A Company's Net Cash Flow Will Equal Its Net Income

The areas are operating activities investing activities and financing activities. Revenues earned minus the expenses incurred in order to earn those revenues.

Net Income The Profit Of A Business After Deducting Expenses

The cash balance is the cash received minus the cash paid out during the time period.

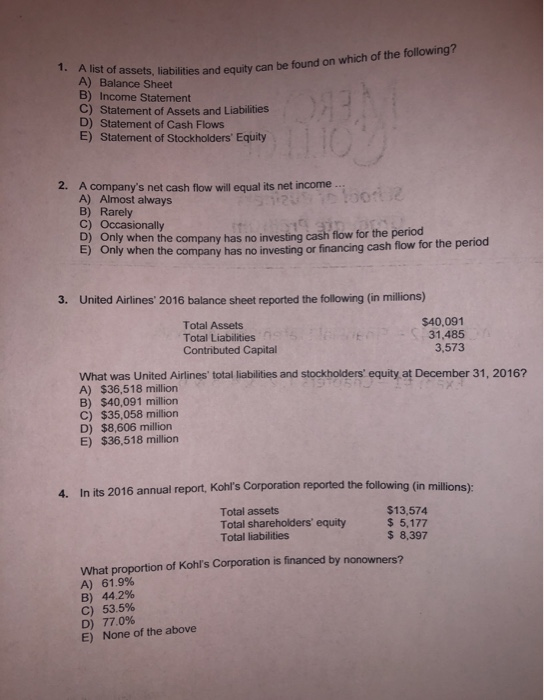

A company's net cash flow will equal its net income. It is rare to impossible to see a companys net income equal its net cash flow because both of them involve different variables. A Almost always B Rarely C Occasionally D Only when the company has no investing cash flow for the period E Only when the company has no investing or financing cash flow for the period 2. E Only when the company has no investing or financing cash flow for the period.

Though they may sound similar both are diametrically opposite concepts. A relationship exists between cash flow and net income but they are separate concepts in accounting. The idea behind separating these sources of cash is to get a better idea of where the cash is coming from.

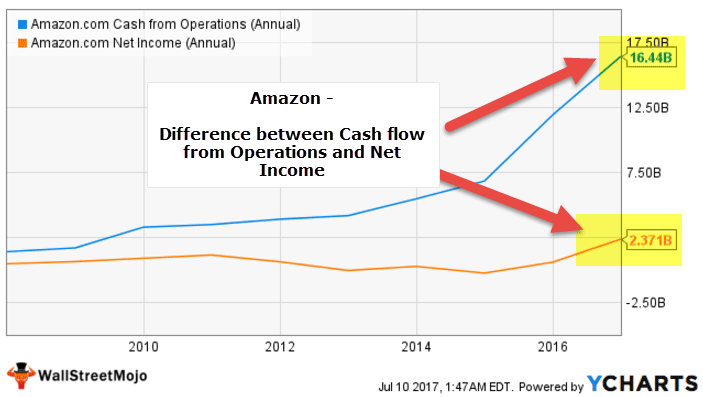

These values are rarely the same. Cash Flow Cash flow measures the ability of the company to pay its bills. Net income is the profit a company has earned for a period while cash flow from operating activities measures in part the cash going in and out during a companys.

Net income for instance involves both cash and non-cash variables while net cash flow contains only cash transactions. Cash flow is the measure of the businesss liquidity or the businesss ability to pay its short-term debt obligations by the cash or cash equivalents that it has on hand. Net income 50000 - 15000 Net income 35000.

A companys net cash flow will equal its net income. A business can be profitable and still not have adequate cash flow. Many a times there is confusion between net cash flows and net income.

Net cash is a figure that is reported on a companys financial statements. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow whereas net Income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. D Only when the company has no investing cash flow for the period.

In this situation the December revenues will increase the December net income but will not increase the companys December net cash flow. The result is a net income figure that does not reflect the amount of cash actually consumed or generated in a period. Here is the breakdown of net income and net cash flow.

Arriving at Equity Value. It is necessary for daily operations taxes purchasing inventory and paying employees and operating costs. Depending on the nature of your business you could have extended credit to a customer allowing them to pay you later no cash received at time of sale and you could have paid your bills using a credit card no cash.

Cash flow statements are broken down into three areas. Net cash flow is the net change in the amount of cash that a business generates or loses during a reporting period and is usually measured as of the end of the last day in a reporting period. Net cash flow is calculated by determining changes in ending cash balances.

Profit is shown on an income statement and equals revenues minus the expenses associated with earning that income. A business can have good cash flow and still not make a profit. The number you get is the companys free cash flow.

Revenue does NOT necessarily mean a receipt of cash and expenses does not always mean a cash payment. A detailed cash flow statement shows what amount came from loans productsservices and investments. A companys net cash flow will equal its net income.

