Meaning Of Average Collection Period

For calculating this ratio usually the number of working days in a year are assumed to be 360. A collection period is the average number of days required to collect receivables from customers.

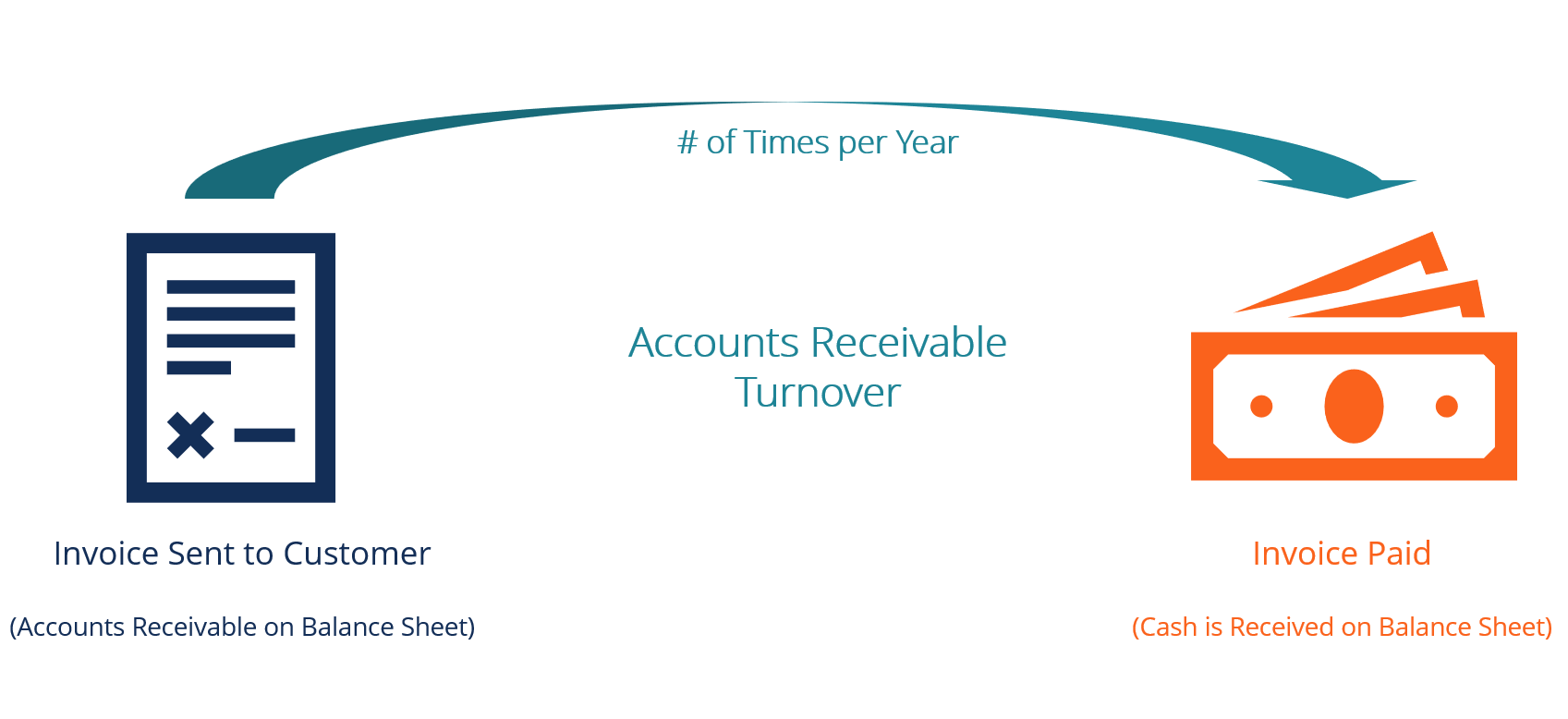

Accounts Receivable Turnover Ratio Formula Examples

It indicates the average number of days required to convert receivables into cash.

