How To Record Credit Card Cash Advance In Quickbooks

Cut checks from your checking account as usual to make use of the advanced funds. A little web research brought up two approaches for recording credit card cash rewards in QuickBooks.

Recording Credit Card Transactions In Quickbooks Best Practices

I just got a new credit card that gives me cash back a percentage of the money I spend.

How to record credit card cash advance in quickbooks. Most QuickBooks courses will spend a lot of time talking about how a full-service accounting system works using QuickBooks. Description Employee name Cash Advance. We do recommend spending time learning the full accounting process and we do have a course that does this.

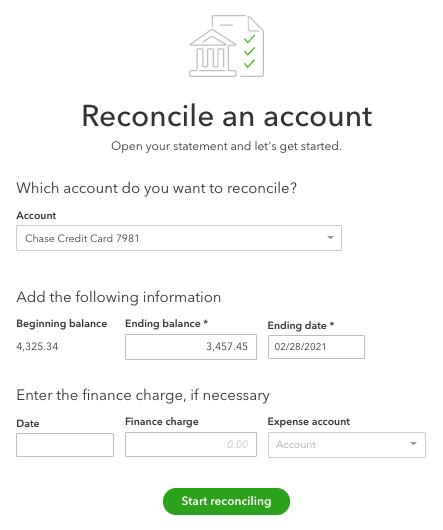

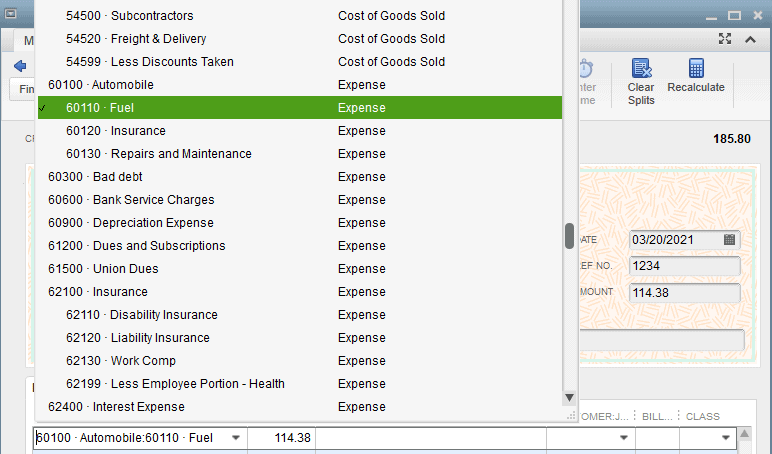

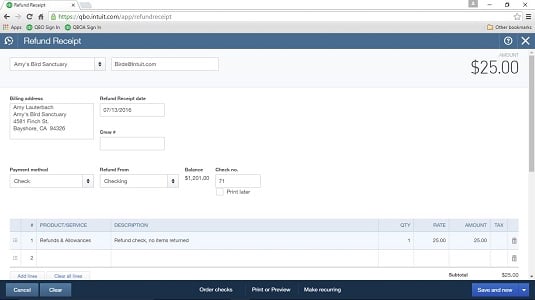

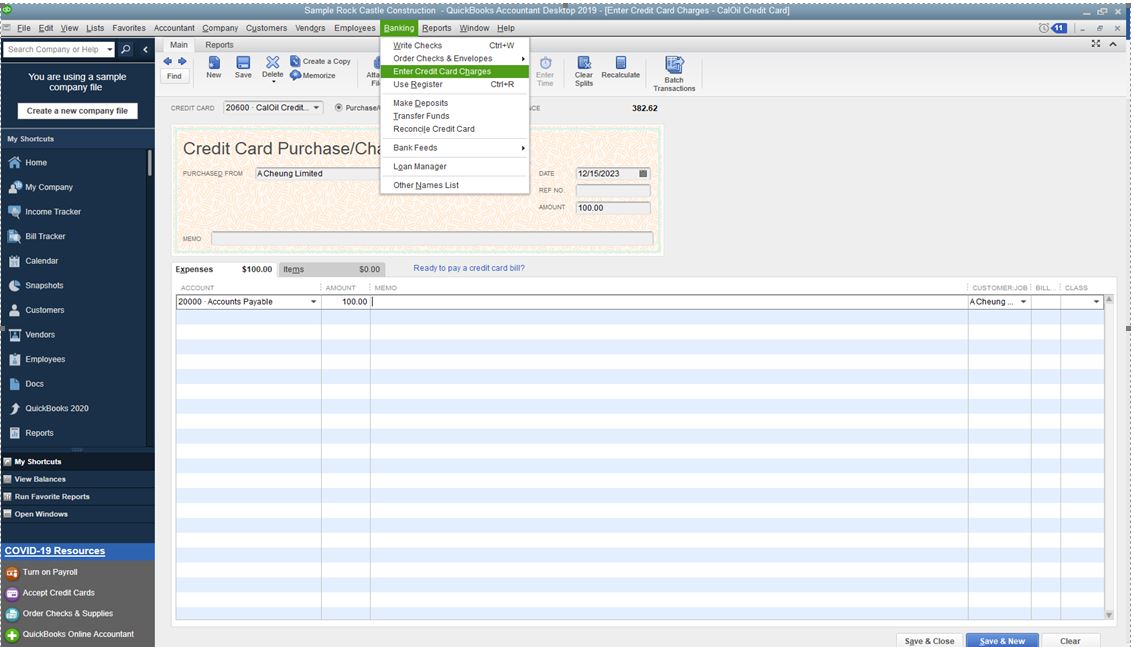

Go through your credit card statement line by line. Set Up Credit Cards. To enter a credit card credit in QuickBooks Online click the New button in the Navigation Bar.

Now every time you receive a credit card payment deposit it right away to the Credit Card Clearing account. Add any applicable attachment like your advance payment request form. When you use a credit card to purchase items used in your business money does not yet leave your business checking account.

