Convert Partnership To S Corp

Visit Us To View Pricing Details. Ad We Can Help You Elect S-Corporation Tax Status For Your Existing Business - Get Started.

Converting From C To S Corp May Be Costlier Than You Think

Used By Over 1 Million Businesses Since 1998.

Convert partnership to s corp. Converting your LLC to an S-Corp when filing your tax return for tax purposes can be a complicated process but it is possible. The IRS ruled that if the business made this conversion and filed this election to continue to be taxed as a corporation the conversion. Say Thanks by clicking the thumb icon in a post Mark the post that answers your question by clicking.

Likewise a partnership can choose to operate as an S corporation. As stated above conversion from a partnership to a corporate status can be done by liquidating dissolving the current business entity or by transferring ownership of the current entity over to the corporation. When converting an LLC to an S corporation the first step is to figure out if the LLC qualifies for S corporation status.

2009-15 that an entity classified as a partnership for US. Over 5000000 filings since 2004. If you want to convert S corp to partnership it is imperative to understand the pros and cons of doing so.

At this time they can also put in a request to change to an S corporation for tax purposes. The IRS issued Revenue Ruling 2009-15 which addresses the question of whether when a partnership becomes a corporation for federal tax purposes it is eligible to elect to be taxed as an S corporation in. A domestic California stock corporation can convert into a California other business entity.

A California limited liability company LLC limited partnership LP or general partnership GP can convert into a California or foreign other business entity. C Corporation Requesting a Change to File as an S Corporation. And a foreign business entity can convert into a California corporation LLC LP or registered GP if the conversion.

Conversion of a Limited Liability Company LLC to a Subchapter S Corporation S corp can reduce employmentself-employment taxes for highly profitable companies with simple ownership. Federal tax purposes that becomes a corporation may elect to be an S corporation without a deemed short year as a C corporation. Another method to convert to a tax partnership tax-free without undergoing an inversion is the LLC drop-down which entails the S corporation forming a wholly-owned LLC that is initially a disregarded entity for tax purposes and transferring all of the S corporations.

The first step in changing a partnership to an S corp is to file articles of incorporation with the secretary of states office for the state in which you are doing business. When an LLC wants to be an S corporation instead they will need to formally change their entity type with the formation state. Ad We Make It Easy To Incorporate Your C-Corp Get Started Today.

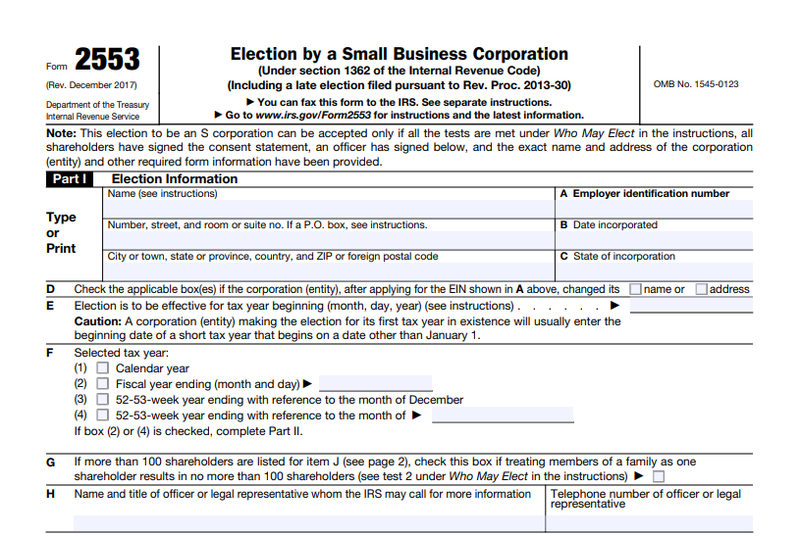

In that ruling the agency addressed the issue of whether an S corporation can convert to an LLC file an election to retain its tax treatment as a corporation and also hold onto its S status. You would then need to get an EI number for the corporation file the form with the IRS to elect taxation as an S Corporation. Converting Forming the corporation would require a State charter.