:max_bytes(150000):strip_icc()/cash-1462856_1920-5a3353653b0b4ba882838c80df7e89f3.png)

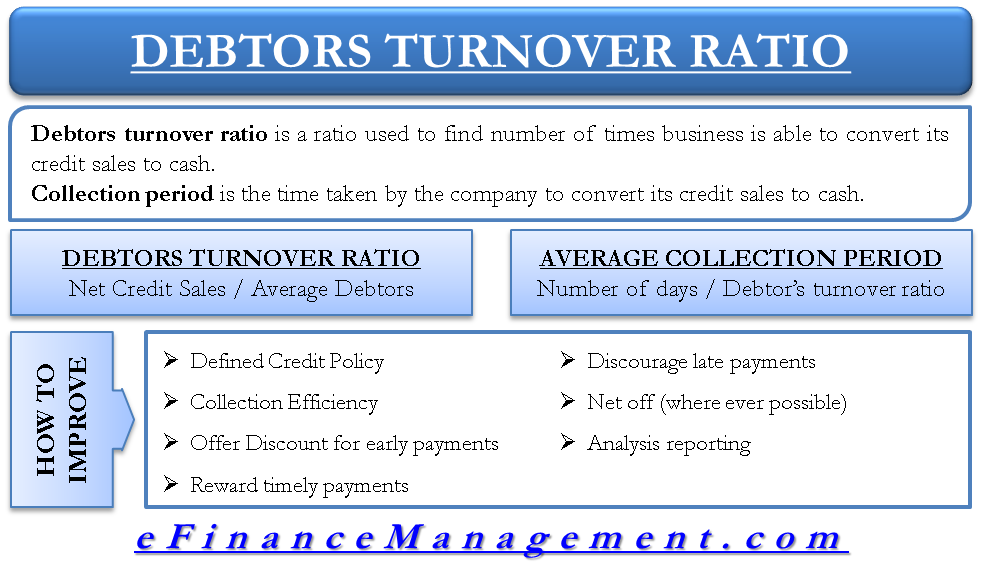

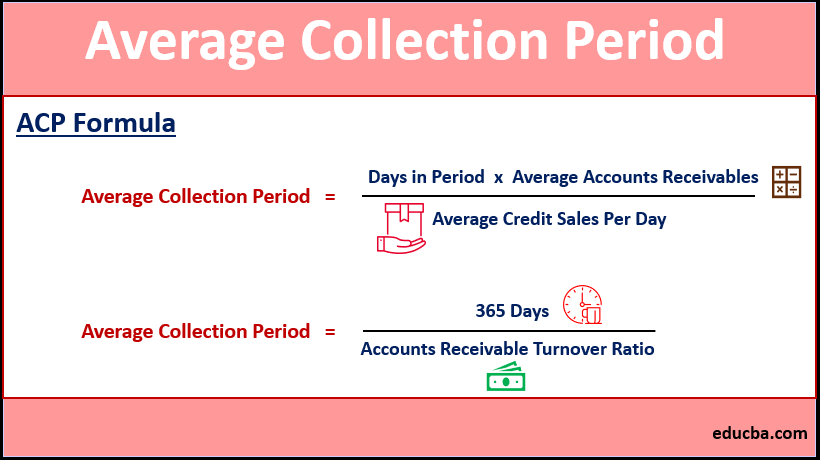

Meaning of average collection period. Average Collection period Days in a year Debtors Turnover Ratio. The measure is used to determine the effectiveness of a companys credit granting policies and collection efforts. Calculating the average collection period for any company is important because it helps the company better understand how efficiently its collecting the money it needs to cover its expenditures.

