Whats An Irs Notice Of Intent To Levy

You neglected or refused to pay the tax. This is the demand to.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Instead its an IRS Final Notice of Intent.

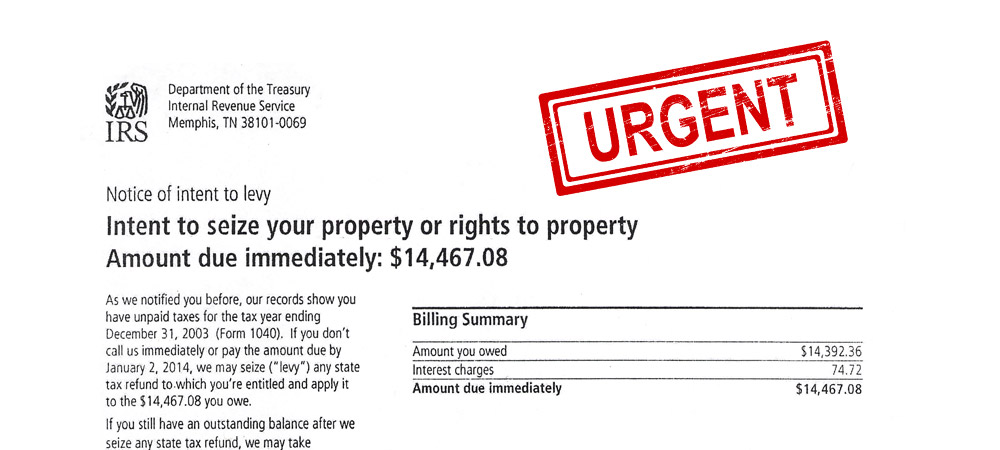

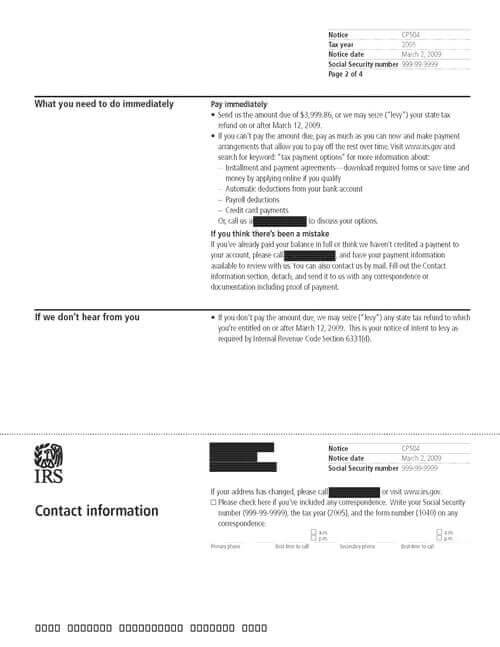

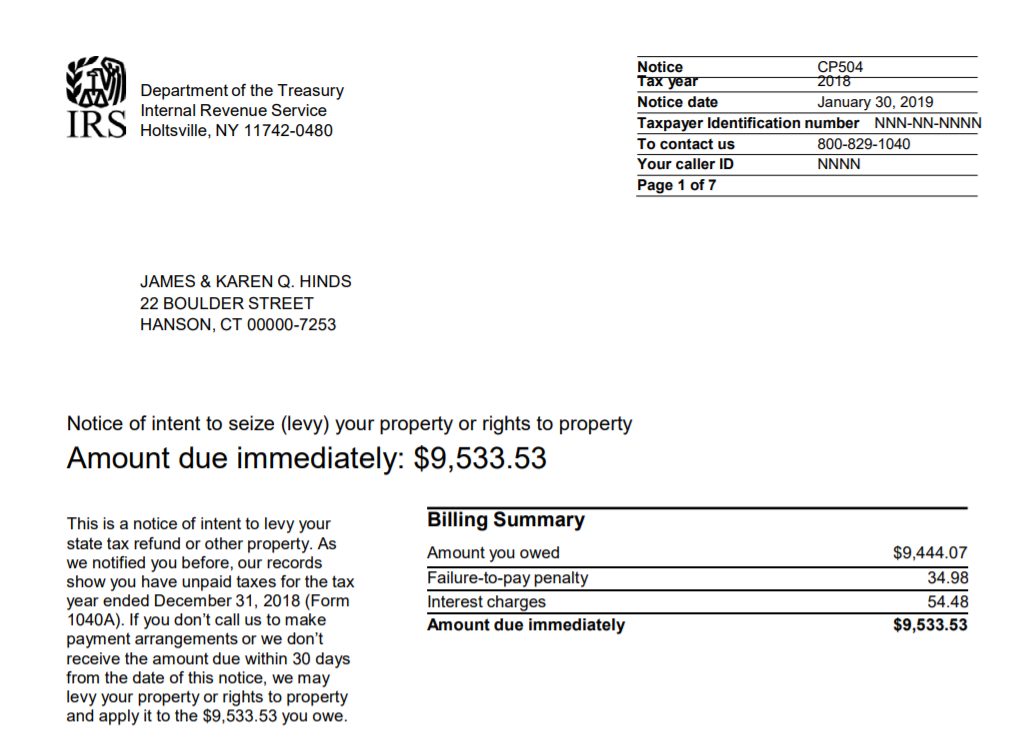

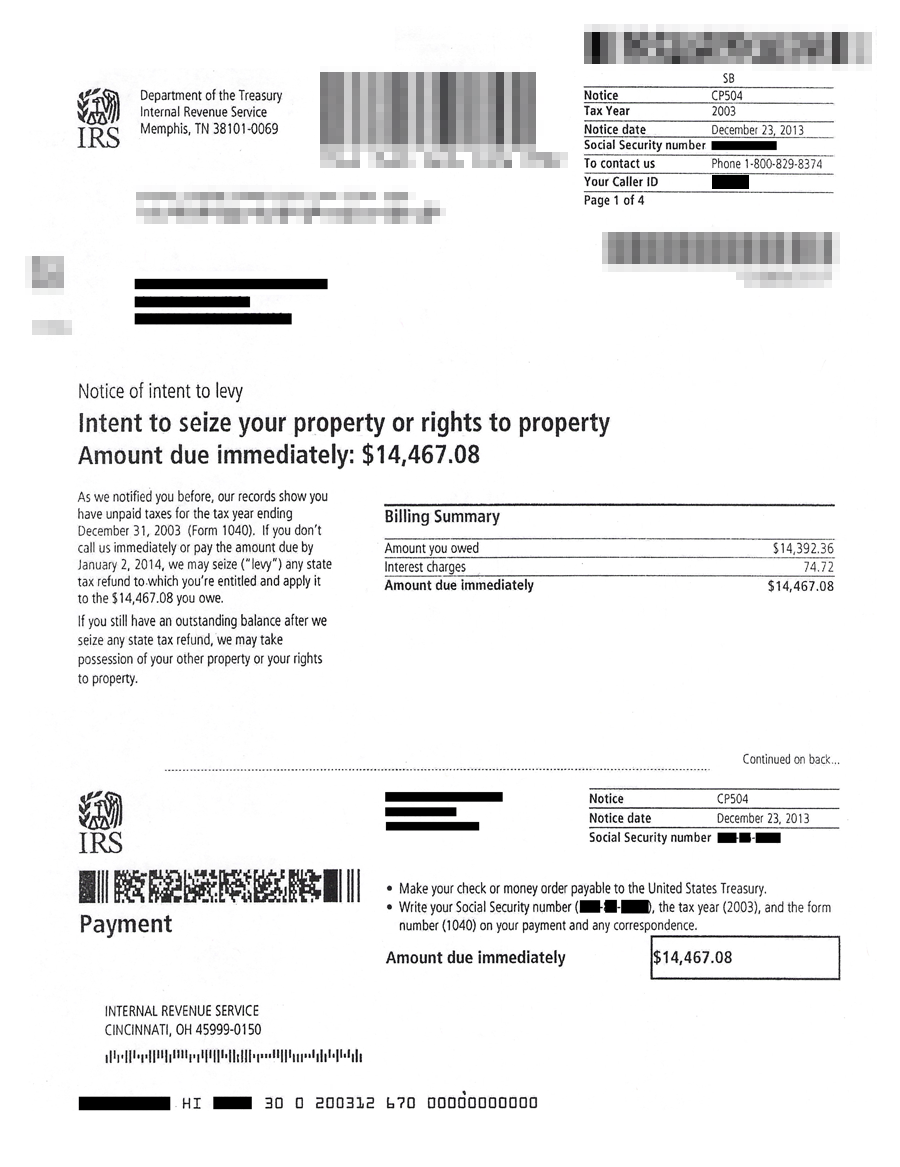

Whats an irs notice of intent to levy. IRS issues Notice of Intent to Levy in a letter numbered CP504 asking you to pay the tax due within 10 days of service of that letter. Stop IRS Collections Resolve Taxes Owed. To do to this reference the Final Notice of Intent to Levy it will state the type of tax you owe for example income taxes the IRS tax form that you filed creating the debt ie Form 1040 and the years you owe ie 2010 2011 2012.