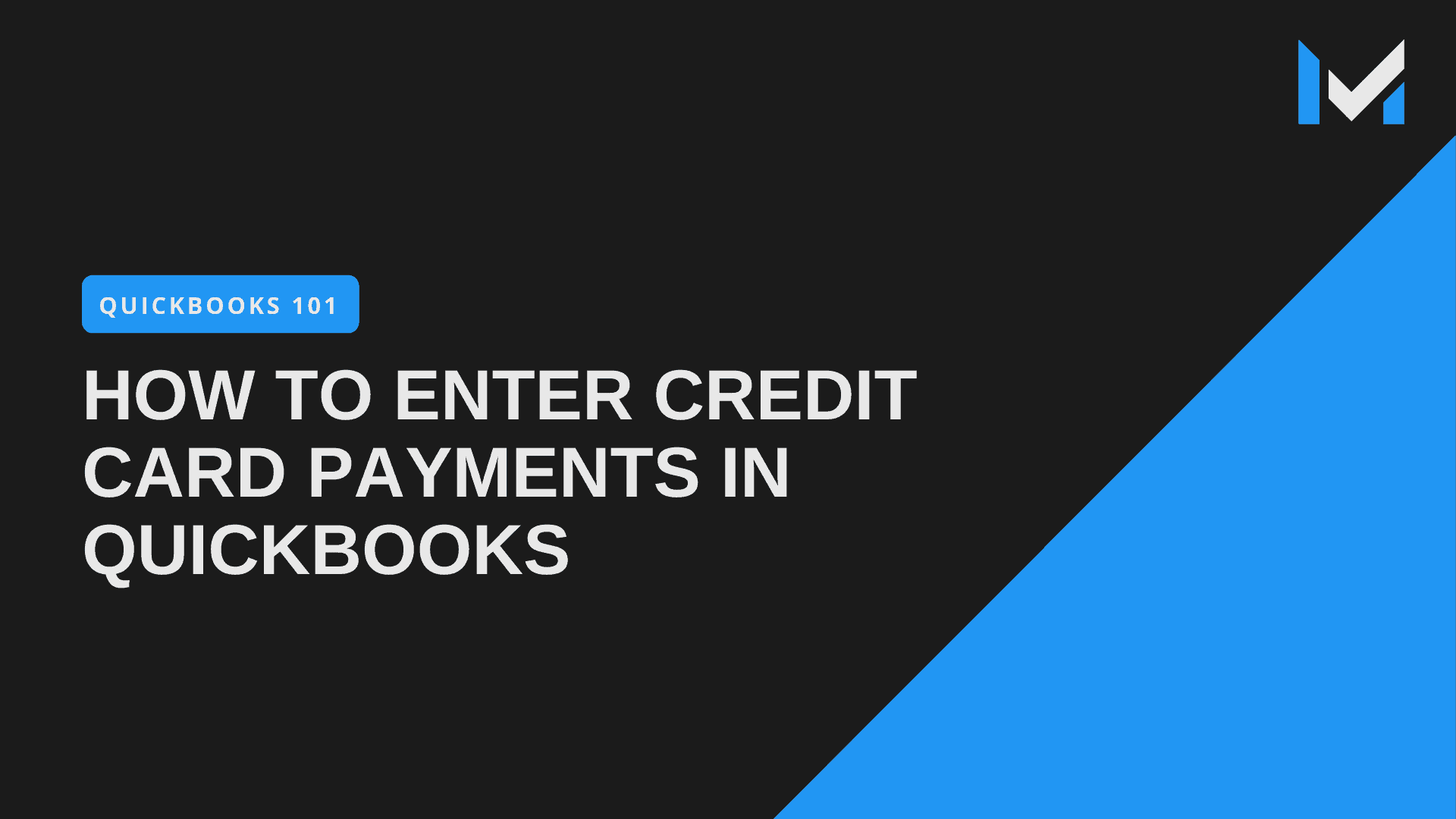

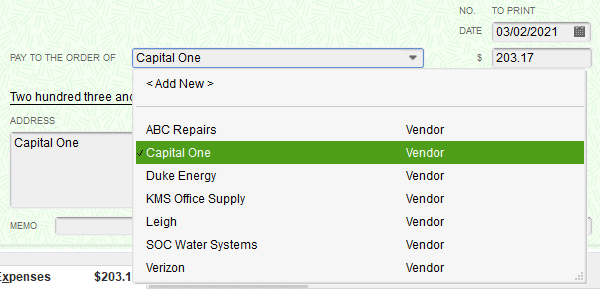

Create Liability accounts for each credit card you use. Then click the Credit Card Credit link under the Vendors heading in the menu that appears to open the Credit Card Credit window. In QBO click the gear icon then Chart of Accounts.

