How To Enter A Returned Check In Quickbooks 2015

Heres what youll need to do. Create an invoice for the bounced check fee.

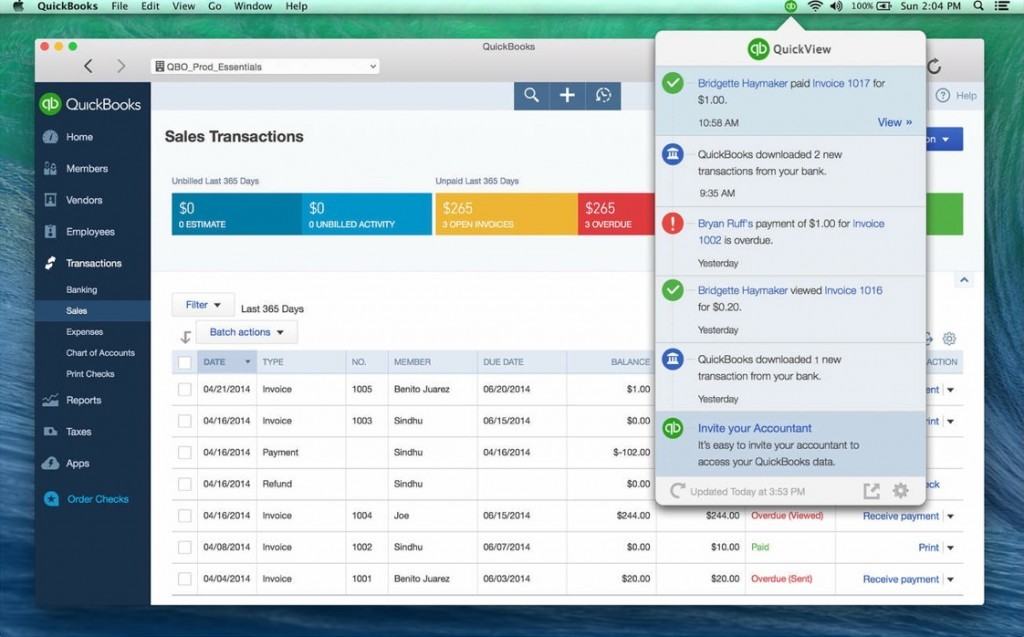

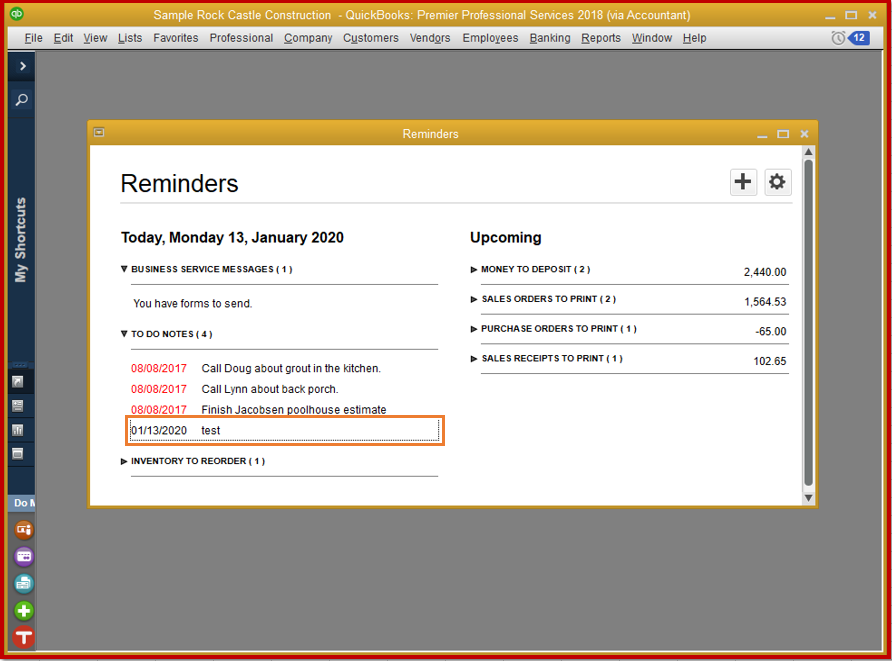

Solved Unable To Save New To Do Tasks In Quickbooks Desk

Record the service charge that the bank charges you for handling the bounced check just like any other bank service charge.