Ad No Money To Pay IRS Back Tax. There it is. If the IRS levies your state tax refund you may receive a Notice of Levy on Your State Tax Refund Notice of Your Right to Hearing after the levy.

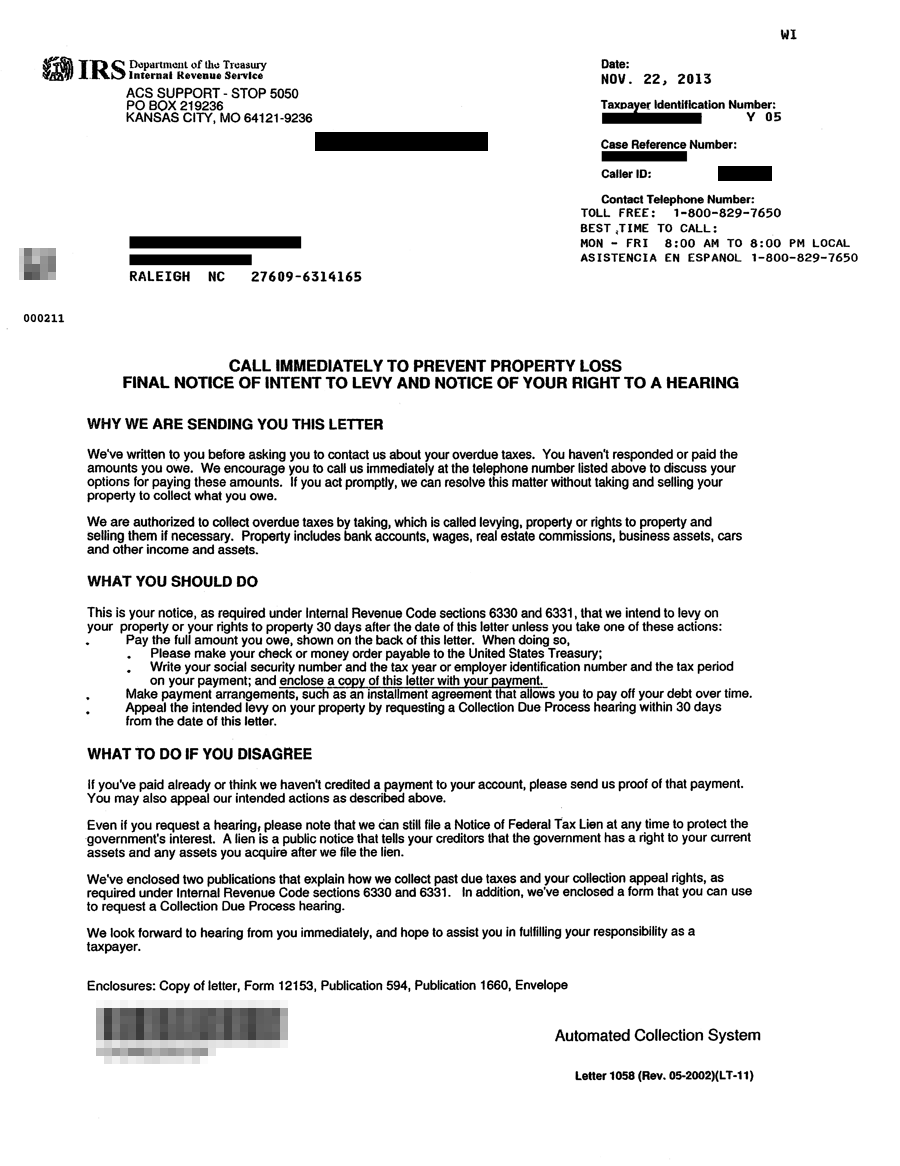

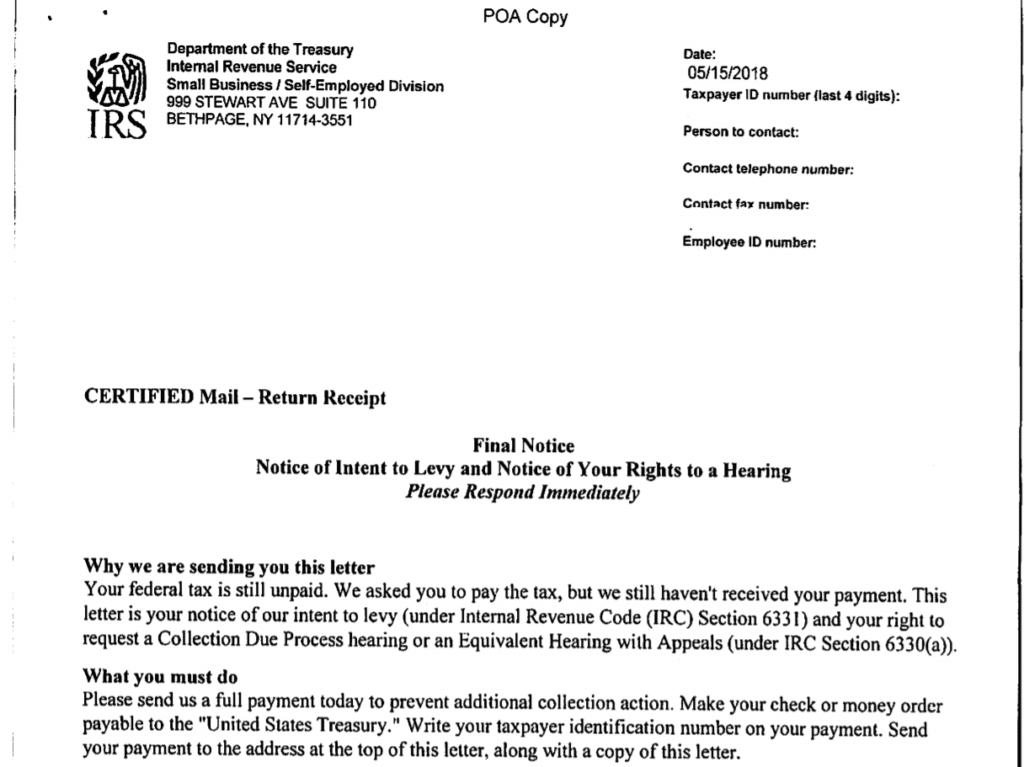

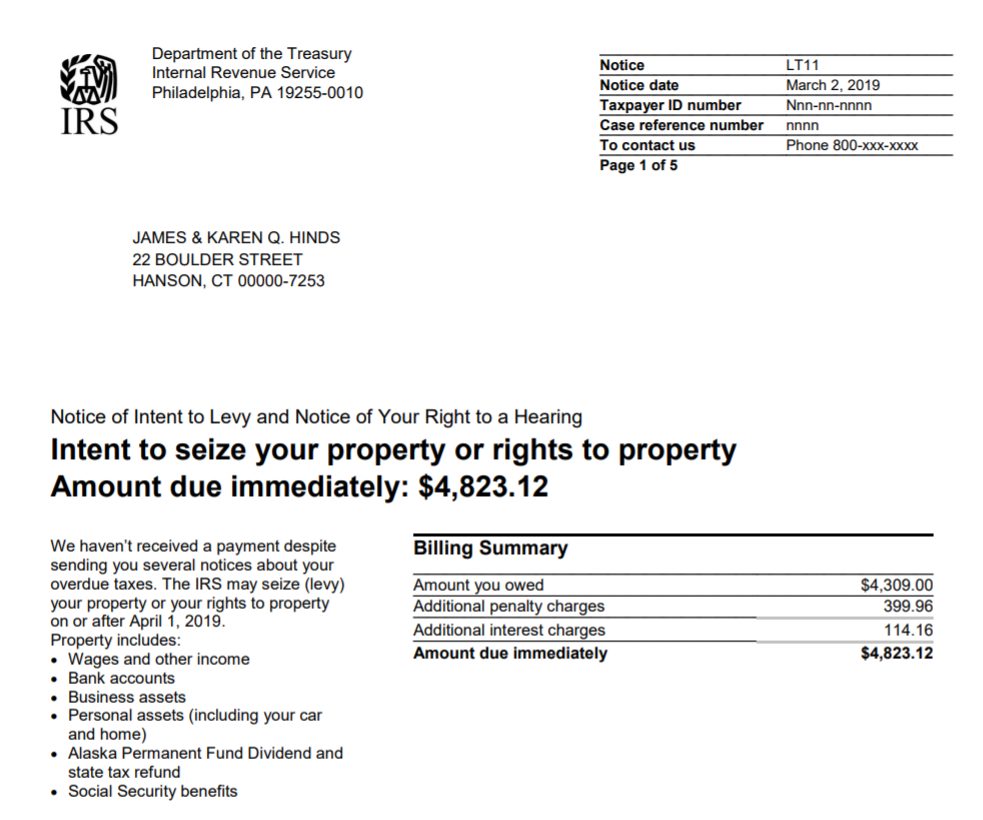

Take that information from the final notice and use it to tell the IRS. The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing levy notice at least 30 days before the levy. And The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing levy notice.

Do You Qualify For The Fresh Start Program. An IRS intent to levy notice is a notice the IRS sends if it plans to seize your assets. The IRS can also garnish your wages or take other drastic collection action.

A certified letter from the IRS and you have a gut feeling it probably does not contain the thousands in tax refunds youve always imagined. Ad Use our tax forgiveness calculator to estimate potential relief available. The law is intended to avoid surprises from the IRS and protect you and the Final Notice of Intent to Levy does just that giving you notice in advance that they are considering sending a levy to.

This means you are running out of time before the IRS can levy your bank account. This letter does not have teeth. This fall some taxpayers received a notice of intent to levy from the IRS a letter that threatens the seizure of state income tax refunds even if theyve mailed a check or their tax.