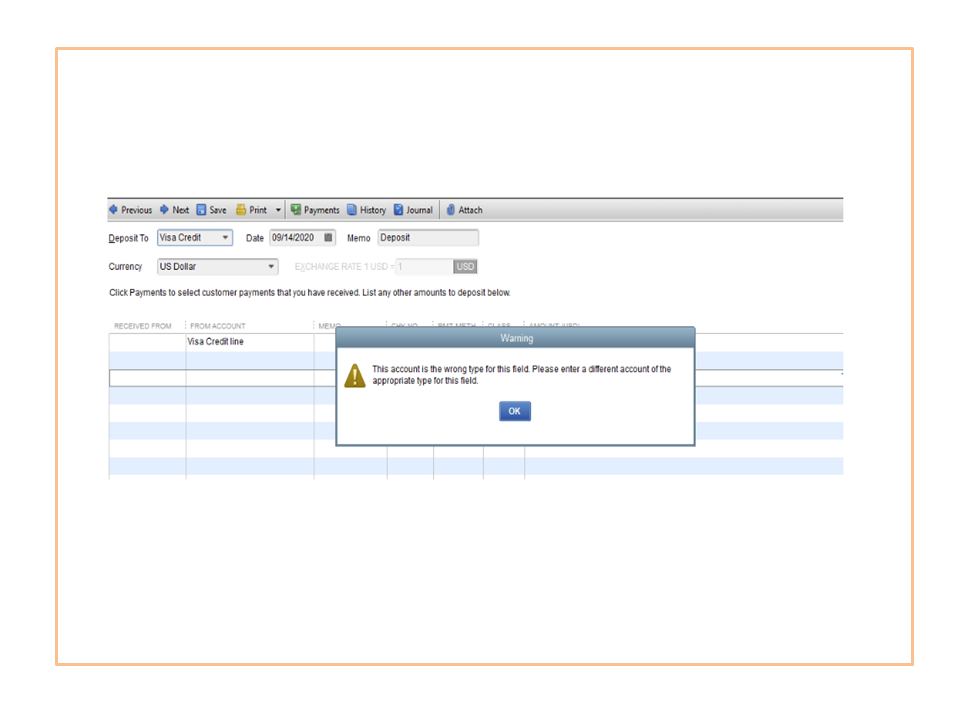

In the Received From column go to the first line and select your credit card vendor. One reason to record a PayPal exchange manually is to produce a receipt and record the installment exclusively for every deal. For example Visa Credit Card.

You can record the entire amount of. Add an Expense account for credit card interest fees. I have tried recording vendor credit for each driver when heshe receives cash advance via comcheck.

Choose the particular bank account in the Bank Account drop-down list. Enter a customerproject if applicable. We have the credit card set up and know how to do a transaction on something we purchased with the credit card but how do we record a 1000 cash advance.

To create a cash advance account in QuickBooks Desktop. Click the New button and select. Select the credit card account you used from the BankCredit.

From the Dashboard click the New button then click Expense under Vendors. Open the Lists menu and click Chart of Accounts. These transactions can be entered into QuickBooks with a journal entry or you can setup a bank account called petty cash.

Create a Journal called Credit Cards or you may prefer to have a separate journal for each card. This guest post is brought to you by Alicia Katz Pollock of Royalwise Solutions Inc. Go to the Banking menu at the top to choose Make Deposits.

Its not a real bank account. Here are the steps to create an Employee Advance check in your QuickBooks account. On the left-panel menu click Accounting and go the Chart of Accounts tab.

QuickBooks Desktop Advances from customers and Adjustments in Quickbooks Desktop how to enter Part payment of invoice at the time of invoice for customers. How to apply the credit to the expense report. How does this type of transaction get recorded.

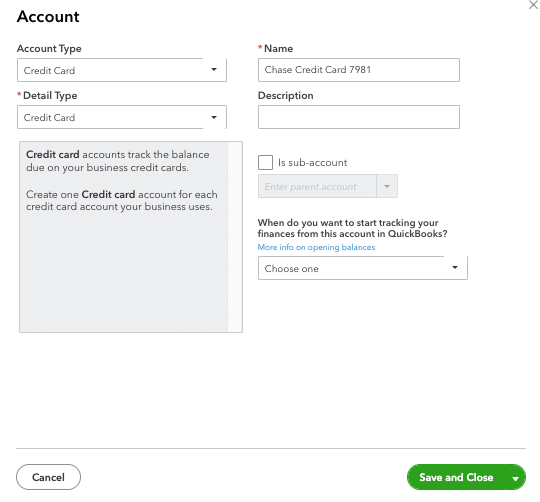

Then as shown above for Account Type select Credit Card give it a unique name including the last four digits of the account number and then select Save and Close. I currently also receive cash back Rewards from my Paypal checking debit card. Click on Company from the Main Menu and click on Make General Journal Entry.

The deposit is not income. On the general ledger record an increase to the checking account by the entire amount deposited. In recent years innovation has improved the system of bookkeeping.

Category Employee cash advances account. For example if you take a trip and spent a lot on airfare you can apply the reward refund to that same travel expense category that you originally used for the transaction. PayPals actions can be sent out to an Intuit Interchange Format iif record and effortlessly imported into QuickBooks.