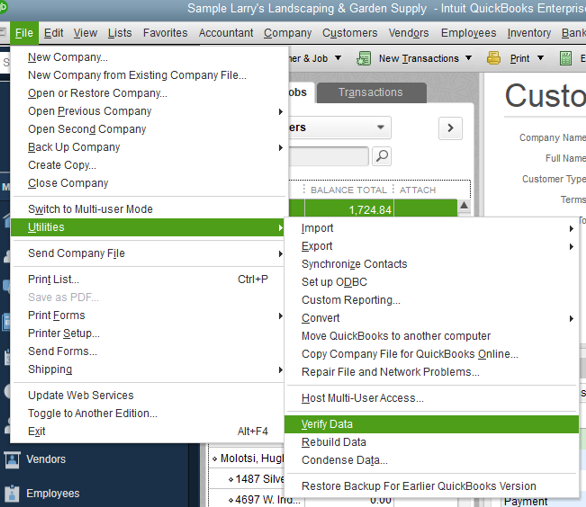

How to enter a returned check in quickbooks 2015. To record a returned cheque which has issued to a vendor a General Journal is needed. Enter the date the check bounced in the Journal date field. Assuming you run Quickbooks in single-user mode you can record an NSF check in just a few simple steps.

Select the Customers menu and click on Create Credit MemoRefunds Enter each line item from the original sale. Click on the CompanyMake General Journal Entries selection to get to the related area in QuickBooks. This video will teach you how to enter NSF - Bounced checks from your Customers.

You should memo the amount Save and close. In our example the returned check was 50 and the bank. Access the deposit screen go to Receive from field and input vendors name.

Enter the bank service charge. Select Save Close. Add the Returned Check Item.

First youll need to enter the voided check in Quickbooks Online. If you make a purchase using a handwritten check or if you want QuickBooks Online to print a check for you you need to enter a check in QuickBooks. In the Manage Bounced Check window enter the bank fee amount for this bounced check into the Bank Fee field.

Select and open the Category details dropdown. QuickBooks ensures that all related details on bounced check transactions are addressed to keep your account balanced and well. Do not enter the NSF fee.

Amount enter the amount of the returned check. Add the NSF Check Charge Item and enter the amount of the fee you are charging your client. In the Debits column enter the amount of the bounced check.

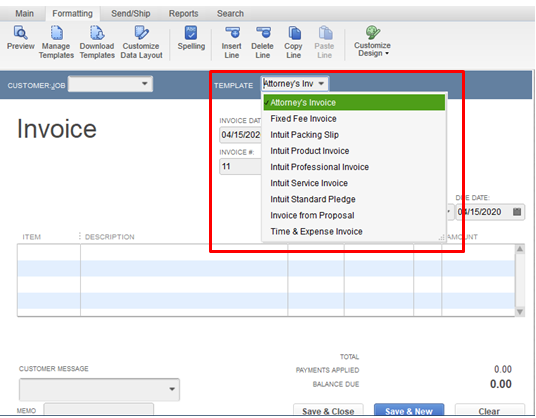

Enter the returned check with Write Check. Create Service items for bounced checks and fees. Next click on the menu Customers-Create Invoices or use the keyboard shortcut Ctrl I to invoice the customer for both the amount of the returned check and the fee charged by your firm.

In the Description field enter a note such as bounced check or NSF check When youre done select Save and close. Check no enter the non-sufficient funds fee. Input the bank charge which is a credit to the account and a debit to expenses.

From the bills screen enter a bill credit. Many QuickBooks users ask questions about how to handle insufficient-funds NSF check transactions. Enter the Date the same date as the withdrawal from the bank.

Enter the item you. Select the Credit radio button to account for the return of goods. Payee select the customer whose check bounced.

Learn how to record bounced or NSF checks from customers in QuickBooks Desktop for Windows and Mac. Select the Items Tab. Heres a few tips for how you might handle the situation.