Notice Of Intent To Levy and Notice of Your Right to a Hearing. Oftentimes the IRS will issue Notice of Intent to LevyIntent to seize your property or rights to property. Do You Qualify For The Fresh Start Program.

The IRS must send you a notice. Free Tax Analysis Options. The IRS will usually levy only after these four requirements are met.

It references a tax period for which you owe taxes. An IRS levy permits the legal seizure of your property to satisfy a tax debt. Ad Receive IRS Levy Notice.

If you determine the notice or letter is fraudulent please follow the IRS. Free Tax Analysis Options. If when you search for your notice or letter using the Search on this page it doesnt return a result or you believe the notice or letter looks suspicious contact us at 800-829-1040.

Ad No Money To Pay IRS Back Tax. The Notice of Intent to Levy is issued as per Internal. If a third-party is holding property that cannot be turned over by writing a check use seizure procedures.

It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property. If you receive an IRS bill titled Final Notice of Intent to Levy. The last notice is called Final Notice.

You usually only get this notice if you have seriously delinquent taxes owed that you havent tried to resolve. This is called a CP504 letter. The word levy means involuntary seizure or taking.

Notice of Intent to Levy and Notice of Your Right to a Hearing is mailed to taxpayers to notify them of their unpaid taxes and that the IRS intends to levy to collect the amount owed if it is not paid within 30. Stop IRS Collections Resolve Taxes Owed. The IRS assessed the tax and sent you a Notice and Demand for Payment a tax bill.

Also give a Form 668-A Notice of Levy to the third-party holding the property. Ad Receive IRS Levy Notice. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

It can be confusing to know when the IRS. 7 rows A notice of intent to levy means that the IRS intends to take your property to pay off a tax. This is a scare tactic.

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Cp504 Notice Of Intent To Levy What You Should Do

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Did You Receive Irs Notice Lt16 What You Need To Do To Prevent An Irs Levy Tax Attorney Orange County Ca Kahn Tax Law

Irs Tax Notices Explained Landmark Tax Group

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Irs And State Bank Levy Information Larson Tax Relief

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Stop Irs Levy Now Stop Irs Wage Garnishment

Notice Cp504b What It Means How To Respond Paladini Law

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

5 19 9 Automated Levy Programs Internal Revenue Service

5 19 9 Automated Levy Programs Internal Revenue Service

Posting Komentar untuk "Whats An Irs Notice Of Intent To Levy"