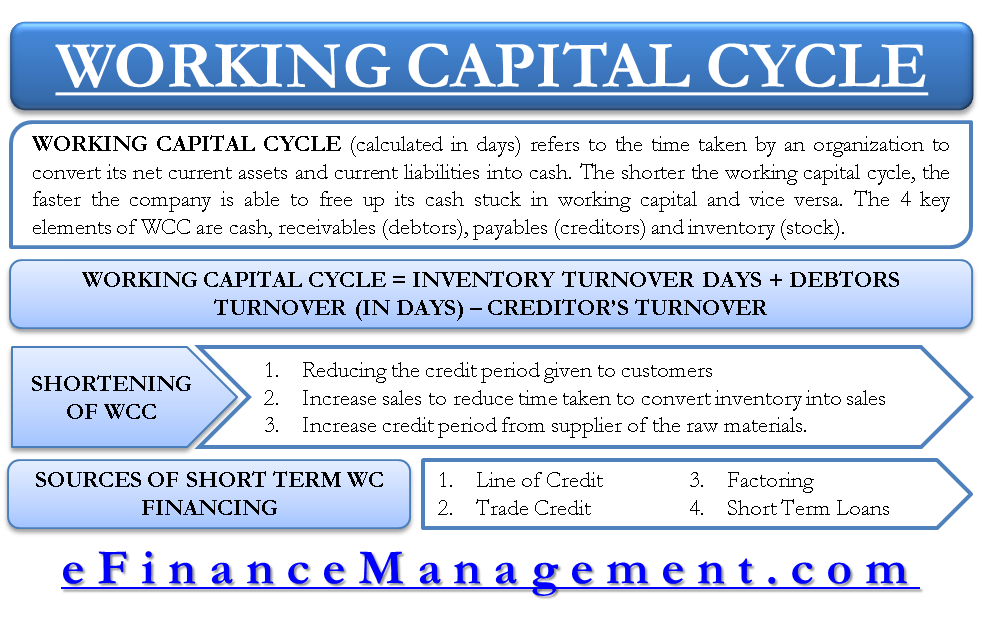

What is the Average Collection Period. An effective operation of a company largely depends on the timely receipt of funds from customers. More Working Capital Management Definition.

The companys credit terms will have a significant impact on the average collection period. To control overdue payments an average debt collection period indicator is used. The term average collection period refers to the number of days waited to receive the amount from the debtors and realized the bills receivables.

A shorter collection period is considered optimal since the creditor entity has its funds at risk for a shorter period of time and also needs less working capital to run the business. An increase in the average collection period could indicate an increased risk of the companys customers not being able to pay for their purchases. The average collection period ratio is often shortened to average collection period and can also be referred to as the ratio of days to sales outstanding.

Average collection period can be calculated as follows. The average collection period is the average number of days required to collect invoiced amounts from customers. A short collection period.

This ratio measures the quality of debtors. The efficiency of the collection period can be assessed by comparing the average against the credit period allowed to the customers. The average collection period is a measure of how long it takes it usually takes a business to receive that payment.

The better the credit terms the higher the average collection period. Low average collection periods indicate organizations that collect payments efficiently. In other words this financial ratio is the average number of days required to convert receivables into cash.

The following formulae are. Heres the formula. The average collection period is also referred to as the days sales in accounts receivable.

The average collection period is the length of time on average it takes a company to receive payments in the form of accounts receivable. Company A is likely having some trouble collecting accounts. It is similar to the concept of days sales outstanding.

Most businesses require invoices to be paid in about 30 days so Company As average of 38 days means accounts are often overdue. The average collection period indicates the days it takes a company to convert its receivables into cash. It is expressed in days and is an indication of the quality of receivables.

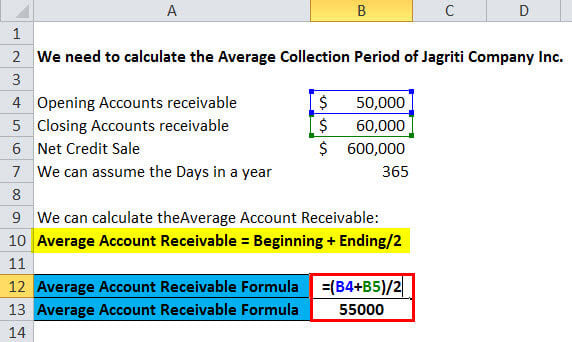

It is measured as the interval from the issuance of an invoice to the receipt of cash from the customer. 4000 360 24000 60 Days Debtors and bills receivables are added. The average collection period takes into account the accounts receivable turn over that is the number of times a business sells its products in a year.