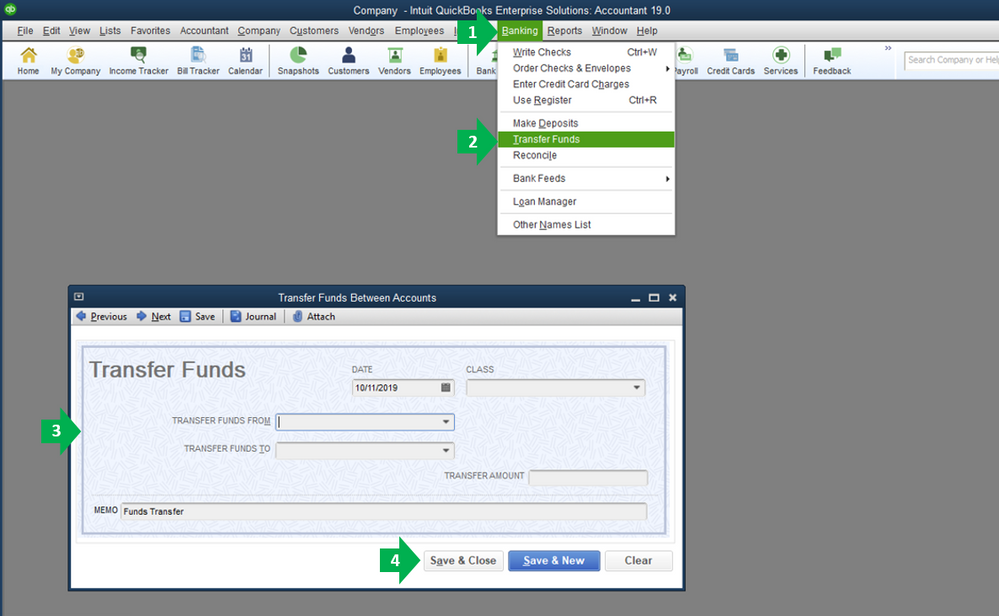

From here double-click the failed payment and on the Receiving Payments window click Record Bounced Check. Under Other select Journal Entry. QuickBooks new Record Bounced Check feature makes this super simple.

In this video learn How to enter a Refund for a Customer in QuickBooks OnlineDid your customer ask for a refund. Go to the Vendors menu then select Pay Bills. Then click the Record Bounced Check button in the Main tab of the Ribbon at the top of the window.

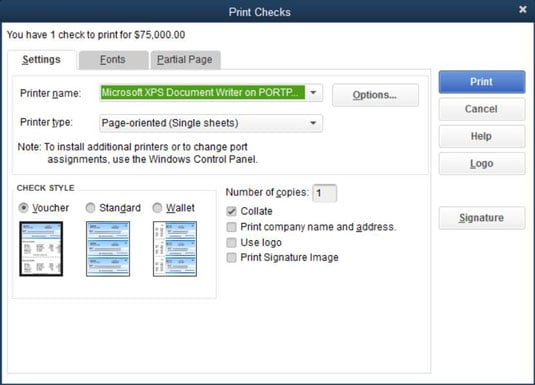

This is done by logging in to your account and clicking the Plus Sign Checks after which youll need to enter the information associated with the check including bank account check number date on which the check was issued dollar amount etc. Use the Write Checks window or the check register but type Debit in the check number field. Change the payment entry.

Enter the Vendor name. Slide 2 Click Next. On the first line select Accounts Receivable from the Account menu.

Open bills enter the vendor name amount date and memo. Enter the returned items with the same amounts as the refund check. When the Received Payment window opens you will notice the new Record Bounced Check button.

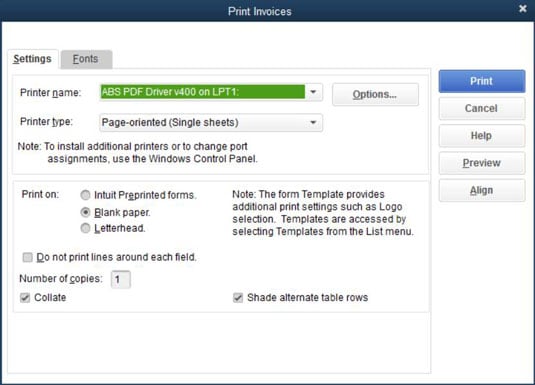

Add sales tax and note the sales reps name if desired. Select the date the bank fee was assessed from the adjacent Date fields calendar drop-down. Description enter the information about the bounced check.

