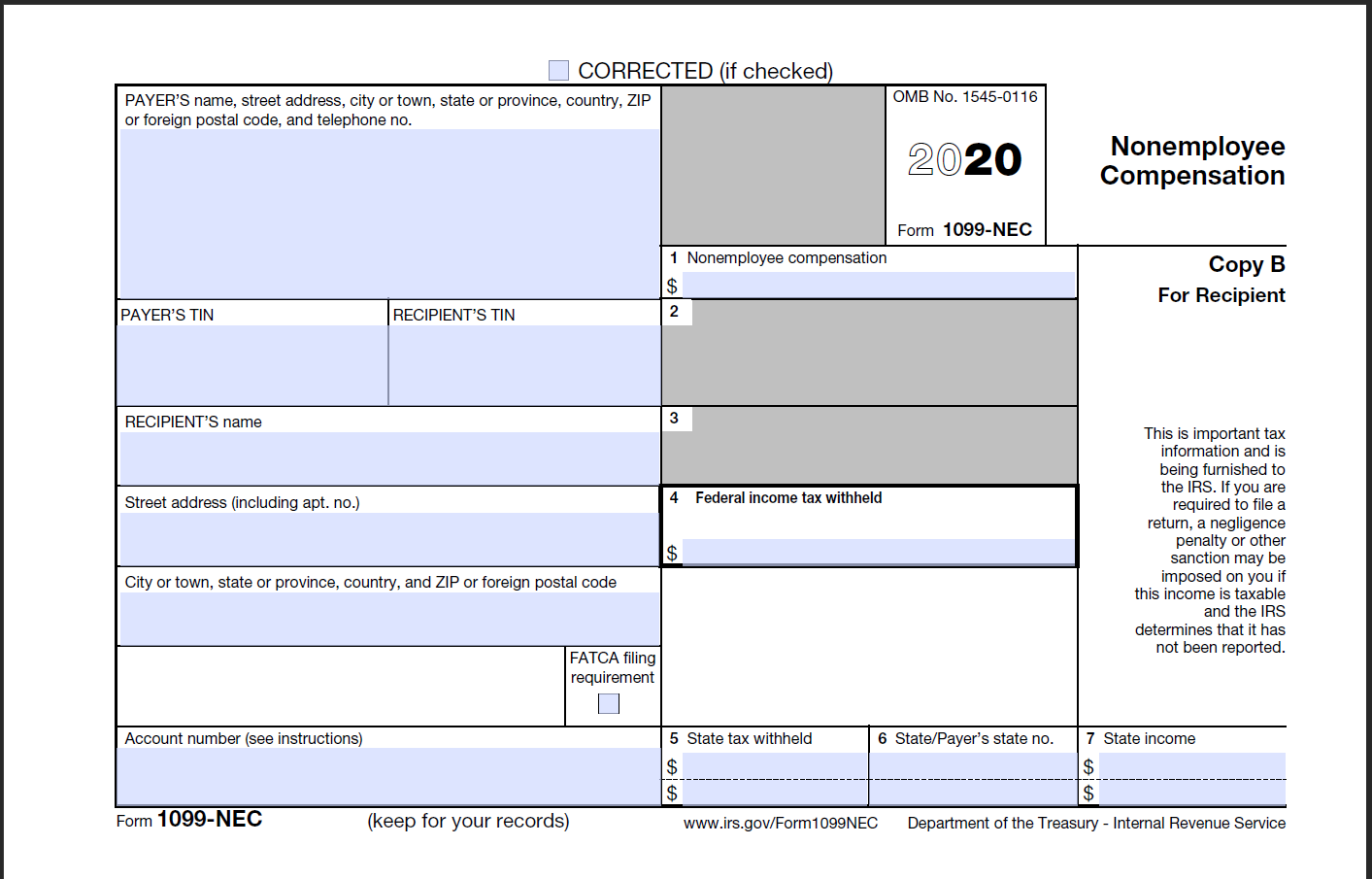

Any person making more than 600 per year is issued a 1099-MISC for income earned in the US. Feb 7 2008 0716 PM. Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US.

By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US. There are several versions of the W-8 form. Instead Form 1042 is used.

Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required. Wages Paid to Employees. An exception from reporting may apply to individuals who are not required to withhold from a payment and who do.

O-1 issued to individuals with extraordinary abilities in science art education etc. Youll need the names addresses and Social Security Numbers or Employer Identification Numbers for each contractor. These tax forms are only used by foreign persons certifying their foreign status.

Only if one talks about a foreign individual who is in the States on a work permit then they need to fill out form W2 on them. All that the foreign contractor needs to do is to complete the basic information in Part I and sign in Part III attesting that the information is true correct and complete. Youll also need some blank 1099 forms.

You can ask them to fill out Form W-8BEN for this purpose. TN issued to teachers engineers and scientist of Canada or Mexico pursuant to the NAFTA treaty. The US company is supposed to request documentation from you that you are a foreign person who is not performing services for compensation in the US.

If any of the contractors are incorporated you do not need to issue a 1099. H-1C issued to foreign nurses. Self-employed via internet- For businesses hiring foreign individuals for work remotely or over the internet a Form 1099 is not required.

If the foreign contractor is not a US. The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

Instead you will need to ask the contractor to complete a Form W-8BEN. A payment to a foreign account is presumed to be made to a US. How To Issue A 1099.

However foreign corporations are not issued this document. Again you do not need to issue 1099 to them as long as theyre not valid US vendors. As long as the foreign contractor is not a US.

Form 1099 Reporting and Backup Withholding. Taxpayer and all of the contracted services were performed outside the US a Form 1099 is not required. By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US.

However these rules do not apply if a tax treaty exists between the countries mentioned earlier in this article or if a person. 11441-1 b 3 it is generally easier to ask them to complete a Form W-8BEN.

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemble The Actu Irs Forms Fillable Forms Tax Forms

Irs Approved 1099 Int Tax Forms File Form 1099 Int Interest Income For Each Person To Whom You Paid Amounts Reportable In Boxes 1 Tax Forms 1099 Tax Form Irs

1099 For International Contractors Safeguard Global

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Tax Forms The Secret Book Card Templates Printable

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Form 1099 Nec For Nonemployee Compensation H R Block

Fillable Form 8865 In 2021 Financial Position Financial Information Fillable Forms

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

1099 Nec Filing Circumstances Form 1099 Nec 2020 In 2021 Nec Form Compensation

Fast Answers About 1099 Forms For Independent Workers Updated For 2018 Fillable Forms Independent Worker 1099 Tax Form

Do I Need To File 1099s Deb Evans Tax Company

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Form 1099 Nec Instructions And Tax Reporting Guide

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Printable Job Applications Doctors Note Template

Will I Receive A 1099 Nec 1099 Misc Form Support

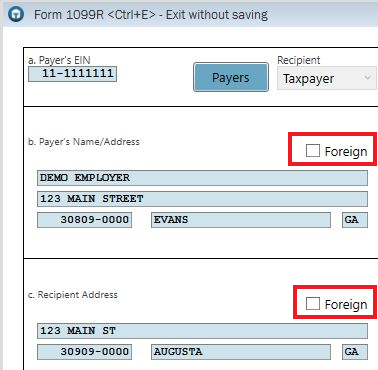

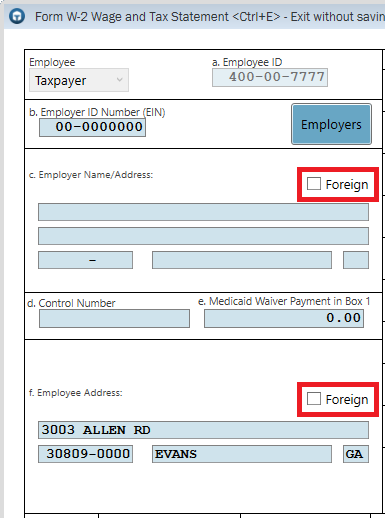

How To Enter A Foreign Address Support

How To Enter A Foreign Address Support

Irs Form 1099 S 2017 2018 Irs Forms Irs Form

Posting Komentar untuk "How Do I Issue A 1099 To A Foreign Person"