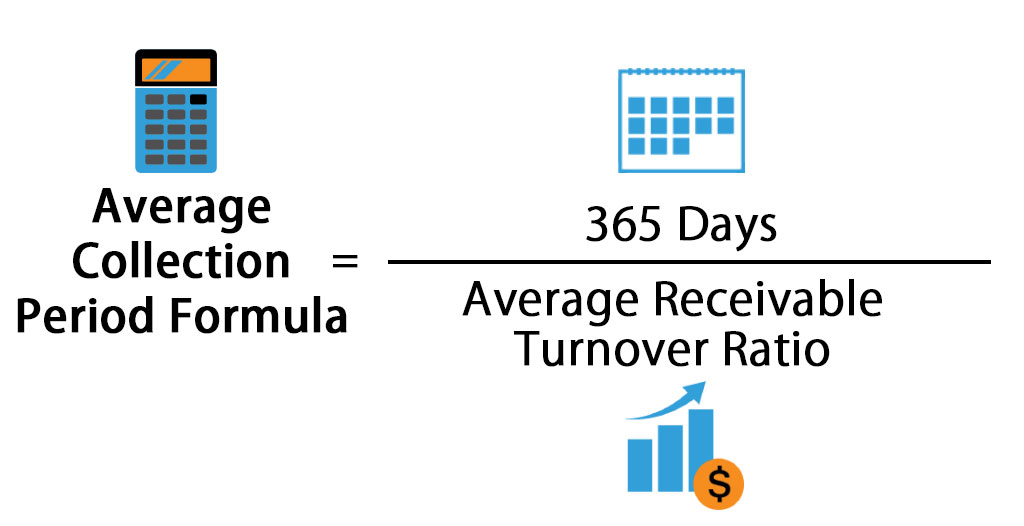

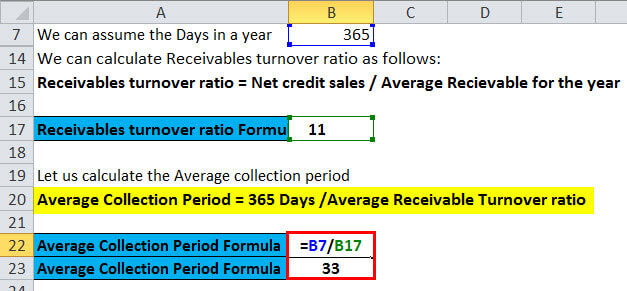

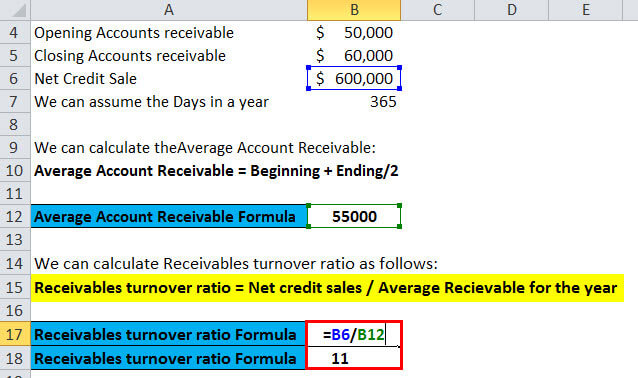

The average collection period is the average number of days between 1 the dates that credit sales were made and 2 the dates that the money was receivedcollected from the customers. Average collection period is computed by dividing the number of working days for a given period usually an accounting year by receivables turnover ratio. A lower average say around 26 days would indicate collection is efficient and effective.

The formula for the average collection period is. Significance of the Ratio. The average collection period is the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable.