The reason for this anomaly is your income statement in short shows the details of revenue expenses and net income or loss revenues minus expenses. In the short term many businesses struggle with either cash flow or profit. A companys net cash flow will equal its net income-Almost always -Rarely-Occasionally-Only when the company has no investing cash flow for the period-Only when the company has no investing or financing cash flow for the period.

To arrive at equity value take the following steps. When using unlevered free cash flow to determine the Enterprise Value EV Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest of the business a few simple steps can be taken to arrive at the equity value of the firm. Cash flow is the inflow and outflow of money from a business.

Net income Depreciation and amortization-Cap Ex-Increase or decrease in net working capital Free Cash Flow FCF. Net income reflects the companys revenue minus expenses for the given period. Are Net Cash Flow and Depreciation Related.

Net cash flow represents the amount of money received spent on operating investing and financing activities for the given period. Positive cash flow. Rapid or unexpected growth can cause a crisis of cash flow andor profit.

Under the accrual method of accounting net income is calculated as follows. If a company earns revenues in December but allows those customers to pay in 30 days the cash from the December revenues will likely be received in January. The net cash figure is commonly used.

While the two metrics are both aimed to help businesses understand their fiscal health they measure different factors and will not be equal to each other. It is calculated by subtracting a companys total liabilities from its total cash. Difference between Net Cash Flow and Net Income.

Intel Corporation reported the following on its 2013 income statement in millions. A corporations net income does not necessarily equal its net cash flow from operations. Profit is your net income after expenses are subtracted from sales.

Net cash flow 25000 - 10000 Net cash flow 15000. This measures the ongoing sustainability of the company. Then be sure to addsubtract the change in net working capital.

Hence the Net Cash Flow for 2011 is CFO CFI CFF Effect of Exchange Rate 71501 25709 -4533 975 -513 513 million.

Cost Accounting Study Guide Ebook Rental Cost Accounting Accounting Education Bookkeeping Business

:max_bytes(150000):strip_icc()/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

How Do You Calculate A Company S Equity

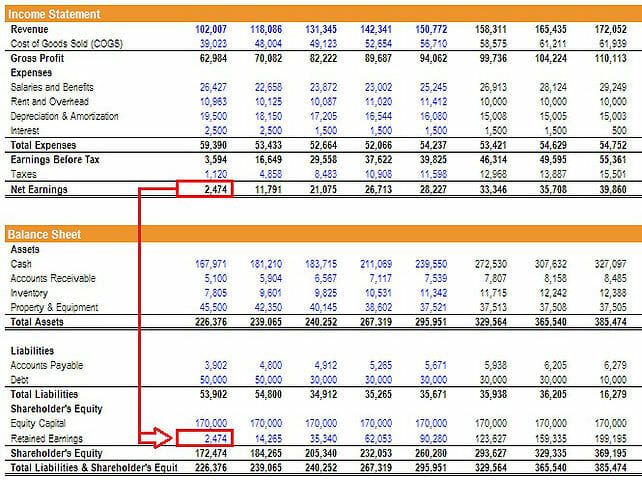

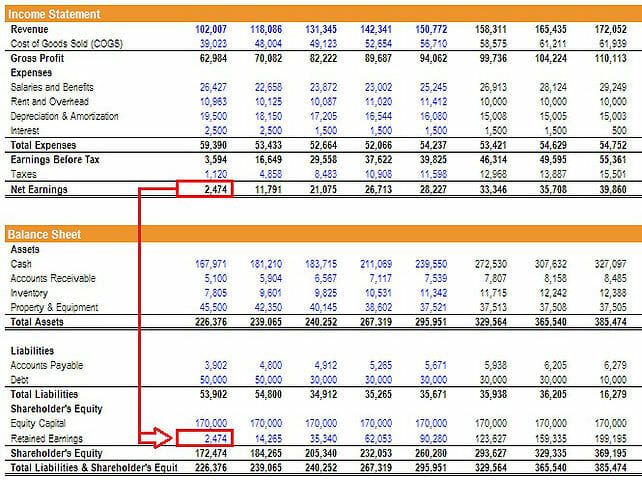

Solved 1 A List Of Assets Liabilities And Equity Can Be Chegg Com

Cash Flow Vs Net Income Key Differences Top Examples

Reconciling Net Income To Free Cash Flow The Motley Fool

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Cash Flow Vs Net Income Key Differences Top Examples

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Principles

Net Income The Profit Of A Business After Deducting Expenses

How Do Net Income And Operating Cash Flow Differ

How Do Net Income And Operating Cash Flow Differ

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Disclosures In Notes To Financial Statements Financial Statement Financial Statement Analysis Financial

Is It Possible To Have Positive Cash Flow And Negative Net Income

49 Make A Professional Report With These Free Download Income Statement Template Here Income Statement Statement Template Templates

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Tim Meant To Be Investing Credit Card Statement

How To Read A Balance Sheet Complete Overview

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Posting Komentar untuk "A Company's Net Cash Flow Will Equal Its Net Income"