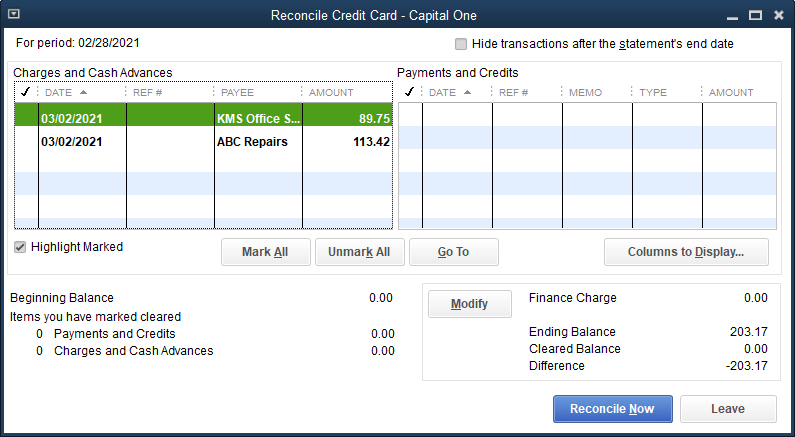

Click Save and Close. How to do record a cash advance from our Business Credit Card in Quickbooks. The charges and cash advances associated with your credit card will appear on the left while your payments and credits will appear on the right.

How to Record Credit Card Cash Rewards in QuickBooks. QuickBooks Online with its QuickBooks Payments option uses Intuit Merchant Services for customer credit card processing services and efficiently receives credit card paymentsQuickBooks credit card processing includes customer payment links when invoicing depositing cash receipts from payments into the users merchant account daily and automatically recording the credit card transactions. However a credit card purchase is considered a cash purchase for accounting purposes.

Copy and paste the above description field text in the memo field. How to record credit card Cash Rewards in QuickBooks Online. Choose the employee from the specific drop-down.

When I imported the refund transaction into QuickBooks I was at a loss as to where to put the rebate. Enter a class. You can even split the transaction into.

Choose the account the expense was for. Go to your QuickBooks Desktop Banking menu and choose Write Check. Create a bank account in QuickBooks called Credit Card Clearing.

Enter the Payee name and select the credit card used for the transaction from the Payment Account drop-down. However many small businesses want. All you have to do is input the cash advance in QuickBooks.

Its simply a place to record credit card payments as you receive them. Choose the date for the particular check. Click New in the upper right corner of the new screen.

Enter Beginning Balances for each credit card. For each individual transaction on your credit card statement find the matching transaction in QuickBooks and click it. In the Chart of Accounts.

Deposit the entire cash advance into your business checking account. Click the Account button in the lower left corner then click New. In the end vendor open balance is amount of cash advance that he returns to company.

This course will jump right into bank feeds and how to use them. Record an increase to the credit card payable account by the entire amount deposited. Select the vendor from whom you made the purchase by using the Payee drop-down.

Tap the Deposit To drop-down to select your bank account and enter the correct date in the appropriate box. Then at the end of the trip create a bill from vendor with all of the expenses in proper accounts and pay this bill using the previously recorded credit.

Quickbooks Tutorials 2018 How Do I Enter Cash Back Rewards On A Credit Card Youtube

Solved Credit Card Cash Advance

How To Record Credit Card Payments In Quickbooks

Quickbooks Point Of Sale Counting Your Cash Drawers Quickbooks Point Of Sale Support Quickbooks Point Of Sale Counting

Solved Refund And Cash Back From Credit Card

How To Record A Debt Refinancing In Quickbooks Loan Manager Quickbooks Loan Finance

How To Enter Credit Card Charges In Quickbooks

How To Record Credit Card Payments In Quickbooks

Quickbooks Online How To Record Credit Card Cash Back Rewards Youtube

Solved Best Way To Connect Credit Card Charges To Bills

Solved Refund And Cash Back From Credit Card

How To Record Bounced Checks In Quickbooks In 2021 Quickbooks Quickbooks Help Records

Accounting Insight News All Your Accounting News In One Place Brought To You By Accountex Accounting Insight News Quickbooks Business Tax Deductions Payroll

Solved Credit Card Cash Advance

How To Record Refunds In Quickbooks Online Dummies

Recording Credit Card Transactions In Quickbooks Best Practices

Solved Credit Card Cash Advance

How To Record Credit Card Payments In Quickbooks

Recording Credit Card Payments On A Cash Basis In Quickbooks Youtube

Posting Komentar untuk "How To Record Credit Card Cash Advance In Quickbooks"