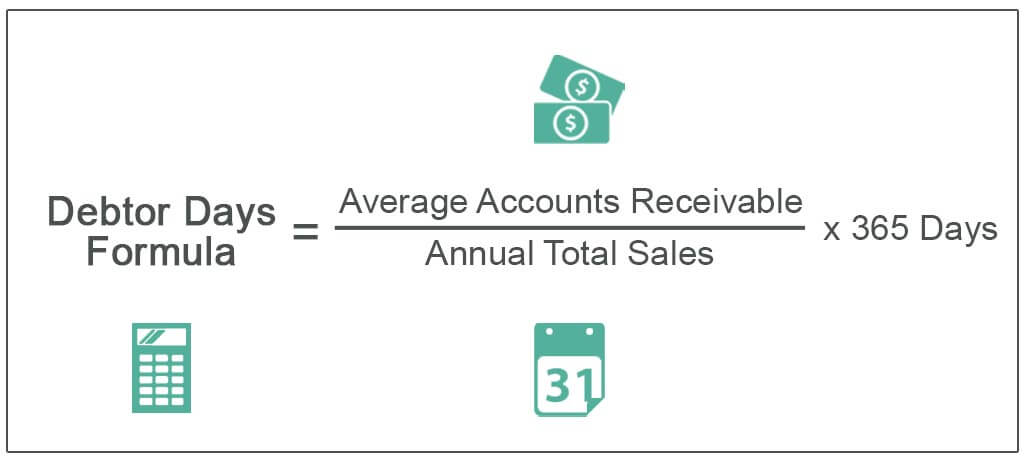

Average collection period is the time a company takes to collect from its credit customers. Of Working Days Net Credit Sales. Average accounts receivable Annual sales 365 days Example of the Average Collection Period.

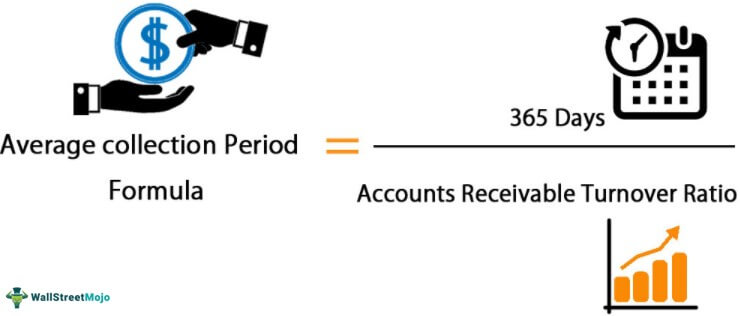

The average collection period is the time taken for a company to convert its credit sales accounts receivables in cash. Average Collection Period Trade Debtors No. The numerator of the average collection period formula shown at the top of the page is 365 days.

Companies calculate the ACP to ensure they have enough cash on hand to meet their financial obligations. Average Collection Period. A definition of the average collection period is the average length of time the seller waits for payment from the buyer after the product is sold.

The average collection period formula is the number of days in a period divided by the receivables turnover ratio. The average collection period is the amount of time it takes for a business to receive payments owed by its clients.