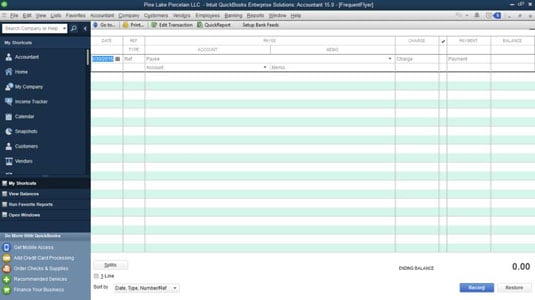

Link the deposit to the Bill Credit. This is never a pleasant situation but it must be dealt with. Open the check register and select Debit Card from the Type drop-down list.

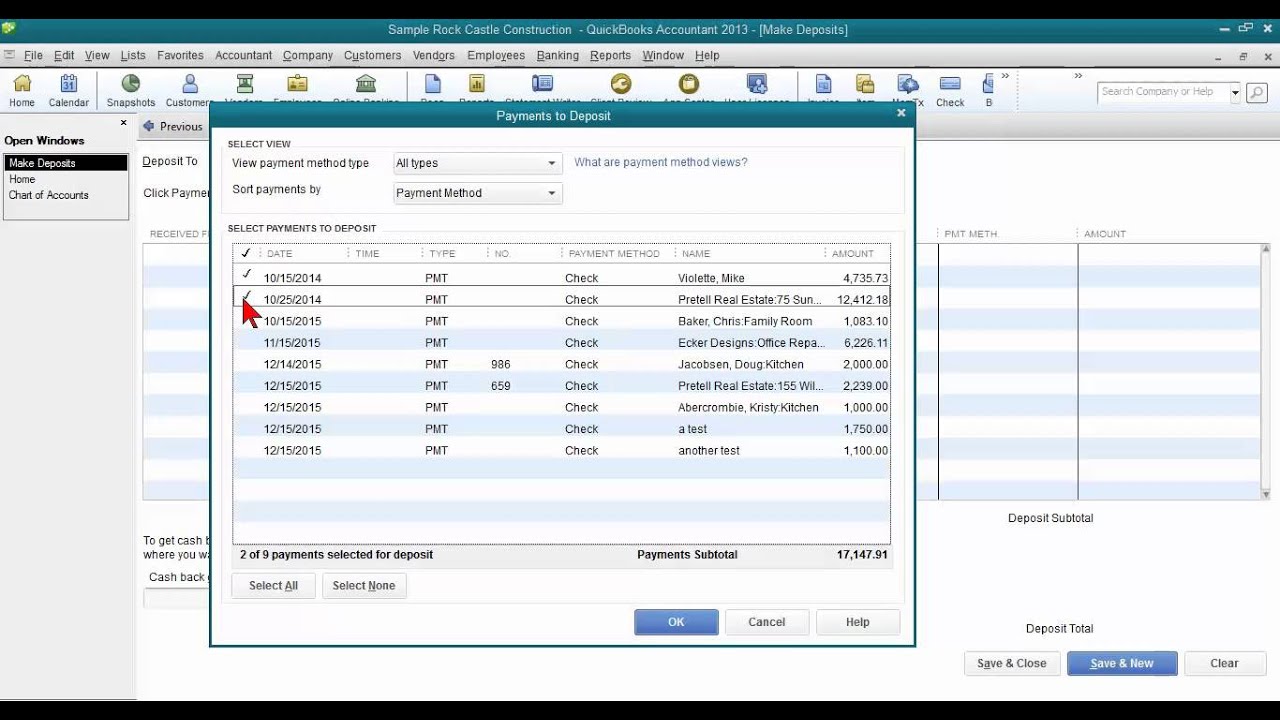

In the Amount field enter the amount of the bounced check. You can record NSF or bounced checks from customers with the Record Bounced Check feature or by manual process. Memo enter additional information and the notes about the bounced check.