The partnership contributes all its assets and liabilities to the corporation in exchange for stock in such corporation and immediately thereafter the partnership liquidates distributing the stock of the corporation to its partners. Mark the last Partnership. Contact a Professional Business Attorney.

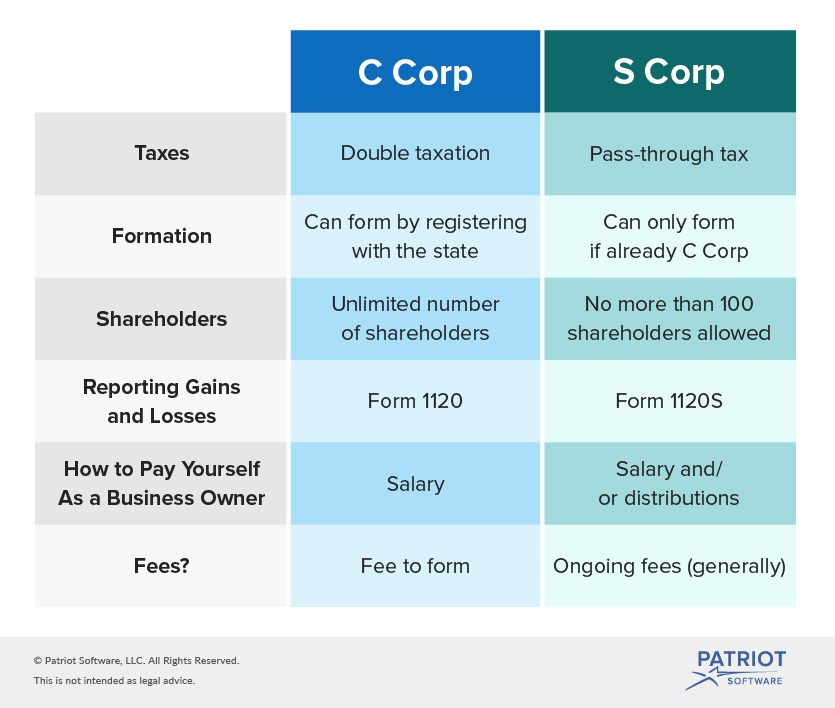

When changing their filing status from a C corporation filing Form 1120 to an S corporation filing Form 1120-S the Internal. What are the options in converting from a partnership or LLC partnership to a corporate entity status. S corporations have the option to change their business operations and run as a partnership.

Ad File your S Corporation today. Our Business Specialists Help You Incorporate Your Business. Not every corporation can be taxed as an S corporation.

Lacerte currently only supports converting a C Corp to an S Corp or vise versa. You can submit the documents necessary to convert your LLC to an S-Corp. The IRS has ruled in Rev.

Quickly Easily Form Your New Business in Any State For as Little as 0 State Fees. If an unincorporated state law entity that is classified as a partnership for federal tax purposes converts into a state law corporation under a state law formless conversion statute the following is deemed to occur.

S Corporations Learn 15 Advantages Disadvantages Corporate Direct

S Corp Vs C Corp Which Is Right For Your Small Business The Blueprint

Oh How The Tables May Turn C To S Conversion Considerations Stout

Can I Convert My Llc To An S Corp When Filing My Tax Return Turbotax Tax Tips Videos

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Llc Or Corporation Legal Business Book Nolo

How Changes In Corporate Tax Rate Can Affect Choice Of C Vs S Corp

How To Convert A Sole Proprietorship To An S Corp Truic

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Converting From C To S Corp May Be Costlier Than You Think

What Is The Difference Between S Corp And C Corp Business Overview

Valuation Critical For C Corp To S Corp Conversion Valuation Research

S Corporation Countermeasures Insights Barnes Thornburg

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

Difference Between S Corp And C Corp Difference Between

Single Member Llc To S Corp Benefits Drawbacks More

S Corp To Partnership Conversion Under Build Back Better

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Starting A Company Llc Vs Corporate Considerations Rubicon Law

Posting Komentar untuk "Convert Partnership To S Corp"