Debtor Days Meaning Formula Calculate Debtor Days Ratio

Average Collection Period Formula Calculator Excel Template

How To Improve Debtor S Receivable Turnover Ratio Collection Period

Debtor Receivable Days Tutor2u

Average Collection Period Meaning Formula How To Calculate

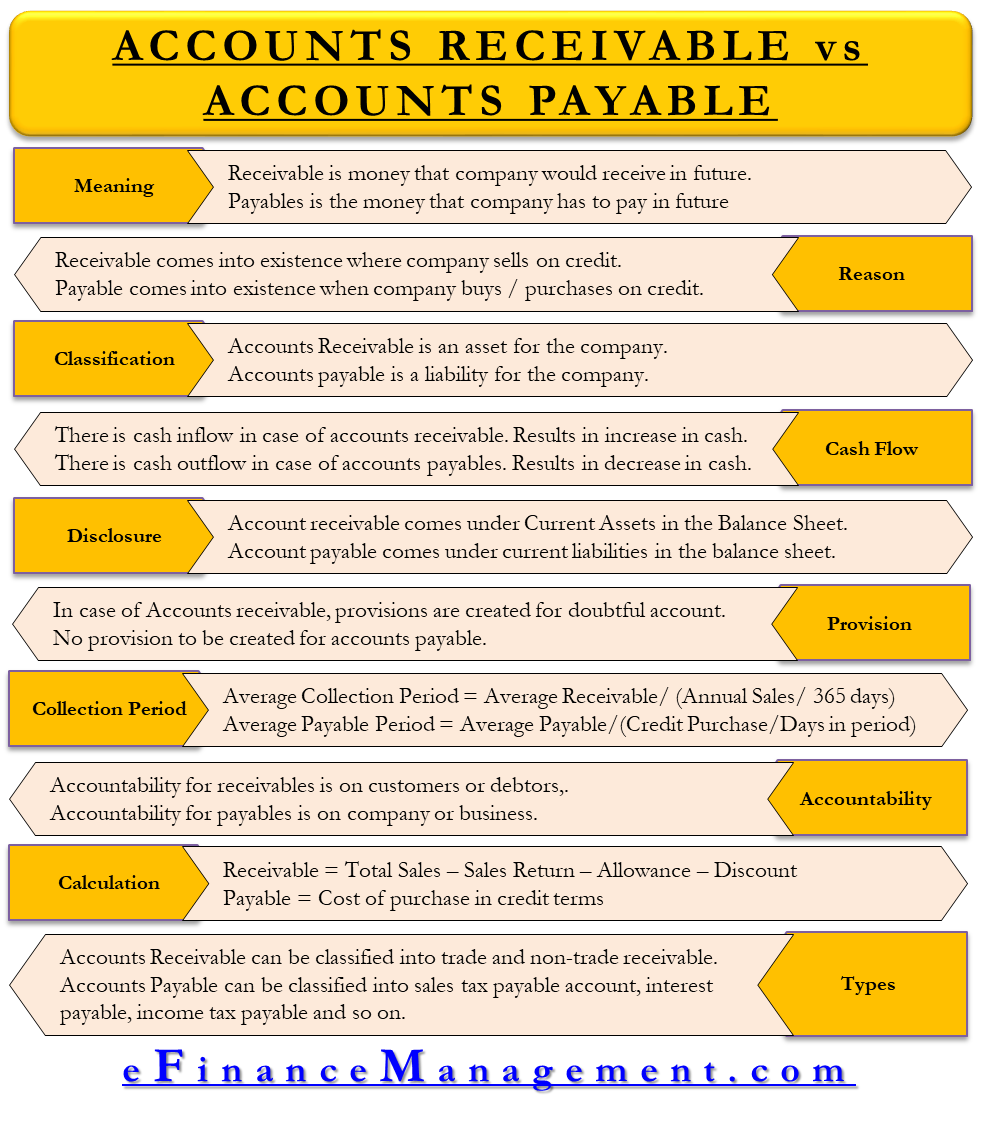

Accounts Receivable Vs Accounts Payable All You Need To Know

Average Collection Period Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/cash-1462856_1920-5a3353653b0b4ba882838c80df7e89f3.png)

Average Collection Period Definition

Average Collection Period Definition And Explanation

Average Collection Period Definition

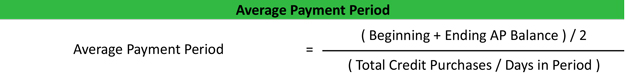

Average Payment Period Formula Example Calculation Explanation

Average Collection Period Overview Importance Formula

Average Collection Period Formula Calculator Excel Template

Average Collection Period Formula Calculator Excel Template

Average Collection Period Advantages Examples With Excel Template

Turnover Ratio Definition All Turnover Ratios Uses Importance Efm

Accounting Principles Ii Ratio Analysis

Posting Komentar untuk "Meaning Of Average Collection Period"