Intuit QuickBooks Premier 2015 accounting software Unlike the Accounts Receivable module Accounts Payable module does not have a Record Bounced Cheque feature. Check the Deposit that matches the Vendor check amount. Then use the Enter Credit Card charges window.

In the Payment date field enter the date you found out the check bounced. Account select the appropriate AR. You may consider using a Void Cheque feature but if the cheque is returned at a.

Create a subaccount of your checking account and name it Debit Card. Click the button to start the process. QuickBooks displays a window to capture the NSF information fee bank date and fee you want to charge to your client along with account and class information.

This is done by logging in to Quickbooks and accessing Customers Customer Center Transactions Received Payments. In the Category field select Accounts Receivable. In From Account field put accounts payable.

Record the bounced check in a journal entry. Heres a quick how to if you dont need. Then make a new invoice to the customer so that the customer receives a new invoice for the amount of the returned check and the fee that your company charges.

Solved Chart Of Accounts Issues With Opening Accounts

Quickbooks Tip Clean Up And Fix Undeposited Funds Long For Success Llc

Bounced Checks In Quickbooks Desktop Pro Instructions And Video

Cleared Check Not Showing Up In Reconciliation

Quickbooks Pro 2015 Does Not Support Intuit Online Payroll Upgrade Experience From Microsoft Office Accounting Coolcomputing

How To Enter Credit Card Transactions In Quickbooks 2015 Dummies

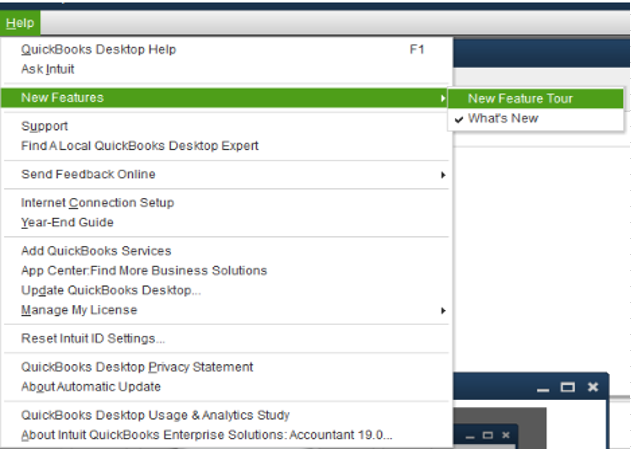

Solved How Do I Change The Template On Invoices

How To Print A Check With Quickbooks 2015 Dummies

Quickbooks Won T Open After Big Sur Update

Www Qblittlesquare Com Wp Content Uploads 2015 10 Quickbooks For Mac 2015 Free Plan How To Plan Freezer Meals

2015 Quickbooks Feature Review New Insights Tab Of Home Page Insightfulaccountant Com

How To Print Quickbooks 2015 Invoices In A Batch Dummies

Solved Reissue Lost Vendor Check

2015 Quickbooks Feature Review New Insights Tab Of Home Page Insightfulaccountant Com

Solved Reconcile A Credit Card With An Overpayment In Qui

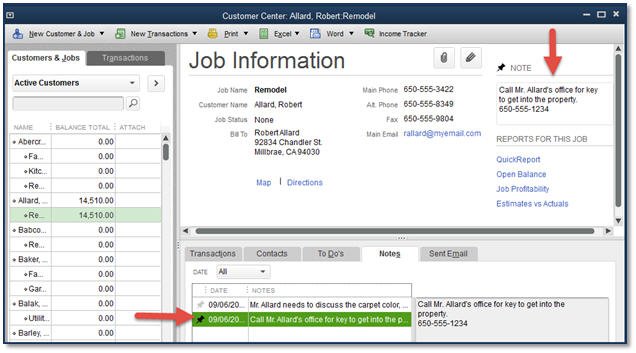

2015 Quickbooks Feature Minute New Pin A Note Feature That S My Name For It Not Intuit S Insightfulaccountant Com

Don T Upgrade To El Capitan Yet If You Use Quickbooks

Solved How Do I Change The Template On Invoices

Posting Komentar untuk "How To Enter A Returned Check In Quickbooks 2015"